Calculating Interest Distribution to Investors in Complex Participation/Syndicated Loans, Pools or Funds

Maximizing Investor Returns / Reducing Risk through Participation/Syndicated Loans

Investors are constantly looking for new ways to maximize their returns. Investing in higher risk private loans is a method to generate 10 to 20% + annual returns. Of course, one of the objectives is to reduce risk and this can be achieved when multiple investors participate in a loan.

In higher-value commercial loans, bridge loans, loans for entrepreneurs (for starting or expanding a business) and short-term tax credit loans, many investors can participate or pool their investments to finance larger projects. Funds based on industry or loan product or investor pools are often created to reduce the risk of each investor while offering maximum flexibility.

Some loan funds and loan pools allow the investor to invest into or divest from a fund/pool/loan before the loan comes to maturity. An investor can decide for example to invest in a loan when the real-estate project reaches a specific milestone or divest when he/she feels there is a better opportunity elsewhere (usually divest to another fund within the same finance company as opposed to a complete withdrawal).

Again, to minimize risk and reduce cost to the borrower, in some loans, notably, construction loans, principal is extended progressively to the borrower only as required and contingent on achieving project milestones. These new principal advances are financed by existing or new investors that can join a loan or fund. This obviously adds to the complexity of calculating the distribution of income to investors.

Revenue models for the investor vary greatly: some Fund Administrators will pay the investor no matter if the borrower pays or does not pay the accrued interest every month (revenue based on accrued interest) and others will only pay the revenue portion to the investors if the borrower pays at least the accrued interest (revenue based on cash received). Whether based on accrued interest or cash paid, the revenue must be redistributed to each investor on a pro-rated basis of his investment amount and participation time (number of days or months of participation).

The Impossible Job of Interest Distribution to Investors

With this flexibility though, comes a major headache for Fund Administrators who must manage the revenue (interest revenue) for each investor based on the amount invested and on the time period this investor was involved in the loan.

Not many software tools can deal with such complexity, and although spreadsheets can be created to solve part of the problem, the time required to compute accrued or paid interest and investor distribution can take days, not to mention the great chance of error.

Calculating the interest in participation or syndicated loans is one piece of the equation, preparing statements is the next phase, a long and arduous process without the proper tools.

Investor management software to the rescue!

Yes there are solutions out there! Margill Loan Manager, a world-class software product, sold in over 40 countries, offers a highly sophisticated Investor module specifically created to manage irregular investments, divestments, payments and of course calculate revenue distribution by investor.

Let’s do a example and throw in a few curve balls…

Borrower ABC Inc. is given a credit facility of 1,250,000 (could be $, £, €, no matter) at a rate of 12% annually for 12 months. Investors in the participation/syndicated loan receive this return too.

- If investors were to receive a lower return than the rate charged to the borrower, then this lower rate would be entered or, when reporting, a special custom report or statement could be created to factor in the spread or revenue for the Fund Administrator.

We will be using Compound interest, compounded monthly (we could have used Simple interest or compounding at another frequency (annually, semi-annually or other). We will also be using the banking method called the Effective rate method. Day count will be the most precise: Actual/Actual – could have been Actual/365, 30/360 or Actual/360.

ABC must pay accrued interest every month.

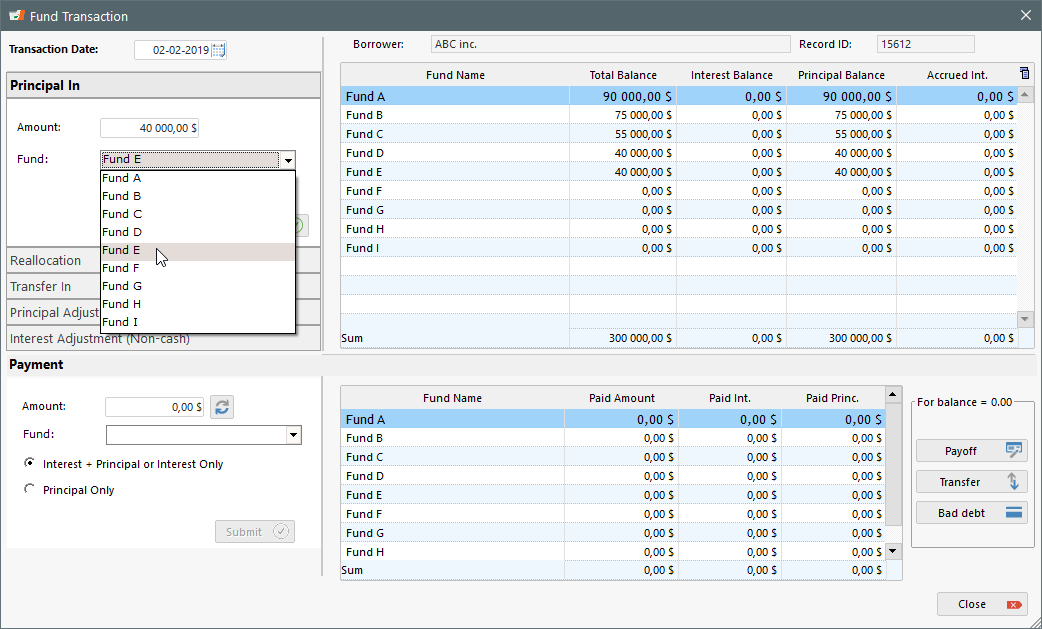

- First draw of 300,000 on Feb 2, 2019

- 5 investors wish to finance this first draw:

- Fund A: 90,000

- Fund B: 75,000

- Fund C: 55,000

- Fund D: 40,000

- Fund E: 40,000

Initial loan advance of 300,000:

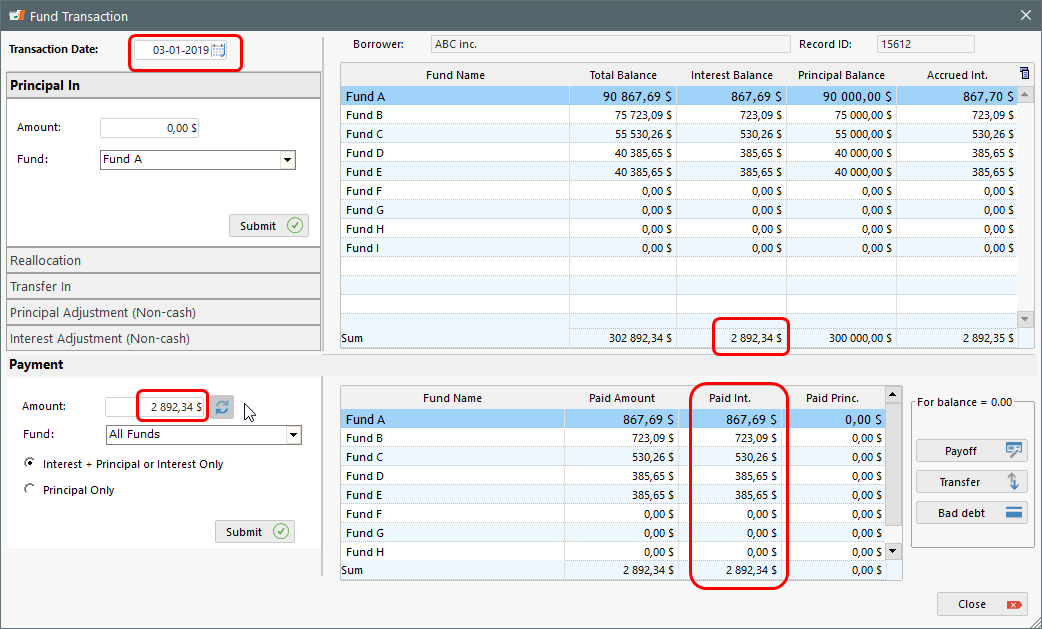

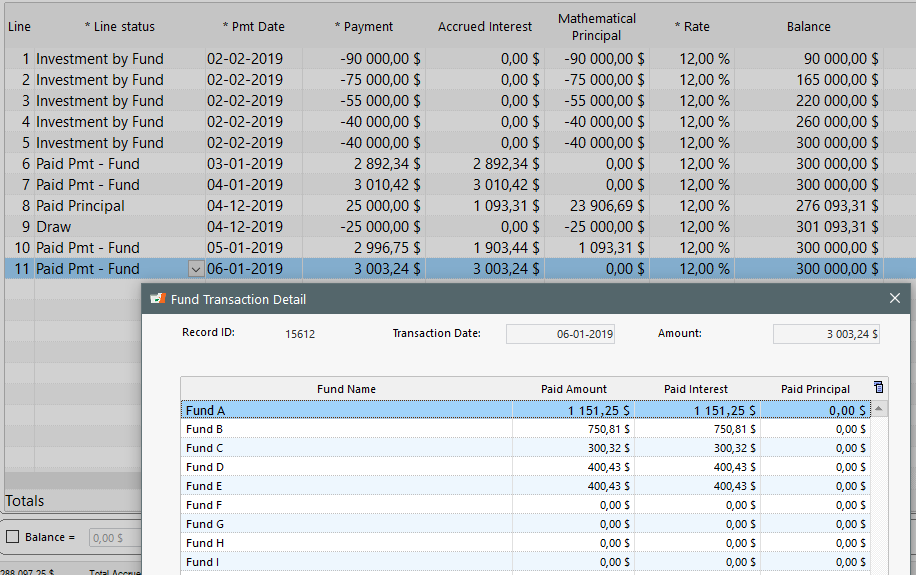

First interest payment on March 1, 12019. Total accrued interest is 2892.34. The accrued interest and individual investor portion is automatically calculated. We allocate to All Funds (investors in this case). Interest is prorated to each investor.

These interest payments can also be mass posted through the Post payment tool (see below).

Special event:

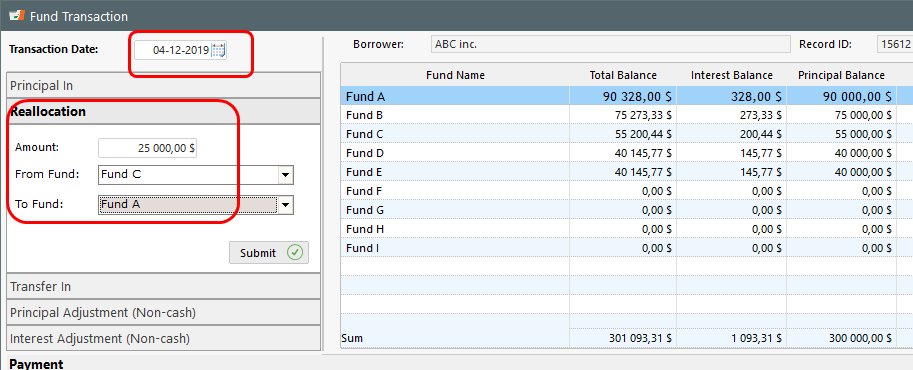

- Fund C: Withdraws 25,000, April 12

- Fund A: Replaces Fund C for 25,000, same day

Reallocation from Fund C to Fund A:

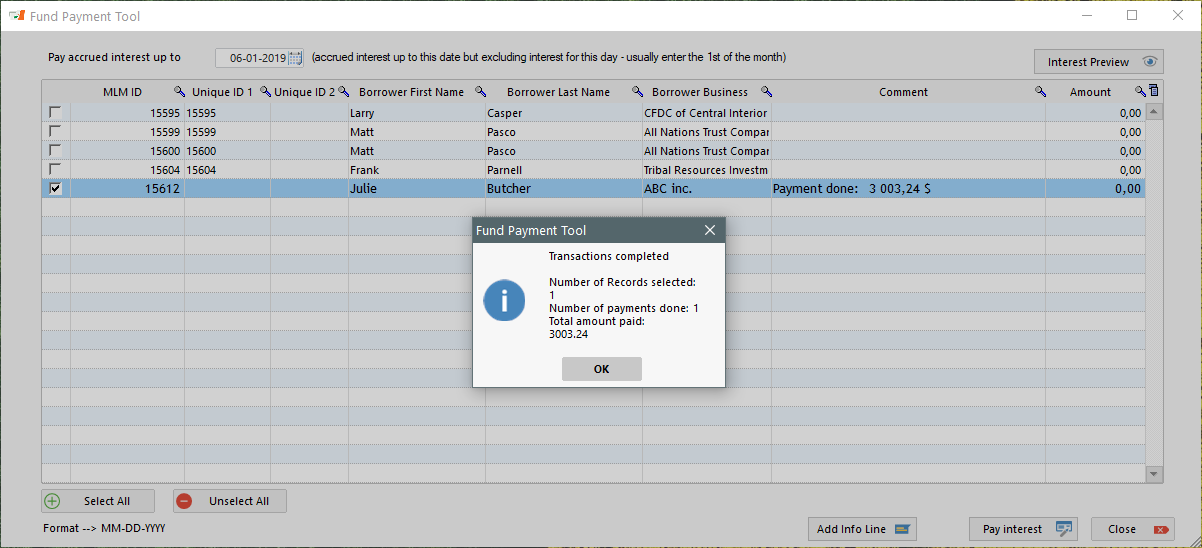

May 1 and June 1 interest payments are posted with the Post payment tool. This tool can post interest payments for a single or hundreds of loans, in seconds.

We can see how the 3003.24 interest payment was applied. Reports can show full portfolio totals for each investor/fund:

The Borrower makes a second draw (the operation is not shown in the images below since method was explained in example above…):

- Second draw of 250,000 on June 17, 2019

- Fund E: 100,000

- Fund F: 100,000

- Fund G: 50,000

- Fund C: Complete divestment (30,000) July 2

- Fund E: Replaces Fund C, same date

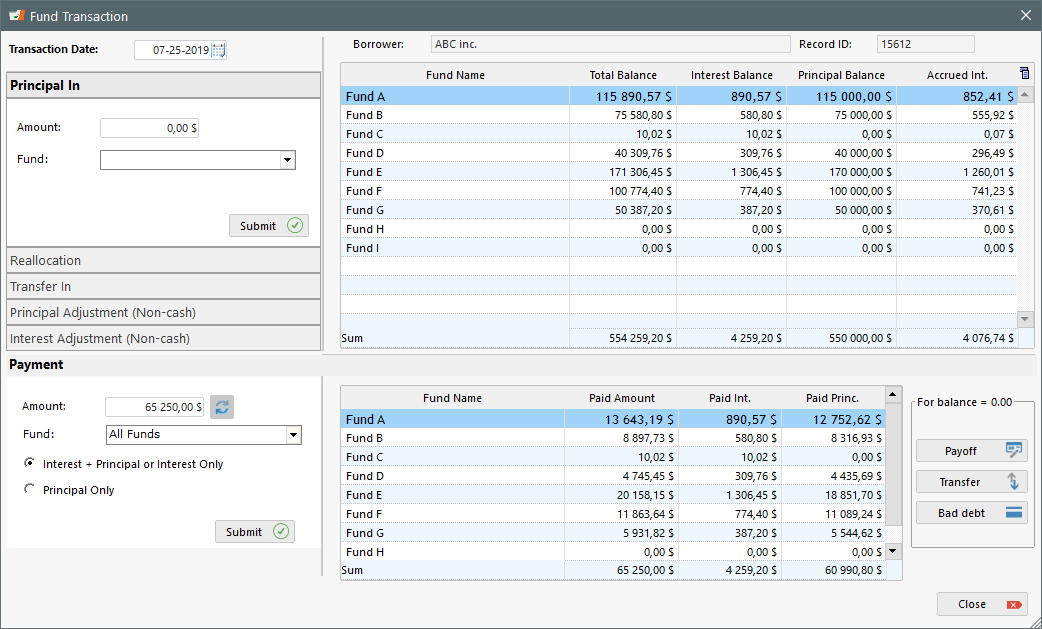

Borrower inherits from a rich uncle and pays back 65,250 on July 25. Outstanding interest is first paid back, and the balance pays the principal. The payment could also have gone 100% to principal with the “Principal Only” option.

On the lower part of the window, one sees the distribution by fund. Notice Fund C had a 0.00 principal balance but a 10.02 interest balance that will get paid off with the 65k payment.

Finally, rich uncle did not leave enough to ABC so there’s a need for more money (operations for adding draws an interest payments are not shown since we are now experts at adding these):

- Third Draw of 600,000 on October 3, 2019

- Fund A: 200,000

- Fund E: 150,000

- Fund H: 175,000

- Fund I: 75,000

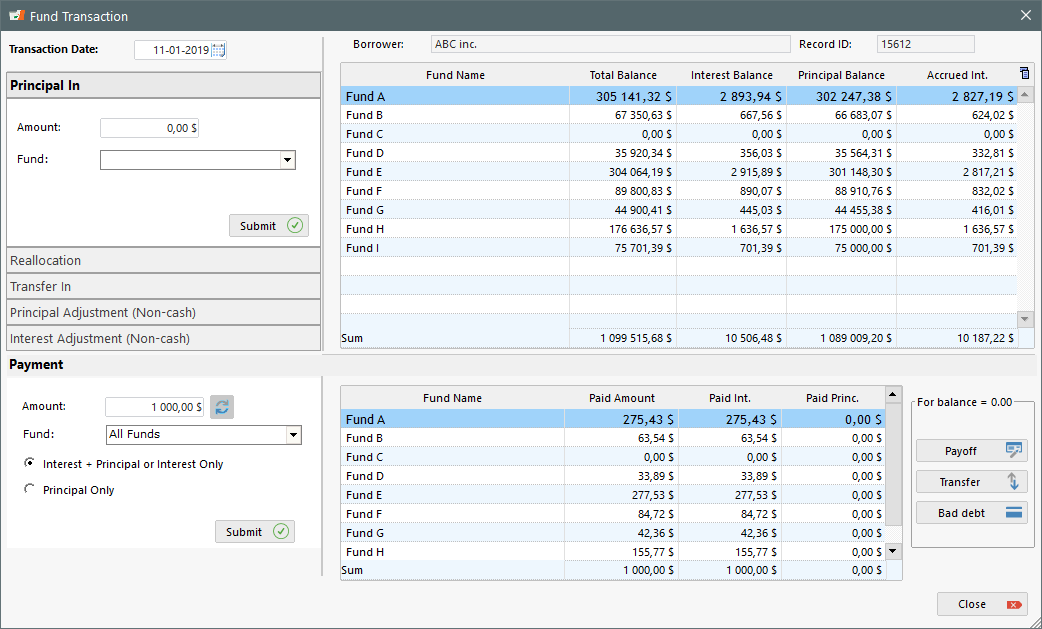

For the November 1 payment that was supposed to pay the accrued interest (10,506.48) ABC can only pay 1000 (see bottom portion).

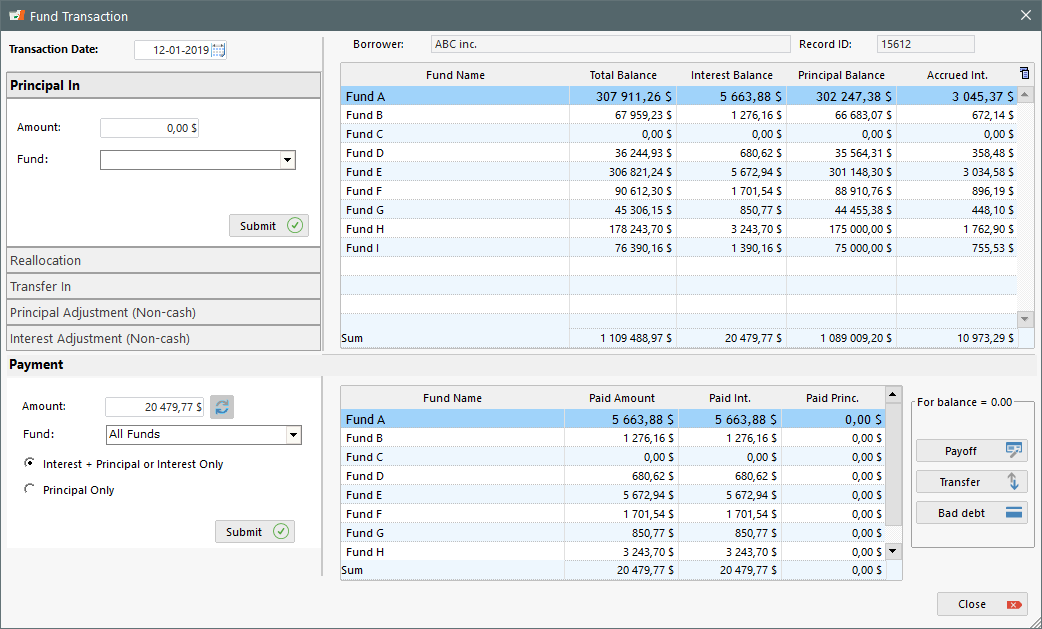

The December 1 interest payment would then be much higher to pay the outstanding and current interest for a total interest payment of 20,479.77.

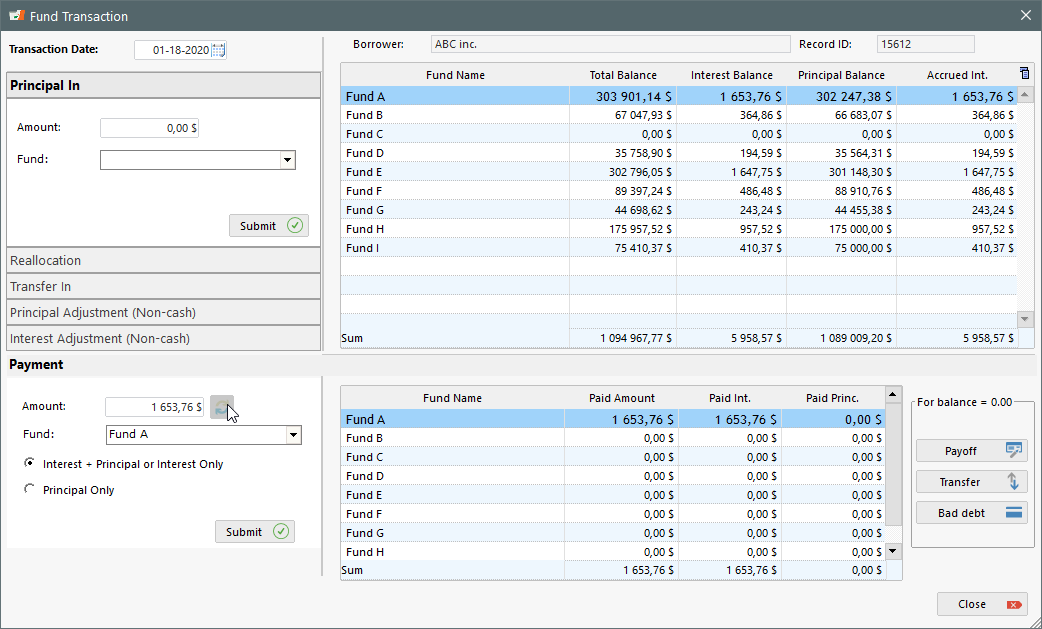

Construction is now complete and on Jan 18, 2020 ABC decides to pay back only 250,000. Fund Administrator decides that Fund A should get paid back first.

Outstanding interest (1653.76) is first paid to Fund A exclusively:

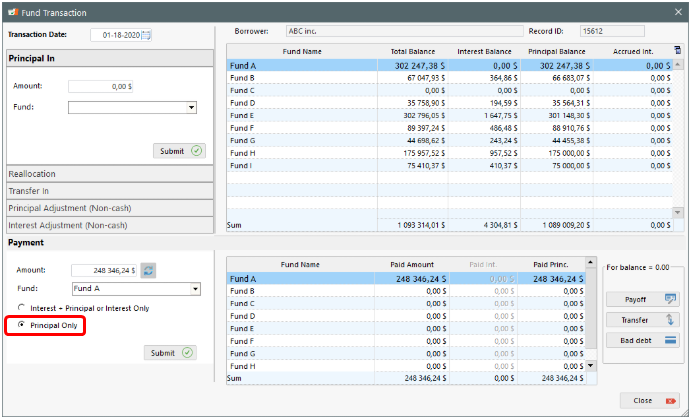

The remaining payment balance, 248,346.24 is then paid to principal to Fund A exclusively (use the “Principal Only” option):

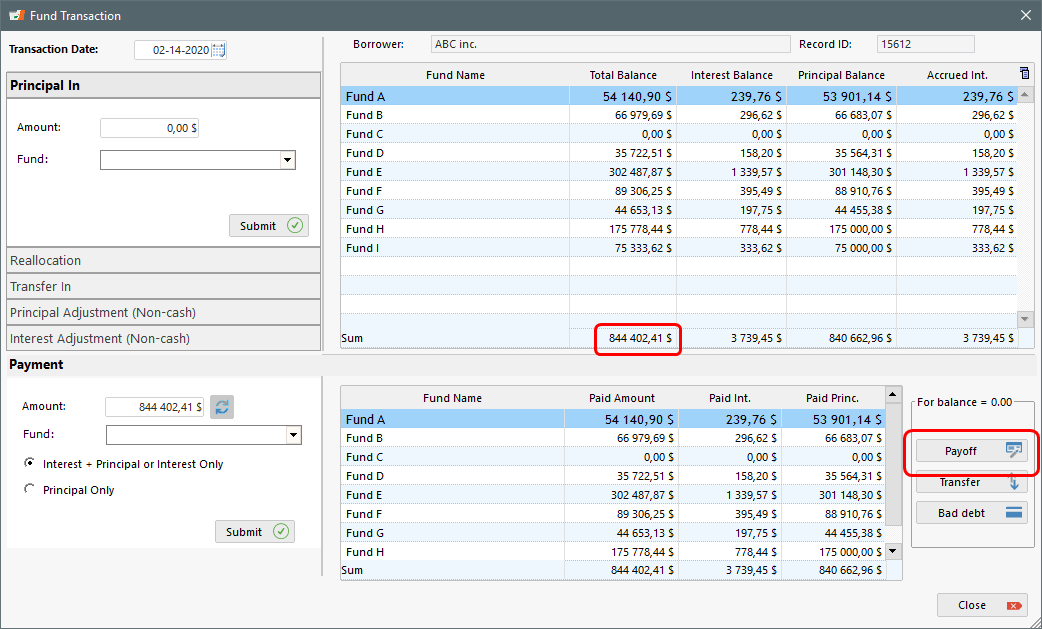

And finally, the full loan is paid off on February 14, 2020. All interest is paid to the investors as well as the principal bringing the loan balance from 844,402.41 to 0.00 with the Payoff button:

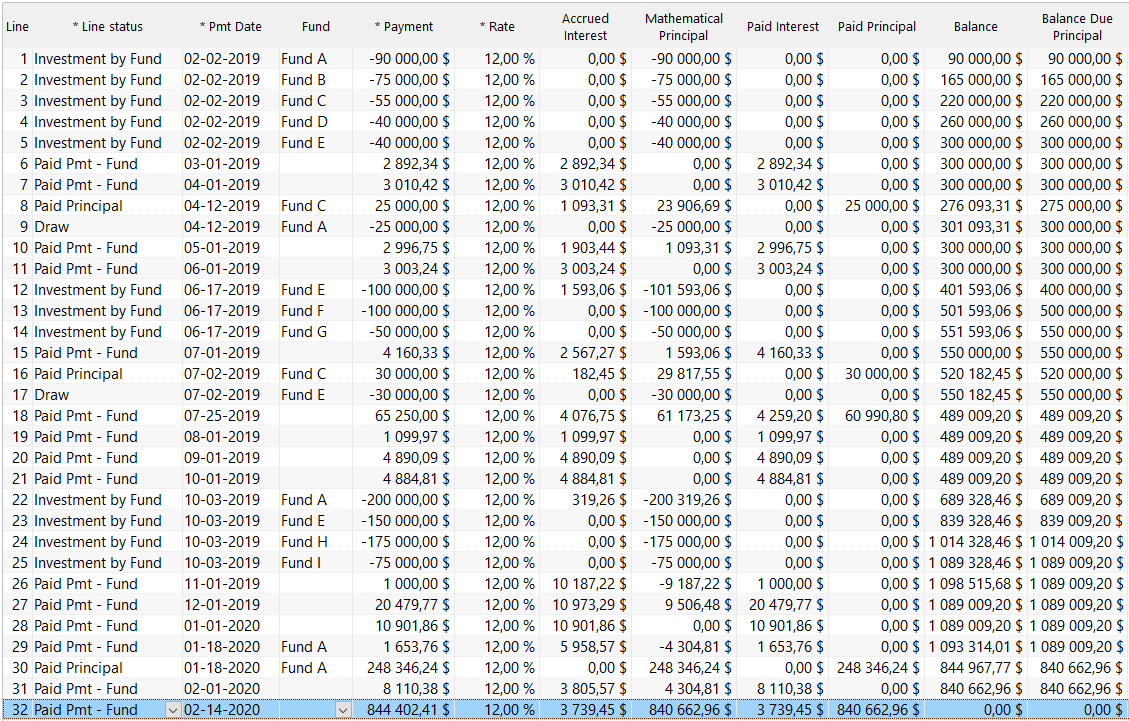

Final schedule:

Multiple other options are available in the module such as:

- Non-cash principal and interest Adjustments

- Non-cash partial or complete P&I Transfers OUT of old loan and IN to new loan

- Bad debt

A loan can include dozens of investors and a portfolio hundreds of investors.

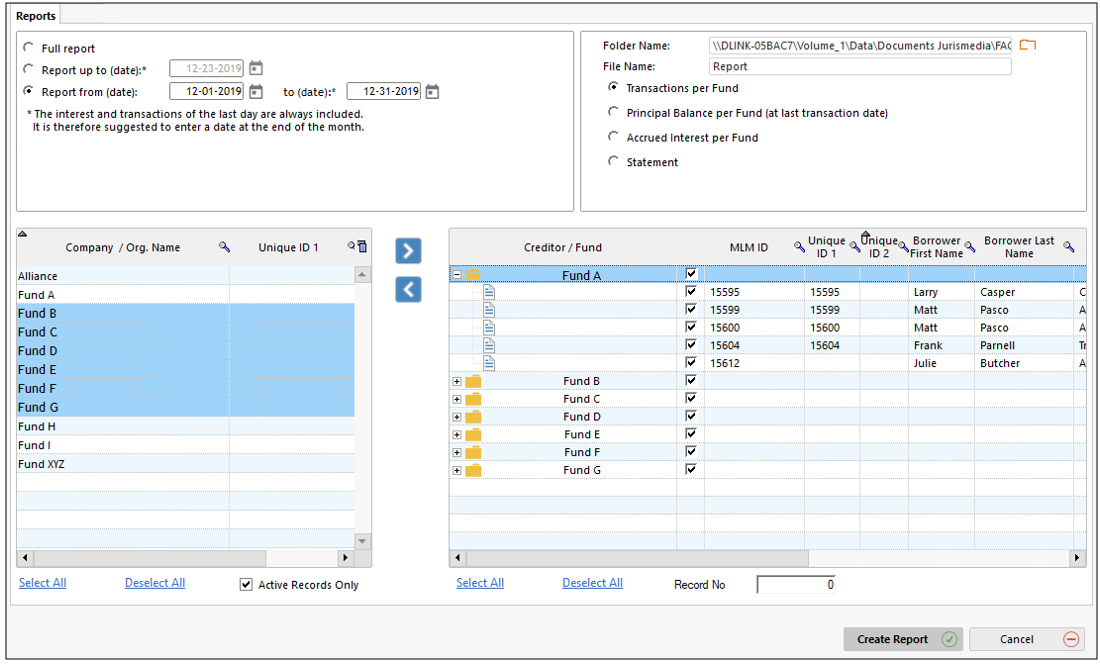

The reporting module allows the production of reports at any date and for any time period for all investors/funds:

- All transaction types (principal advances, cash payments, reallocations, transfers, adjustments, bad debt)

- Principal balances

- Interest accrued

- Custom-built statements

The reports are produced as spreadsheets (Excel) or PDF.

Note: This module cannot include fees. It is meant to calculate the return to each investor. A second loan type for the borrower interactions, could include extra fees (origination, points, automatic penalties, etc.).

Changes in Winter 2022: Variable interest rates can now be added in the module (fixed rates previously).

For more information on this very special module, please contact Margill Customer support: [email protected] or call at 450-621-8283.

Notes on Line statuses used in module:

| Line status (original name) | Fund module recommended name (or purpose) |

| Add. Princ. 2 | Additional Principal |

| Paid Pmt 2 | Payment or Payoff |

| Principal Paid | Reallocation Pmt, Principal Paid, Principal Adjustment Reduce |

| Add. Princ. 3 | Reallocation Principal |

| Add. Princ. 4 | Transfer in Principal |

| Paid Pmt 5 | Transfer Out |

| Paid Pmt 4 | Bad dept |

| Interest Charged | Transfer In interest |

| Interest Paid | Interest Adjustment Reduce |

| Interest Charged 2 | Interest Adjustment Add |

| Add. Princ. 5 | Principal Adjustment Add |

| Information no Impact | Information Line |

| Rate Change | Rate Change |