Setting up and Servicing Cash-flow adapted Agricultural (Farm) Loans Efficiently

Most farmers have special needs when it comes to their loans to buy land, equipment and other farm assets because of their seasonal cash-flow and income spikes. Therefore, agricultural loan products shouldn’t be set up like conventional personal or business loans or mortgages with regular fixed payments, but rather adapted to each farmer’s particular revenue and expenditure rhythms.

A crop farmer most often has greatest cash needs in late Winter (next season purchases), Spring and Summer and greatest cash income in Fall at harvest. Livestock farmers on the other hand, can usually generate steadier expense and income streams.

Depending on crop type and location of the farm (colder countries versus subtropical or tropical countries), there may be two or more harvest seasons. Harvests can be considered Good or Poor, adding yet another cash-flow need to be considered when setting up a loan payment plan.

Lines of credit offer much flexibility of course to the farmer, allowing to borrow and refund as needed. When lines of credit are not available, for capital purchases for example, amortizing loans become the best option. Calculating a comprehensive, cash-flow adapted payment plan for the farmer can become so difficult with conventional calculation tools or spreadsheets, that small agricultural lenders simply cannot easily cater to their clients’ particular needs.

Margill Loan Manager makes lenders’ tasks so much easier with a what-you-see-is-what-you-get approach to creating the payment/amortization schedule based on an predicted cash flow.

We’ve also included an example of a short-term, bridge loans we often see in AG loans.

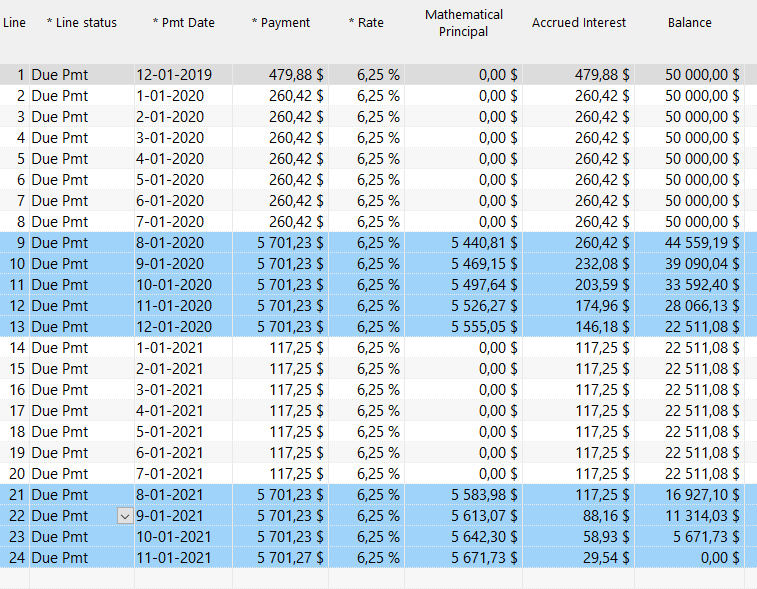

Example 1: Interest-only during low season with principal and interest during the harvest months

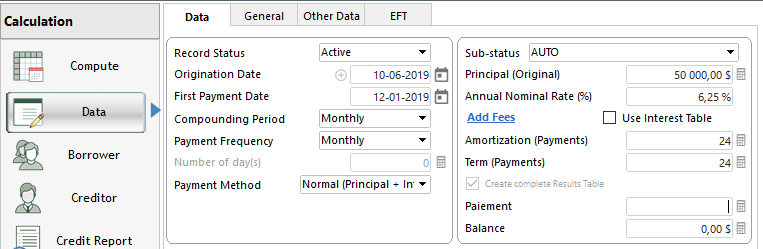

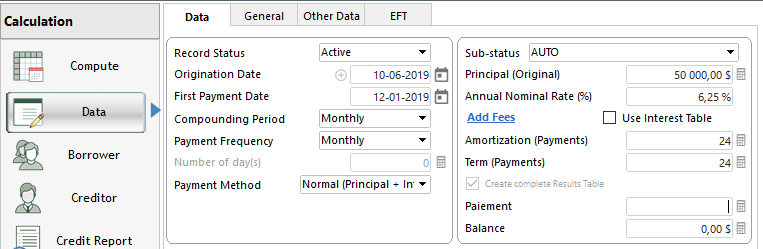

Step 1: Create loan with normal amortization

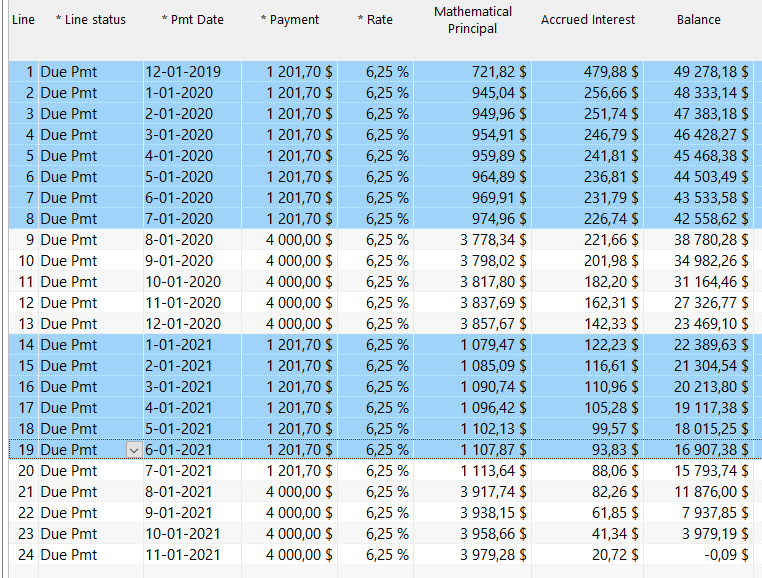

Let’s say this for only 24 months (could be years, no matter)…

Press on “Compute’ to create this normal P&I schedule which you can now adapt line by line or in bulk.

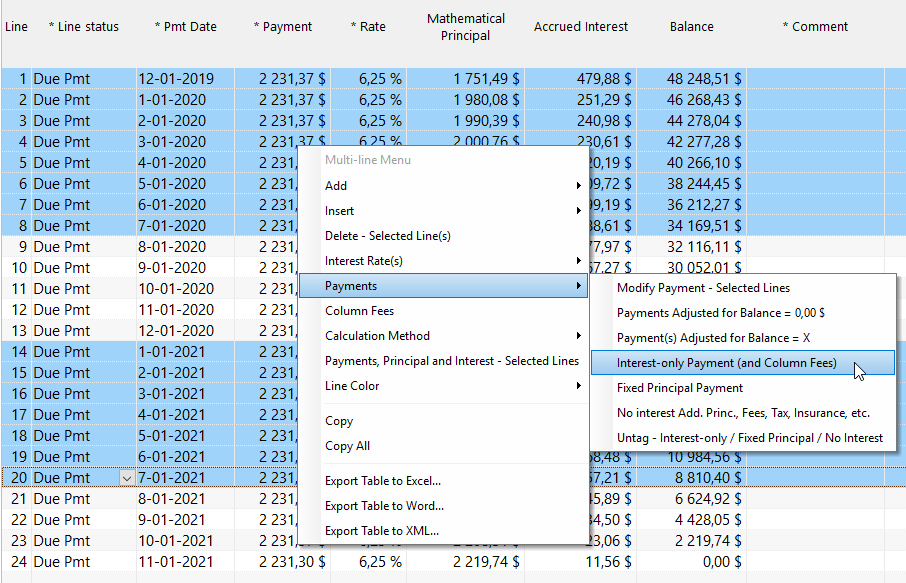

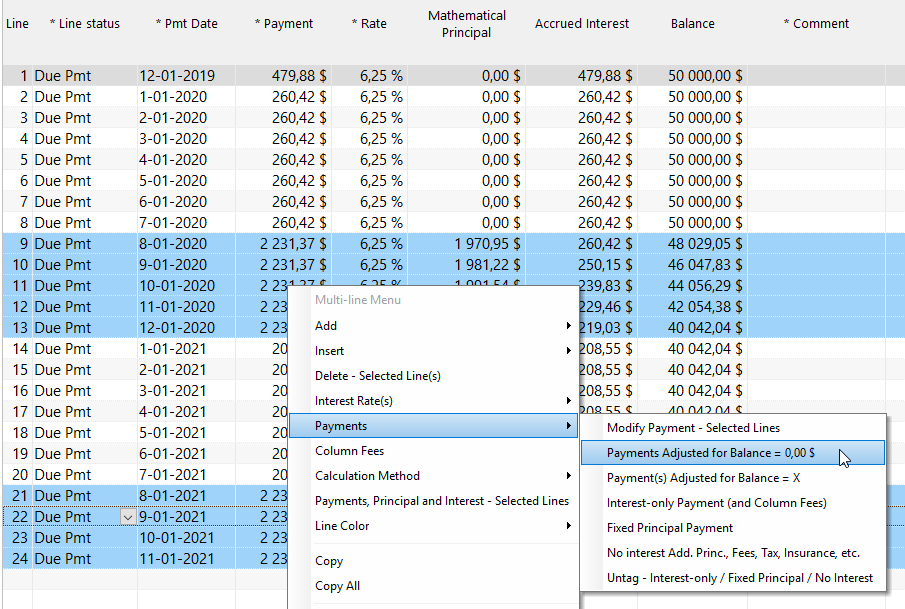

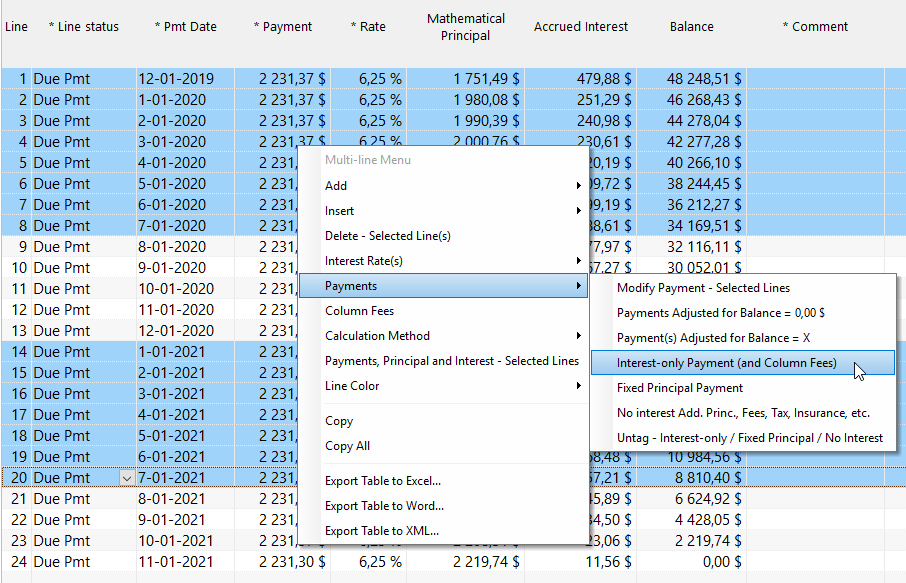

Step 2: Highlight the interest-only months (lines) and right click:

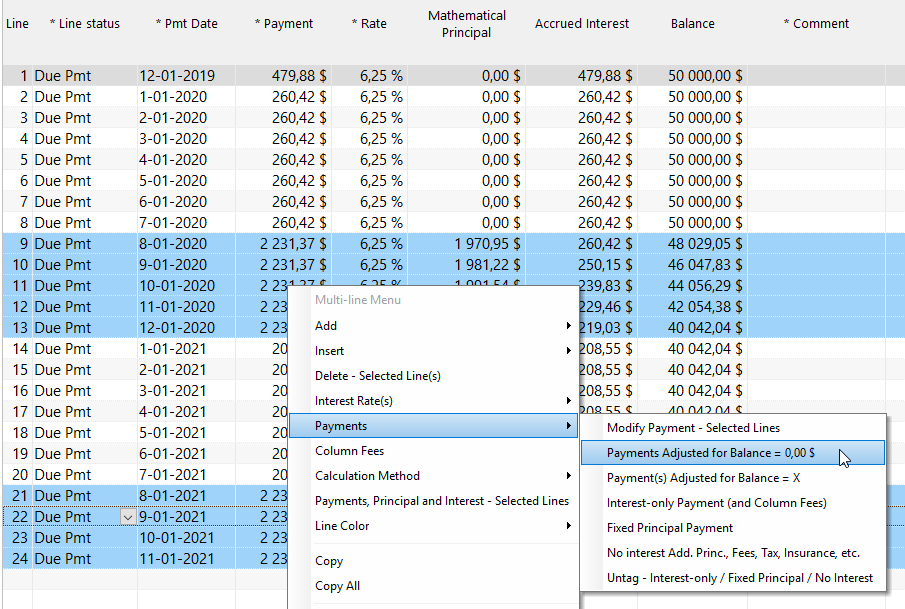

Step 3: Highlight the principal and interest (P&I) months to fully amortize (0.00 balance).

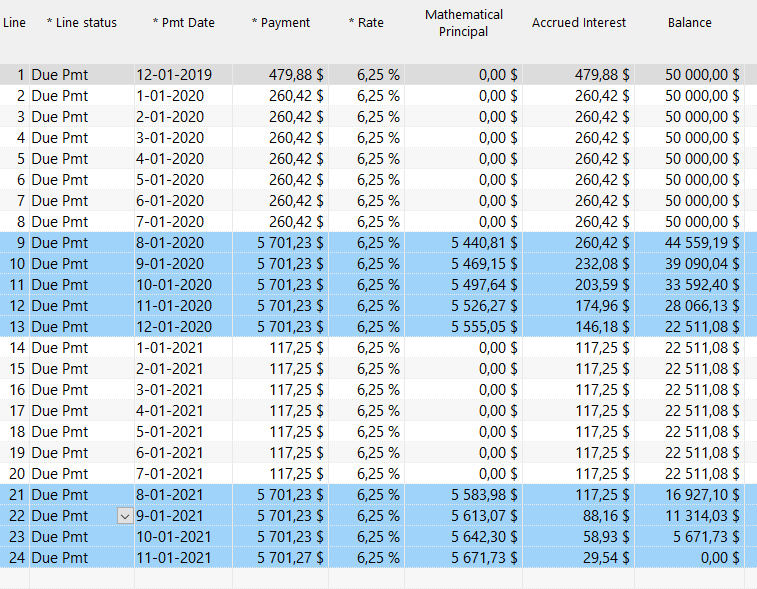

Get the proposed payment plan in seconds – notice below that the payments for the interest-only months (lines 14 to 20) have been recalculated automatically since lines 9-13 pay off principal thus reducing the accrued interest (this automatic re-computation is called a Line Behavior – a pretty sophisticated feature).

Notice the payment amount for line 1 (479.88) is higher since payment was over 1 month after the origination date (what is called a long period).

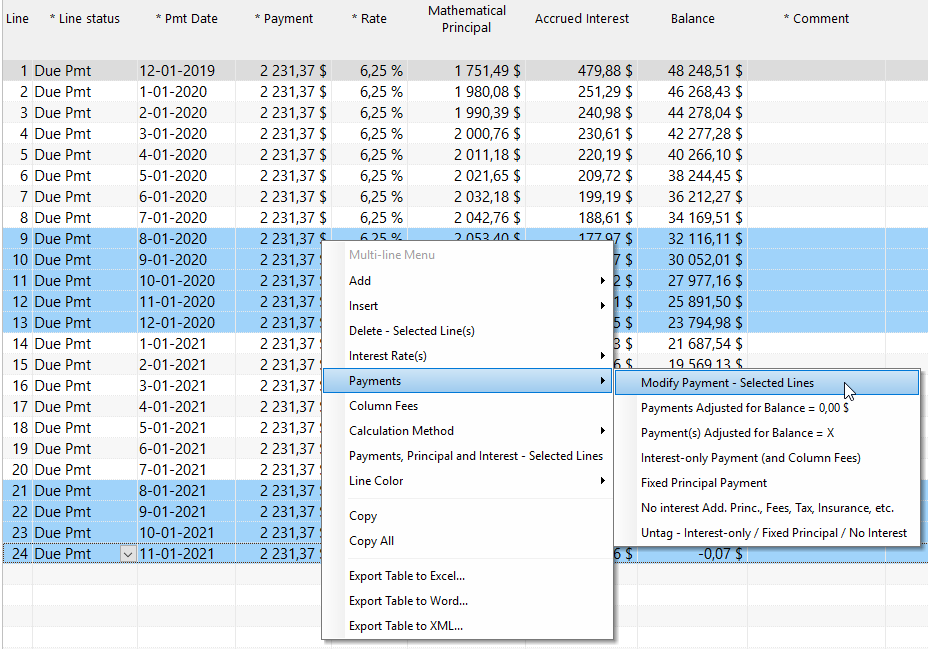

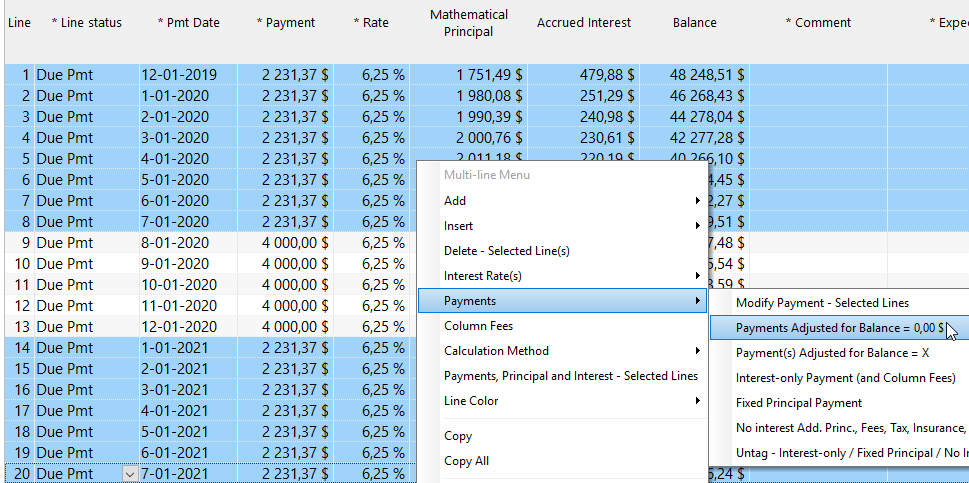

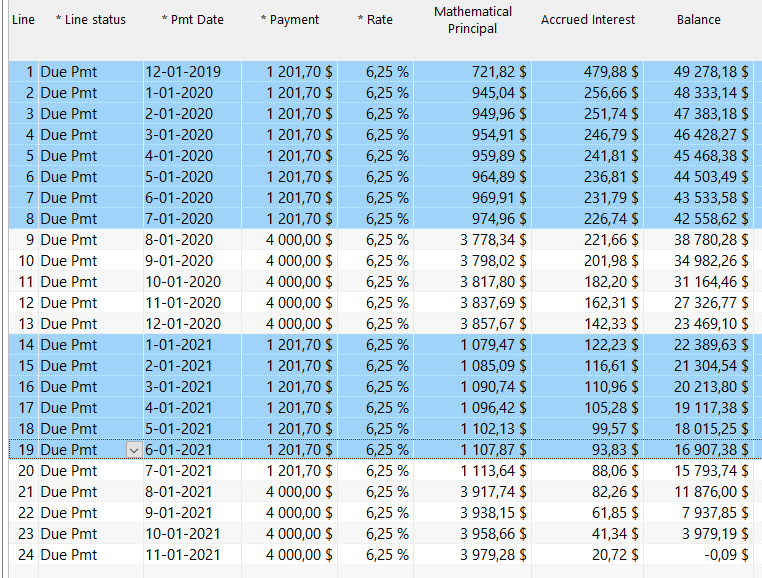

Example 2: Higher set payments during the high cash-flow months and normal amortization during the slow months

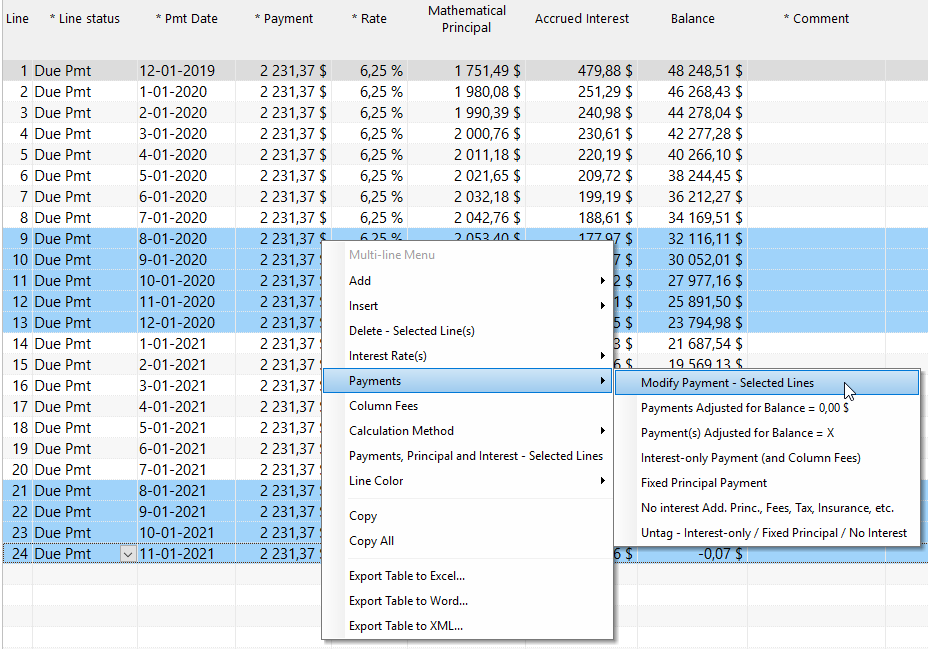

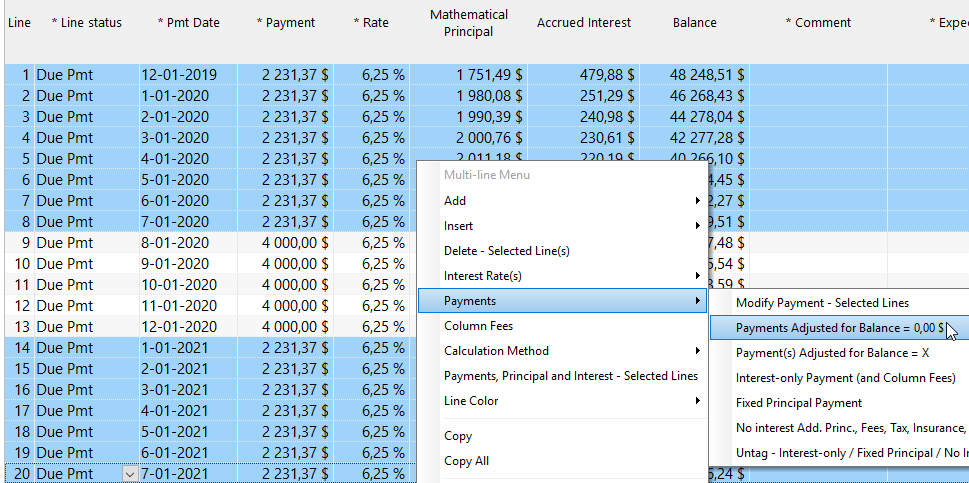

Once the preliminary schedule is calculated:

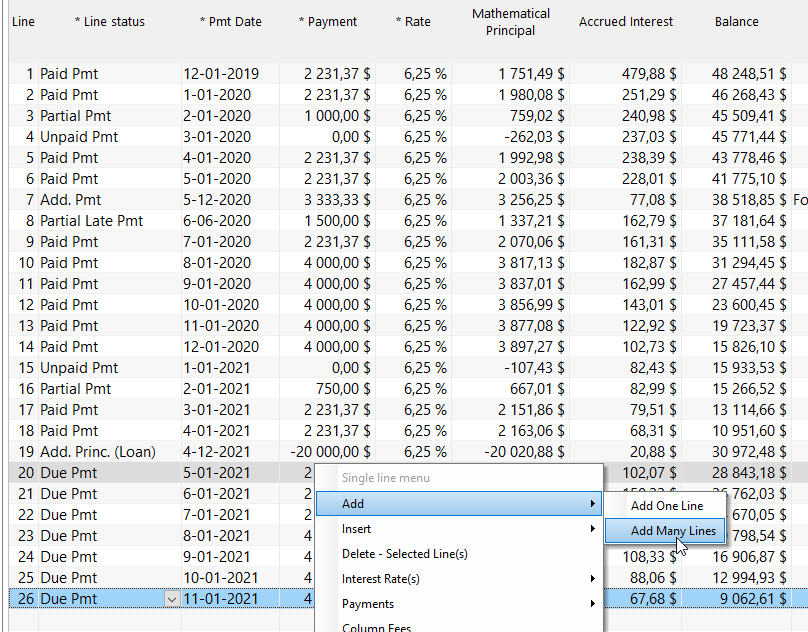

Highlight high revenue months, right click – let’s say the farmer can pay 4000 per month during these 5 months of the year. Margill will ask you to enter the payment amount for the selected lines.

Now select the remaining P&I lines and compute the payment to produce a 0.00 balance:

The resulting payment plan:

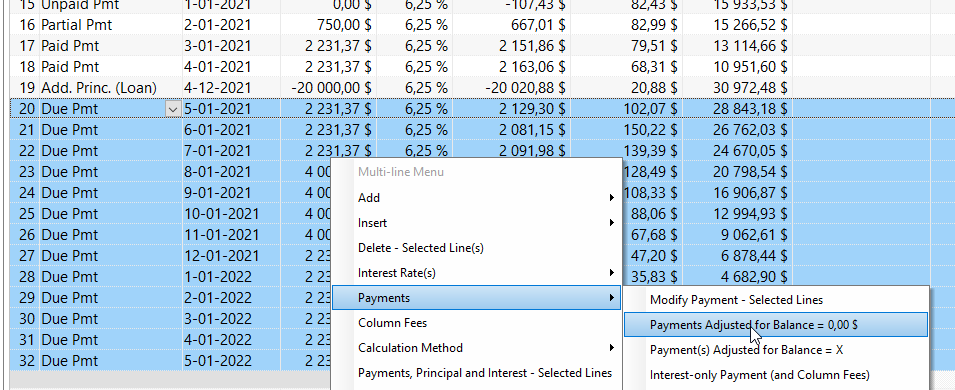

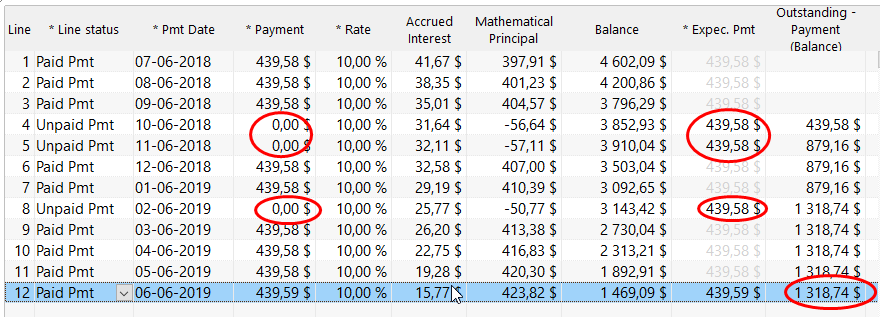

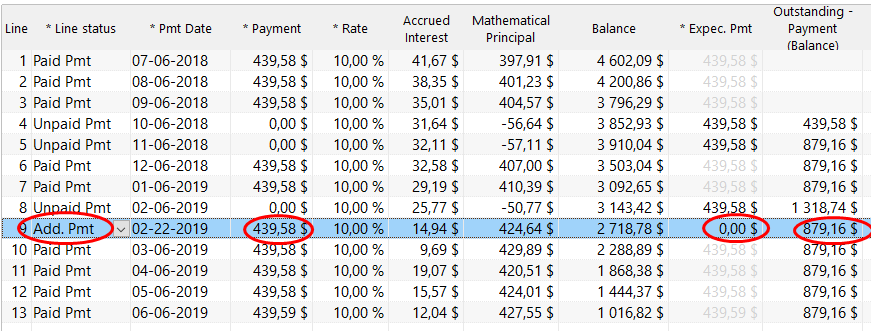

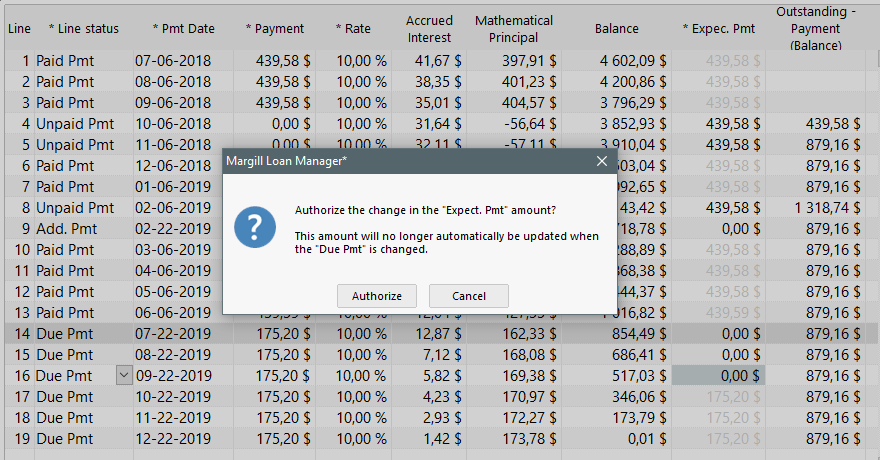

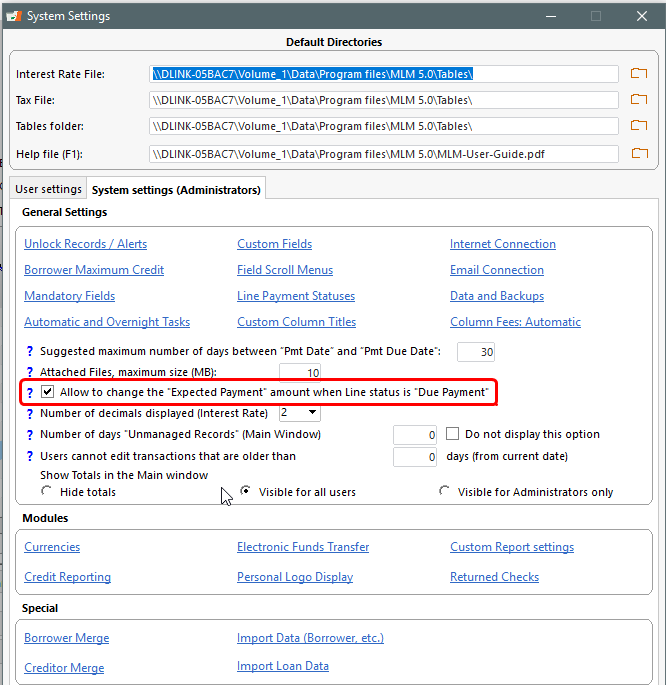

Example 3: Over time payments were made, missed and late, fees were automatically added and so another 6 payments are added to the loan as well as a new 20,000 loan approved on April 12, 2021

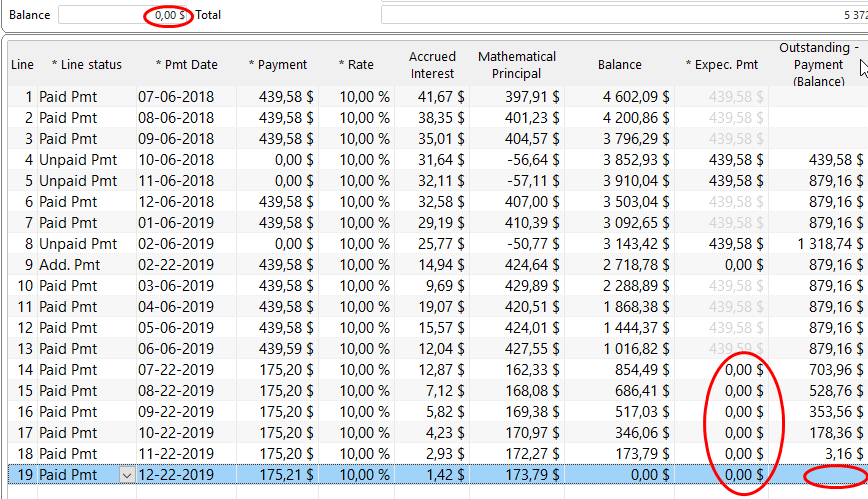

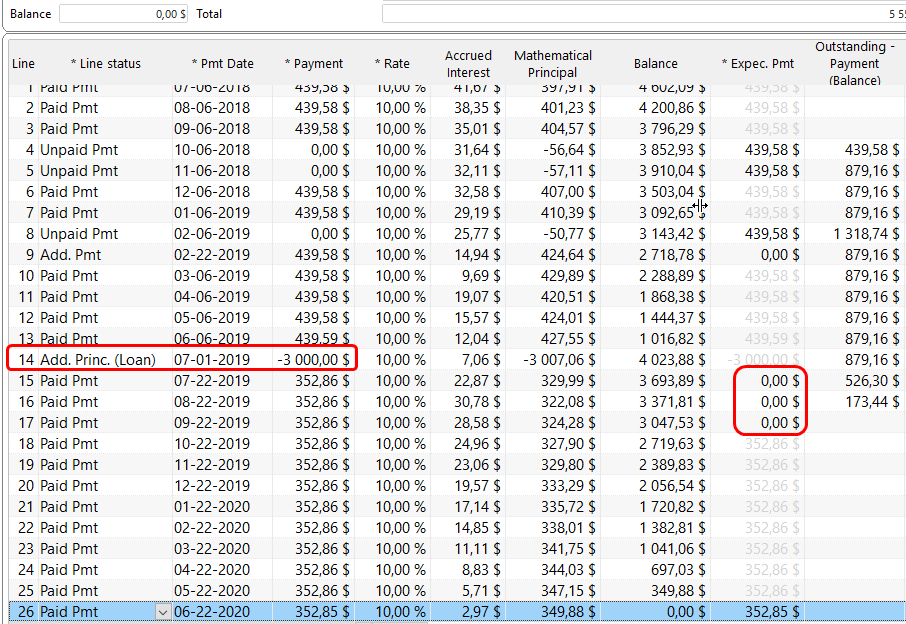

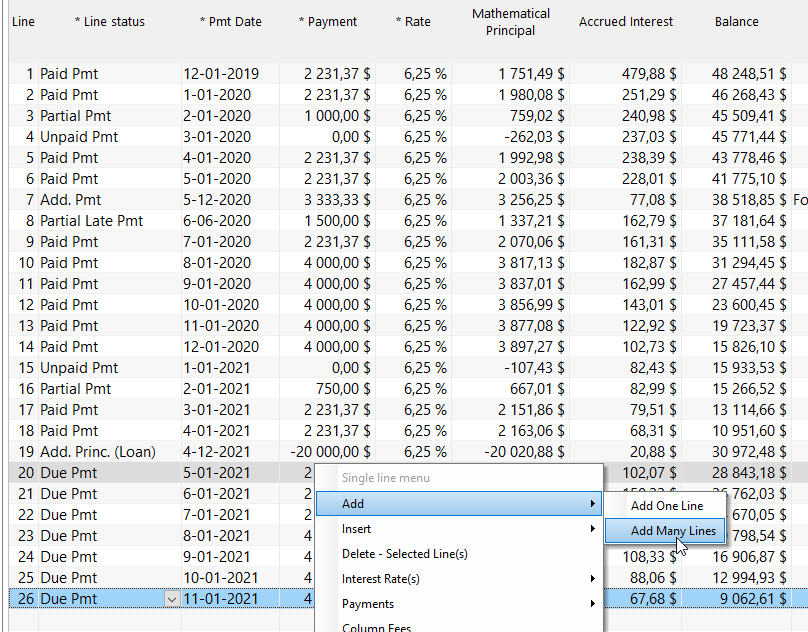

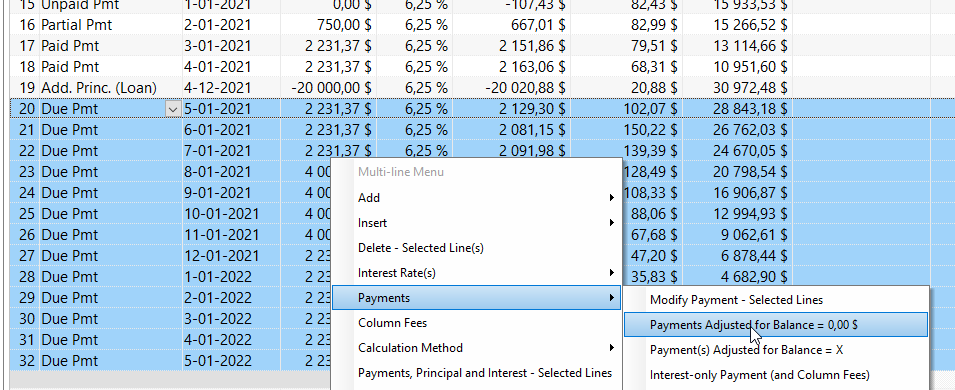

We first inserted a new line – line 19 below – with the right mouse click or the  button in which we entered the 20,000 loan (called an “Add. Principal (Loan)” type transaction). Then we added the 6 extra payments at the end of the schedule:

button in which we entered the 20,000 loan (called an “Add. Principal (Loan)” type transaction). Then we added the 6 extra payments at the end of the schedule:

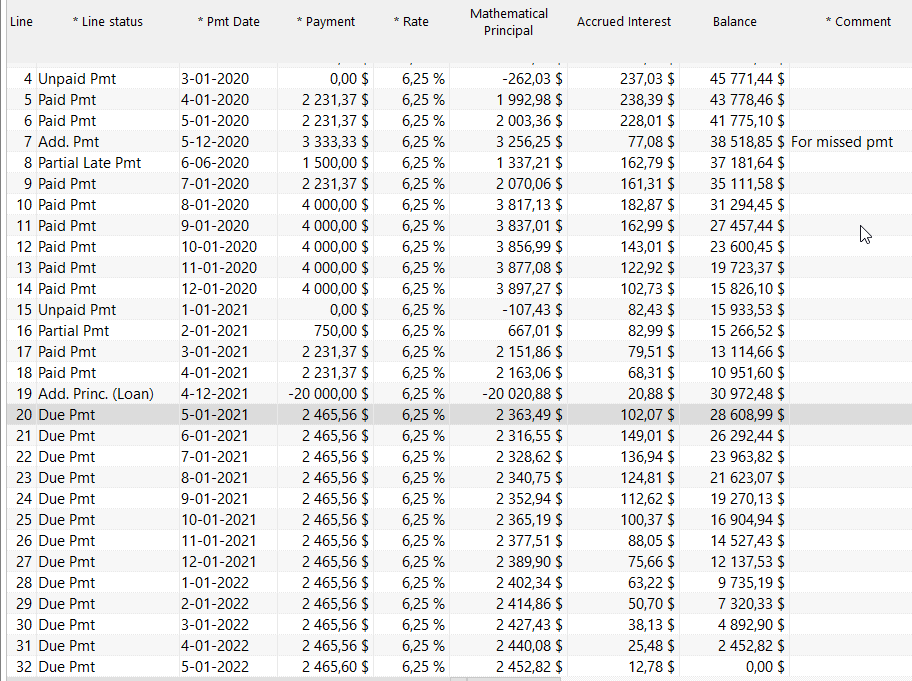

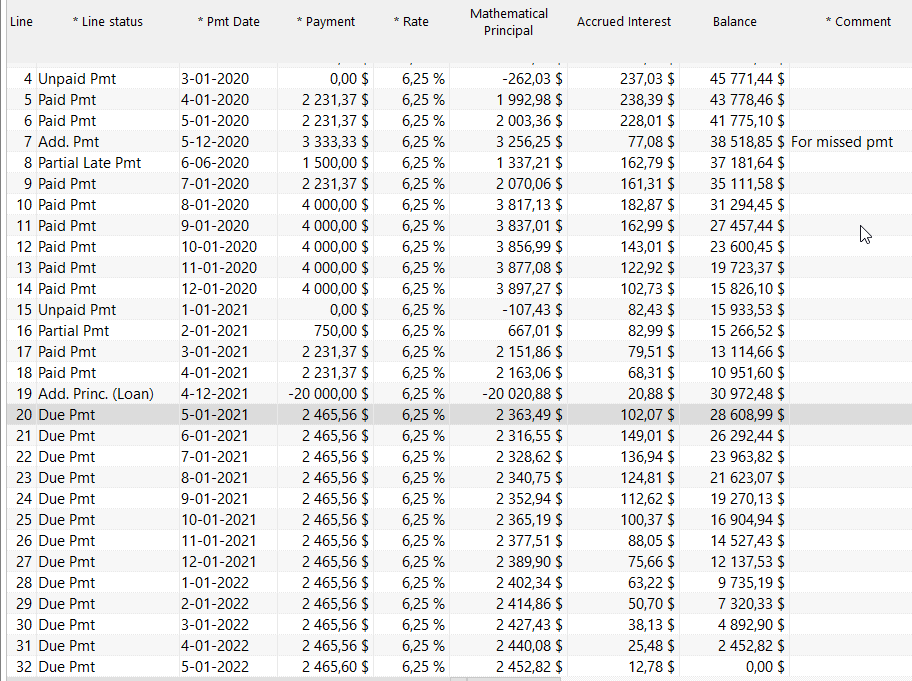

The payments after the 20,000 loan are then re-amortized (could have been special lump sum payments in there too):

Below is the schedule containing the past payments and the future expected payments to fully amortize the loan that now stretches on to May 2022:

Example 4: Bridge loan to help farmers who are expecting to receive a state or federal grant. The grant only comes in (paid by the government) after the project is completed. Interest can be charged normally or a simple Fee charged since interest may be too low for 2-3 month loans.

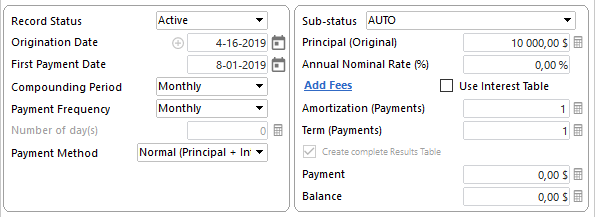

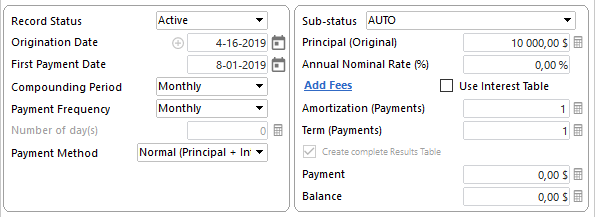

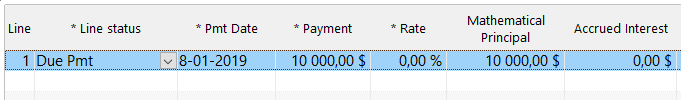

In this example, we have a 10,000 loan for approximately 3 months (we estimate payment on August 1 – date can change later on):

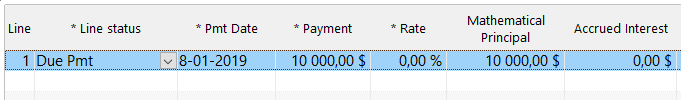

The preliminary result after Compute:

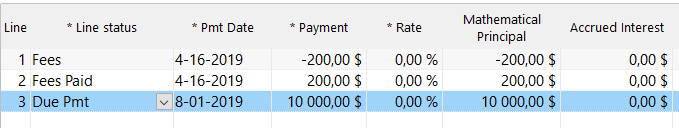

I then must add my Fee (200) – I can add either a fee or consider this fee to be interest. You have both options in Margill with Line statuses.

Press on  to insert a line (or right click with the mouse):

to insert a line (or right click with the mouse):

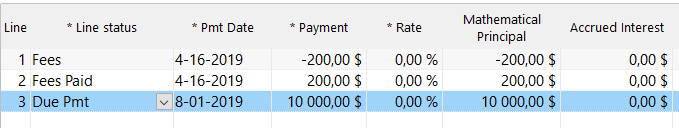

Fees could be paid up front:

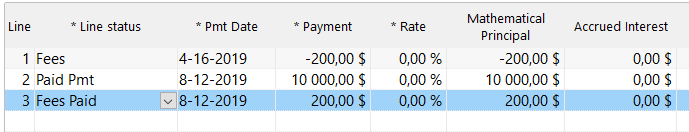

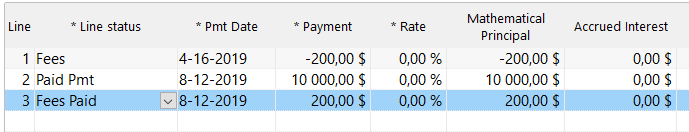

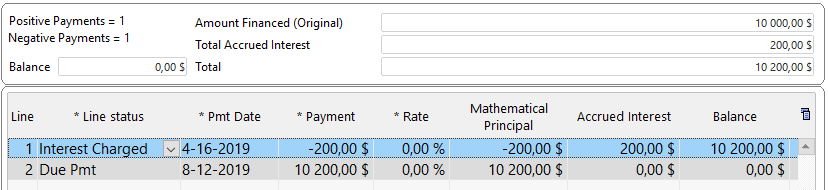

Or paid at the time of full repayment on August 12 for example (for accounting purposes, Fees must be paid separately from the principal so they are properly accounted for):

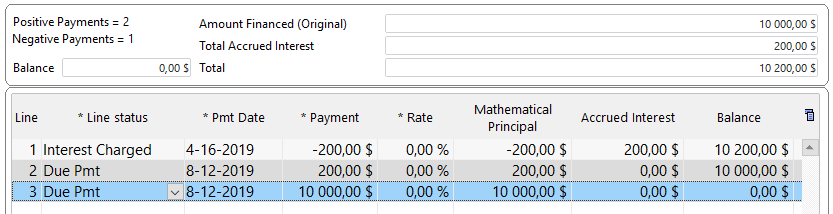

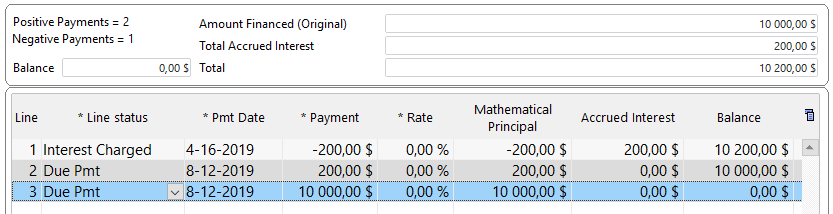

Some would like to consider the 200 as interest so we use a Line status called “Interest Charged” and this shows in the Accrued Interest column:

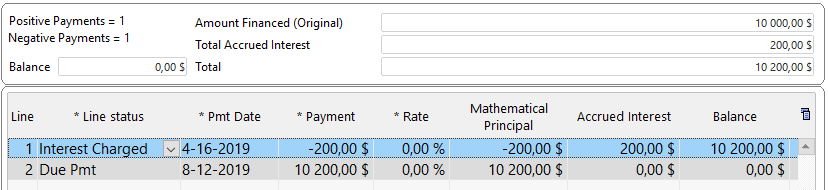

We can split the payment in two or could have one payment of 10,200, no matter (either way, payment will automatically post 200 to interest first and 10,000 to principal):

or

As a agricultural lender you run into other scenarios? Please let us know and we’ll add to this blog! Write to [email protected] or call at 1-877-683-1815 or 001-450-621-8283 and talk to Marc.

button in which we entered the 20,000 loan (called an “Add. Principal (Loan)” type transaction). Then we added the 6 extra payments at the end of the schedule:

button in which we entered the 20,000 loan (called an “Add. Principal (Loan)” type transaction). Then we added the 6 extra payments at the end of the schedule:

to insert a line (or right click with the mouse):

to insert a line (or right click with the mouse):