Margill Loan Manager: Amount Due at current date or any date to “get back on track”

A most appreciated feature in Margill Loan Manager (MLM) is its quick access to four variables, accessible in the reports or in the Main window, that allow the user to instantly see the amount that must be paid by the Borrower to “get back on track” if one or several payments are missed, partial or late.

Variables:

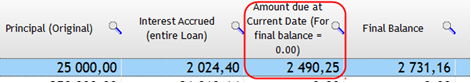

- Amount due at Current Date (For final balance = 0.00)

- Amount due at Current Date (For final balance = original balance)

- Amount due report End Date (For final balance = 0.00)

- Amount due report End Date (For final balance = original balance)

Example:

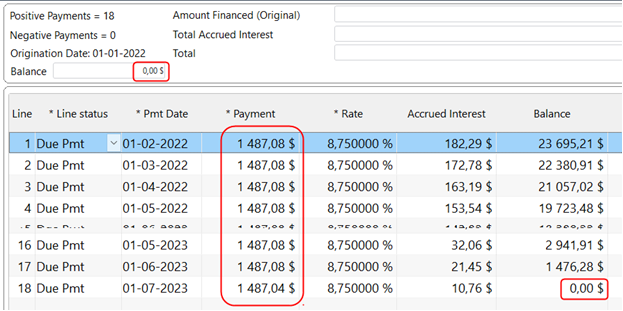

- Loan amount: 25,000

- Principal and interest payments for 18 months

- Regular payment should be 1487.08 with a last payment of a few cents less.

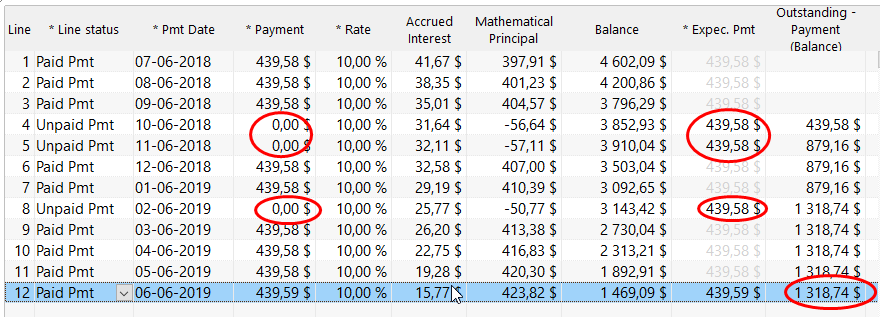

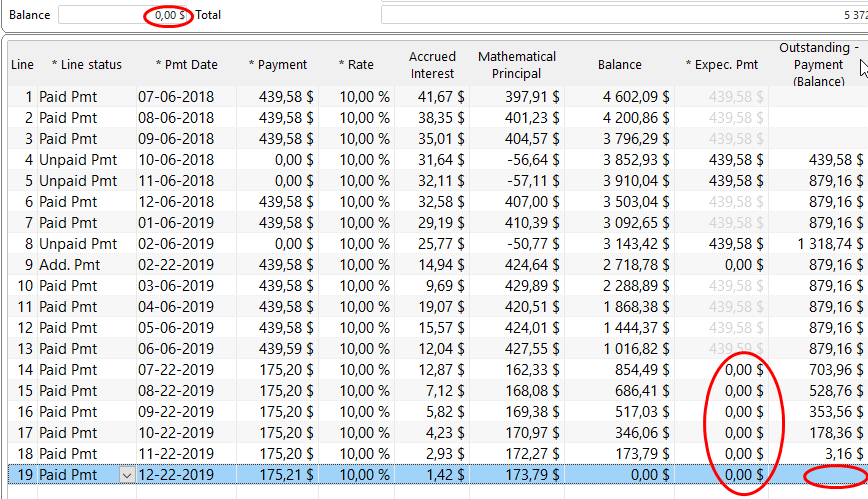

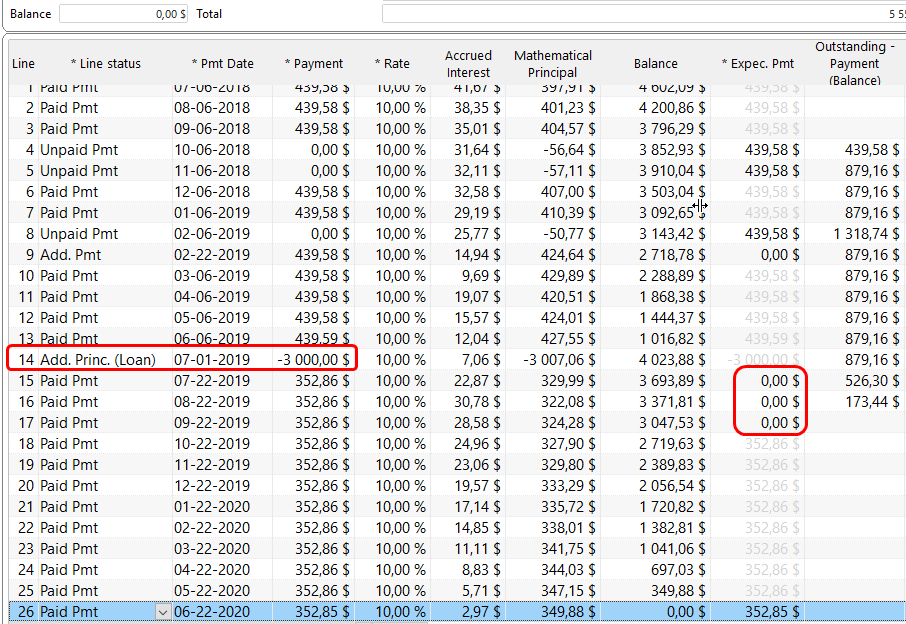

Below is the payment schedule based on contract that would yield a balance of 0.00 if full payments were made on time:

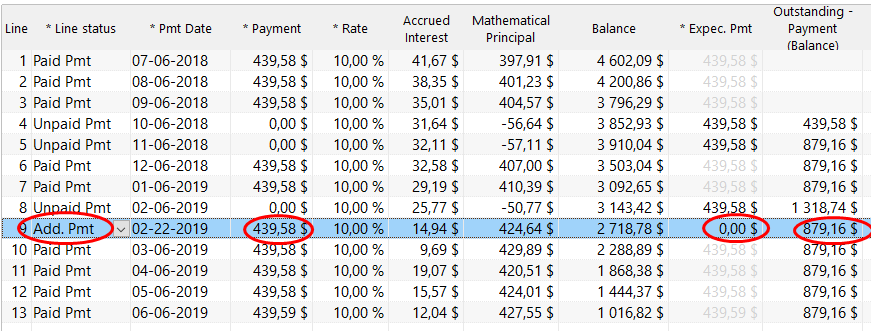

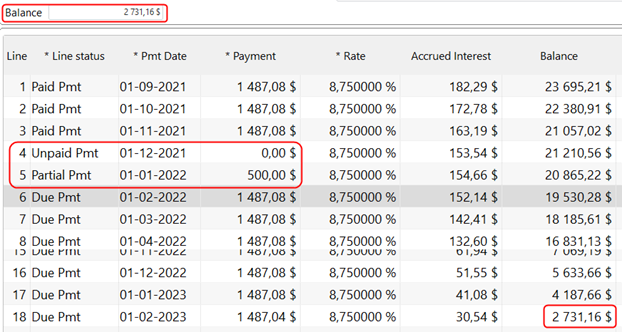

Let’s suppose payment 4 is missed and payment 5 is partial, leading a hypothetical final balance of 2731.16 (in principal, interest and maybe fees had these been added):

Borrower calls you up today January 10, 2022 to know how much he must pay to be back on track. The amount can be seen in the Main window with the appropriate variable. In this case “Amount due at Current Date (For final balance = 0.00)”. So the Borrower would have to pay 2490.25 (today) so that the final balance of 2731.16 (in the year 2023) becomes 0.00. The difference is due to interest accrued on a higher amount if the outstanding amount is paid in the future as opposed to today.

If there had been a residual value, the proper variable would have been “Amount due at Current Date (For final balance = original balance)”

If Borrower wished to know the amount due at another date than today, then a report (Record List) would have been produced to get the data with one of the two variables “Amount due report End Date”.

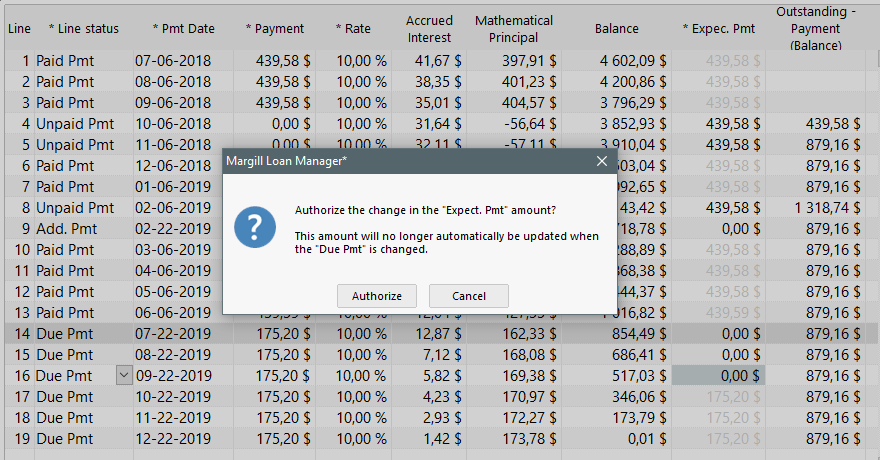

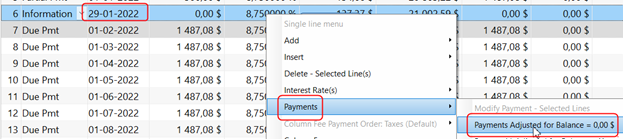

Or you could have gone in the loan itself, inserted a line on the date, right click > Payments > Payments Adjusted for Balance = 0.00 (or Balance = X).

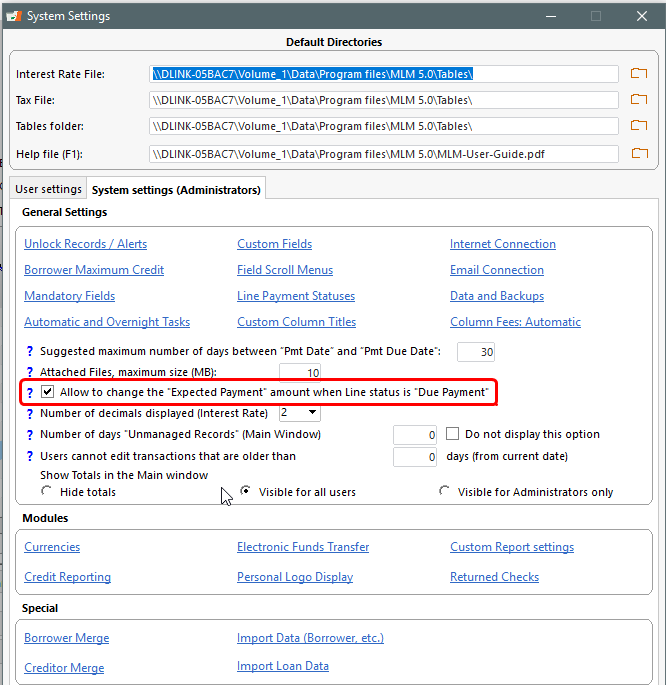

Activate this option in Tools > Settings > System Setting (Admin…)

For “up to current date” calculations, it is strongly advised to use the Automatic / Overnight tasks which compute totals during the night as opposed to when launching Margill in the morning.