Margill

Interest Calculator

The norm for professionals with special interest calculation needs

Margill Calculator, the solution for: Accounting, Real-estate, Finance, Financial planning, Collection, Corporate

Types of calculations

- Loans

- Mortgages

- Lines of credit

- Asset Finance / Leasing

- Investments

- Collection

- Arrears

- APR

- And a lot more!

Key Features

Features

Amortization (Calculation of regular and irregular payments)

Calculate Present Value

Investment comparisons and simulations

Annual Percentage Rate (APR)

Calculation of interest using fixed or variable interest rates

Arrears

Testimonials

Discover testimonials from our Margill Interest Calculator users

-

This software is like no other. It can change the amounts, dates of installments and everything is done quickly. This is an excellent program for the legal and other professions. I highly recommend it to any professional organization.

Alain Direz (France)

-

I want to thank you for the past years and the beneficial relationship we have had with your Company. You provide a valuable piece of software, and your support was always prompt, professional, and polite. My favorite three “p”s.

Craig P. Christiansen Director Information Services Danville Corporations

-

We’ve recently switched from our prior software to Margill and are delighted with its flexibility and reporting features. Its remarkably intuitive and as a result easy to use. We are a small accounting firm and are fairly demanding users and find the Margill product produces excellent working papers and provides a wide range options. We cannot recommend it highly enough.

Reid Fraser, Partner Colin Fraser Financial Service Ltd.

-

I have been using the Margill Standard interest calculation software for 3 years, to help me sort out the cost ramifications caused by the Trustees of a family trust failing to properly administer the Trust over some 25 years. The cost of purchasing the software, and the annual subscription for ongoing support over 3 years, has cost me a little over the cost of one hour of my solicitors time ( at £320 per hour ). The software has more than paid for itself many times over, and I could not have done the job without it. I was able to work accurately, and produce clear and concise reports. My work is done now, but I would highly recommend Margill to others.

Richard Wren Private user

Some Margill clients

An Interest Calculator Designed for Finance Professionals

he Margill Interest Calculator is built for professionals who rely on numbers to analyze, compare, and make financial decisions. Financial analysts, accountants, lenders, and portfolio managers use it to evaluate loans, simulate investments, and understand the real impact of interest over time.

Rather than a one-off calculation tool, Margill supports evolving financial files. Parameters can be adjusted at any point without breaking calculation integrity. This makes it easy to answer practical questions such as: Which financing option is most cost-effective?, How does a rate change affect long-term cost?, or What is the true balance after irregular payments?

Improve accuracy in financial calculations and save time

In finance, even a small error can compromise an entire analysis. Margill automates simple, compound, and capitalized interest calculations using transparent and verifiable logic.

The calculator is particularly well suited for files involving:

- complex repayment schedules

- fixed or variable interest rates

- frequent adjustments

It becomes a daily working tool for producing reliable amortization schedules, comparing financing options, and documenting financial decisions with numbers that are consistent and reproducible.

Types of Interest Calculations Supported

Margill Interest Calculator covers a wide range of real-world financial use cases, including:

- Interest calculations for commercial and personal loans

- Mortgage loan simulations with regular or irregular payments

- Asset financing and leasing scenarios

- Present value and investment return calculations

- Comparison of multiple financing scenarios using different rates or terms

- Calculation of arrears and outstanding balances

This flexibility allows finance teams to rely on a single calculation engine across multiple financial contexts.

Explore Other Margill Solutions

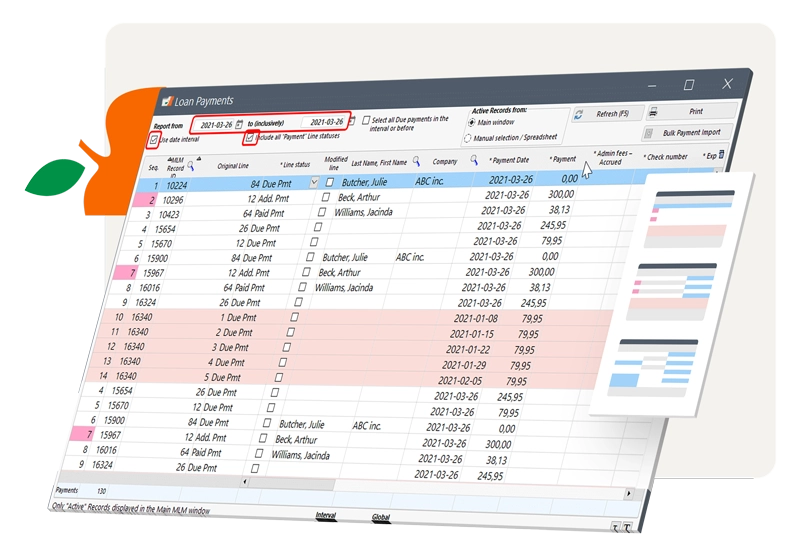

When interest calculations need to integrate into broader workflows, Margill Loan Manager automates, for a handful or for thousands of loans and other financial instruments (mortgages, lines of credit…): interest calculation, amortization schedule production, payment tracking, customer reminders, electronic fund transfer (EFT), fees based on your rules, reporting and so much more.

For legal and regulatory contexts, Margill Interest Calculator – Law is designed to meet court and compliance requirements.

Calculations can also reference officialinterest rate tables when needed.

Margill offers interest calculation services for one-off or specialized mandates, as well as custom programming services to adapt calculation rules to specific financial models.

FAQ About Loan Servicing and Interest Calculation Software

Yes. Margill allows you to simulate different rates, durations, or payment structures to assess the financial impact of each option.

Yes. The calculator supports both fixed and variable interest rates, including when they change over the course of a file.

The calculator allows you to define the dates, principal, interest rate, amortization and payment amount. It automatically generates the amortization schedule, calculates the interest and the unknown data (often the payment amount, or other).

Yes. It supports present value calculations, return analysis, and long-term investment projections.

Yes. It is designed for professional use, delivering accurate, repeatable, and well-documented results.

Margill’s Law version includes additional calculations tailored to the special needs of the legal field: statutory/legal interest, calculation of interest on judgments including court costs, pre and post judgment interest and the option to define special distribution orders or sequence for interest, fees and principal.

Questions ?

Ask us !

Questions about Margill solutions? Our team is here to help! Reach out with any inquiries, and we’ll provide the answers and guidance you need.

+1 877 683-1815 / +1 450 621-8283