Early payoff – How to do this in Margill Loan Manager

Q: How to do an early payoff in Margill Loan Manager

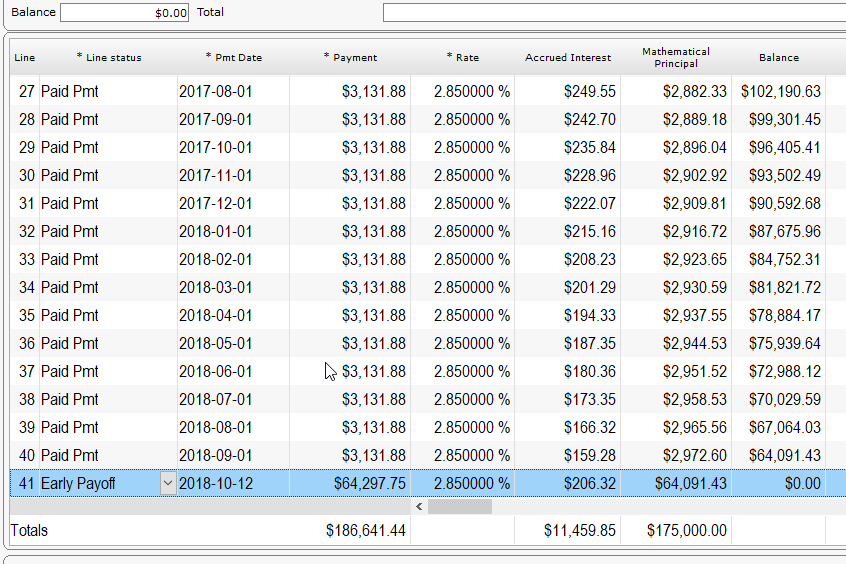

A: For example, the loan term was originally for 5 years or 60 months (so end date was in June 2020). The borrower calls you, the creditor, and wishes to payoff his/her loan early, on October 12, 2018.

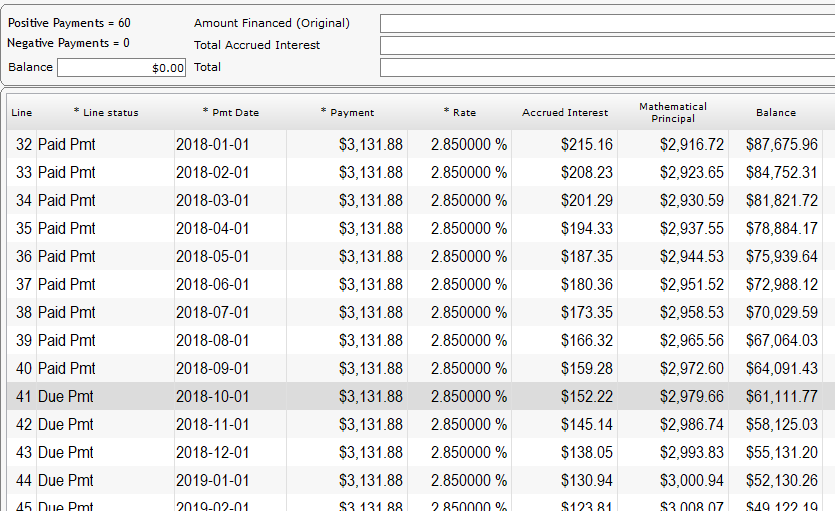

Original payment schedule:

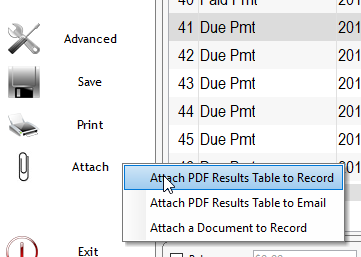

I first recommend to take a snapshot of the full 60 month payment schedule – this was we have an easy to consult original payment schedule. Click on “Attach”. A PDF will be attached to the Record.

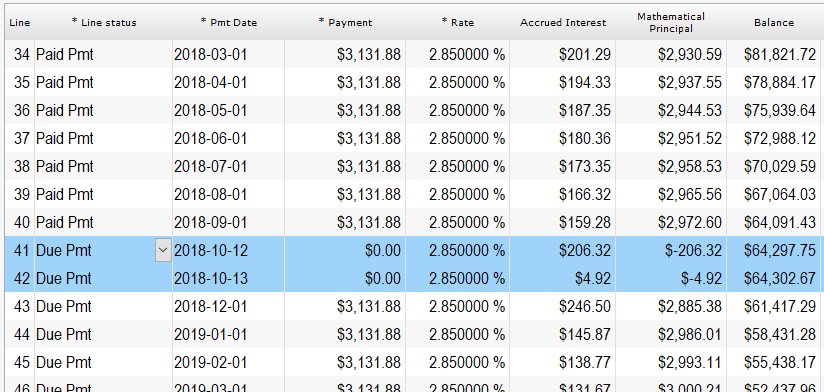

Next change the date to October 12, change the payment to 0.00 so the payoff balance is now shown (64,297.75 in this case). Notice I also changed the 2018-11-01 payment date to 2018-10-13 to see my daily interest on the balance (4.92 per day).

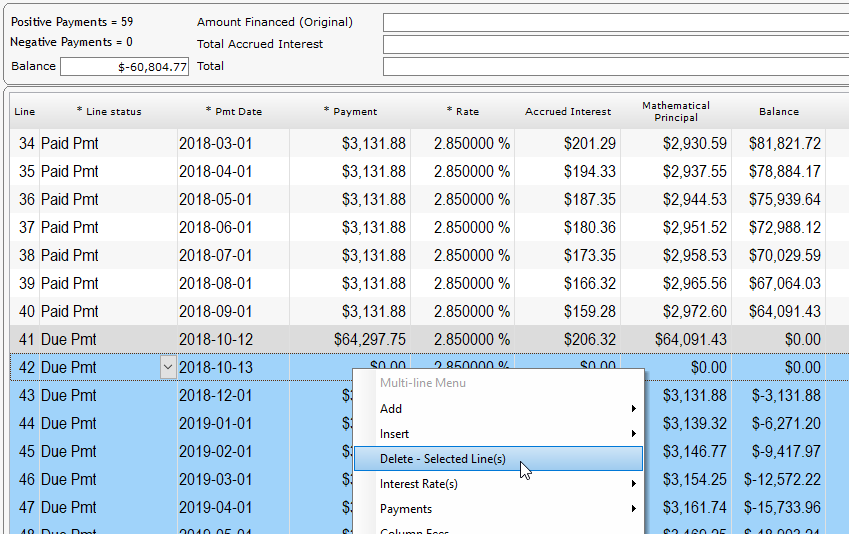

Change the Payment to 64,297.75 (for Oct 12).

You can then delete the next lines that are no longer required (right mouse click).

You could also decide to add extra fees for an early payoff if the contract included this (use Column fees or Line status fees). This will increase the balance of course.

Also, you could create a special payment-type Line status to identify all your early payoffs. Could be interesting for your reports.

If the final payment is late, nothing stops you from changing this final date to enter the true payment date. Extra interest will accrue.