Total Flexibility in your Payment Schedules

Loan servicing made easy

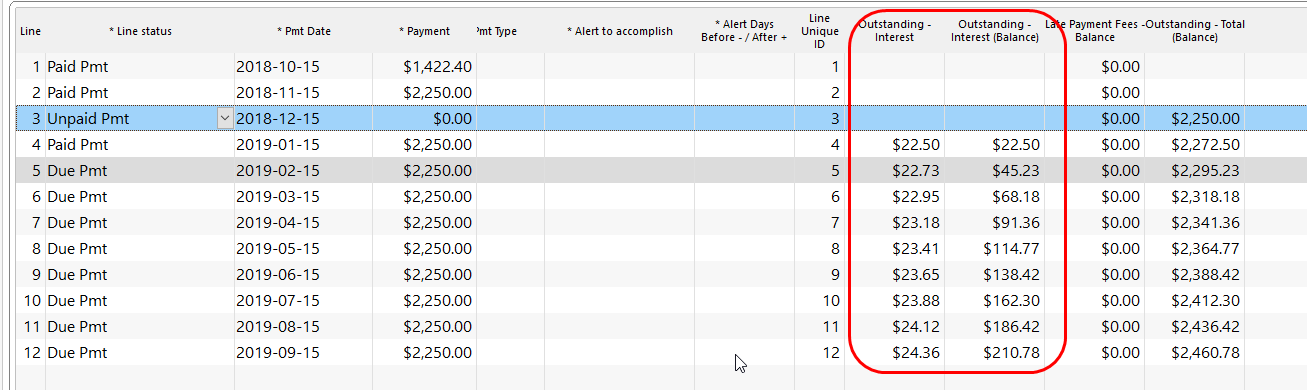

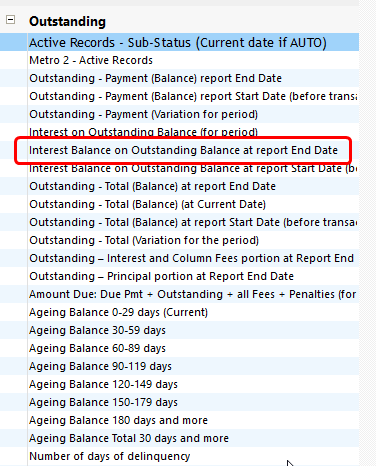

Completely adapt a payment schedule to your borrower’s needs and real life such as irregular payments, seasonal cashflow, interest-only, principal-only, partial, late, unpaid payments, lump sum, automatic fees, negative balances in intercompany loans, interest rate changes, residual value…