Mass data entry / Global database changes / Adding new data in the database in bulk / Mass database changes in Margill Loan Manager

Q: We have added some custom fields for additional loan information. Is there a way we can mass import only those specific custom fields in Loan Manager?

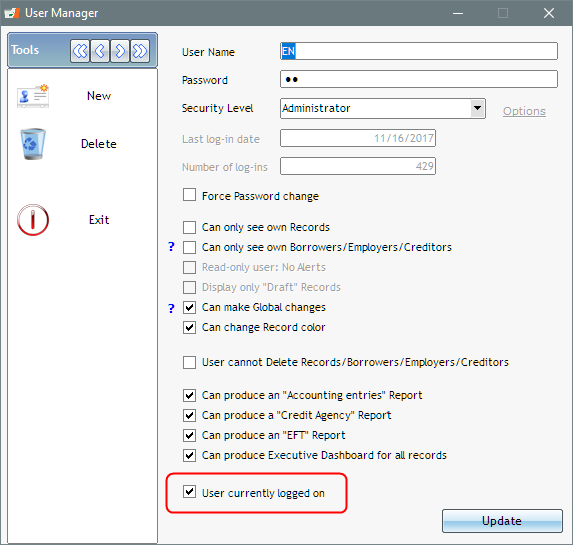

A: Yes you can mass import data into Margill Loan Manager. This is with what we call “Global changes”.

This can be done for the loan, mortgage, line of credit, lease, etc. (the Record) or for the Borrower.

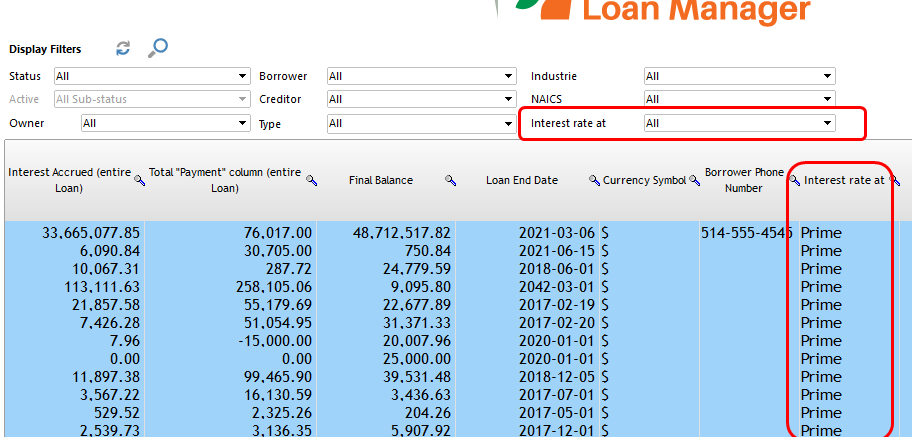

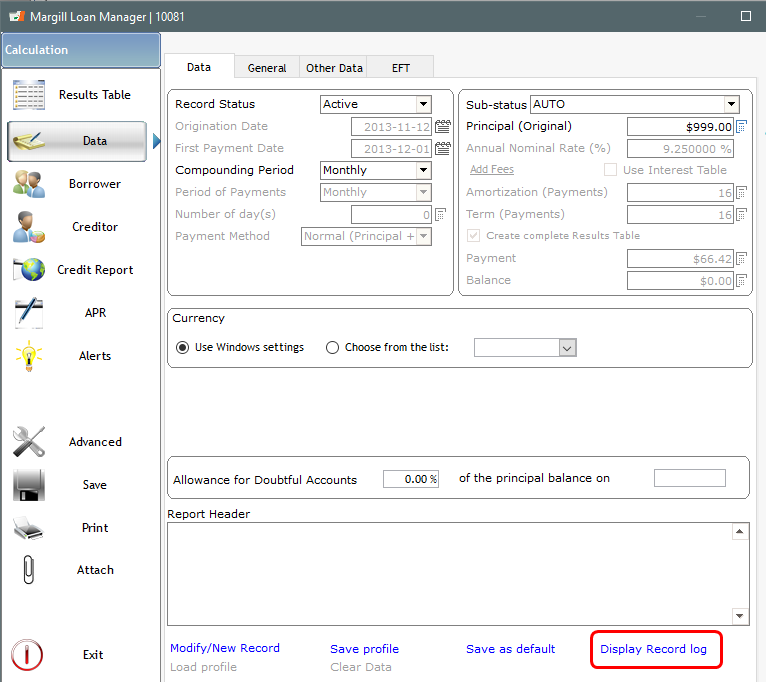

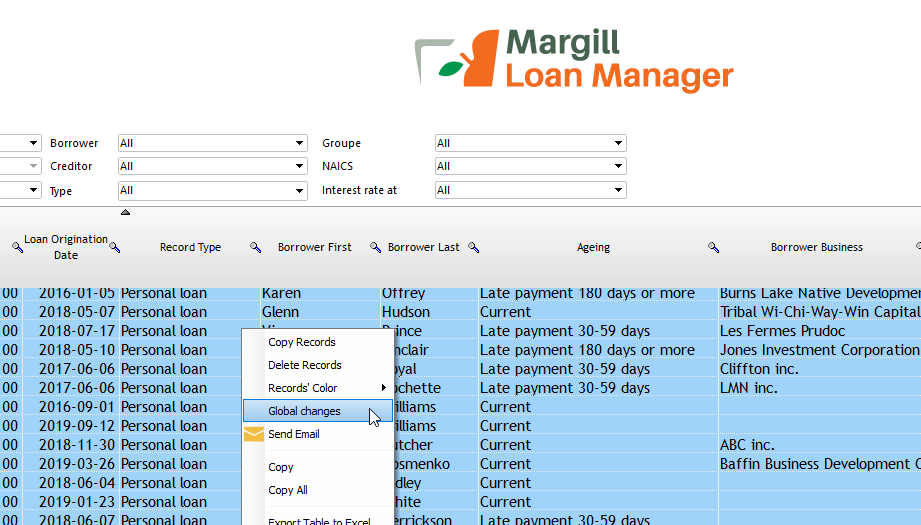

For adding new information or changing data in many Records at once, sort these in the Main window, choose the desired Records, highlight these and right click with the mouse. Choose Global changes:

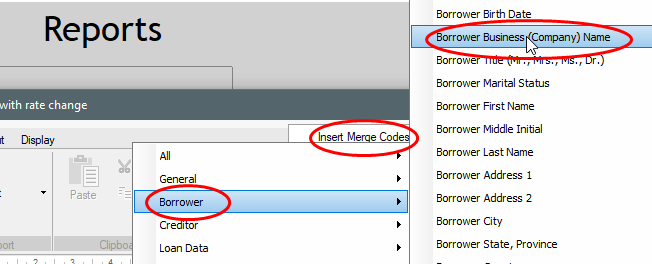

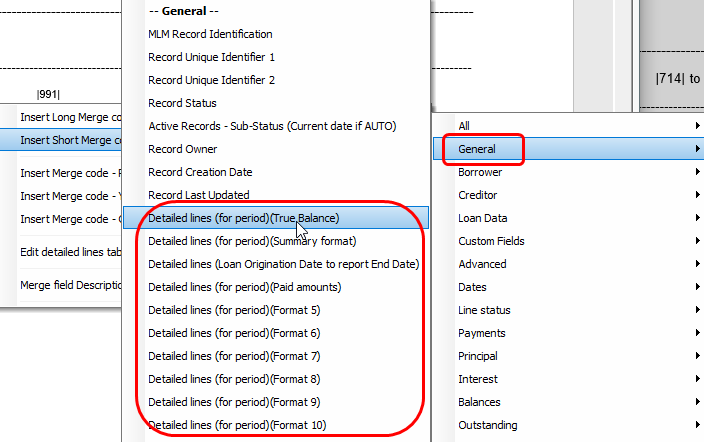

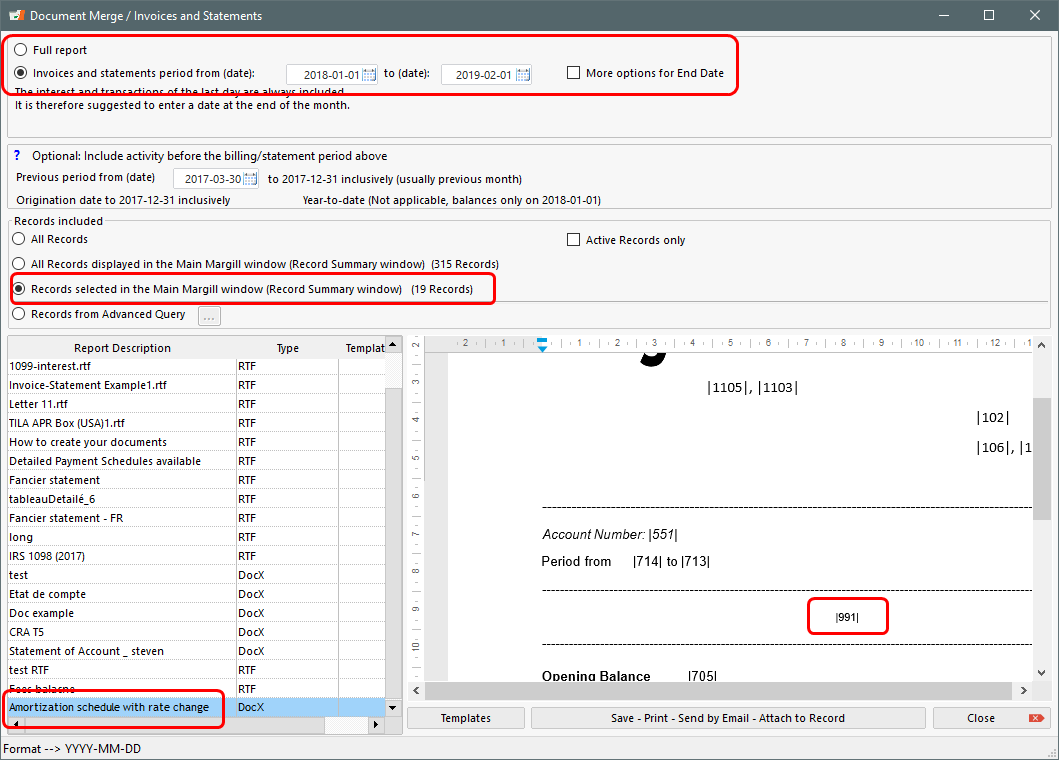

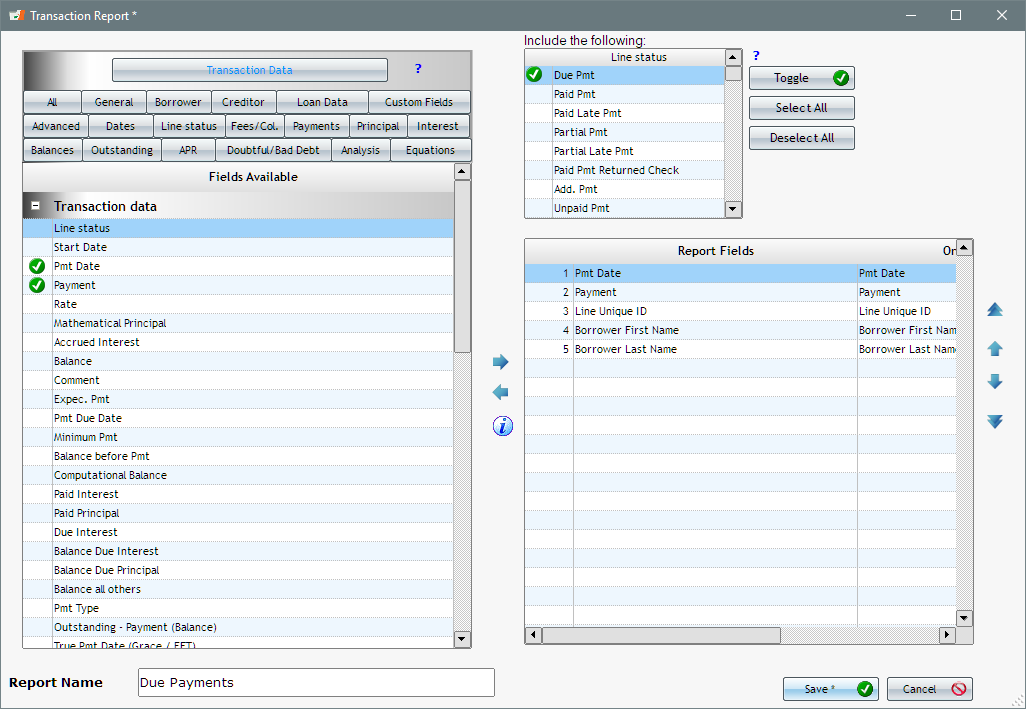

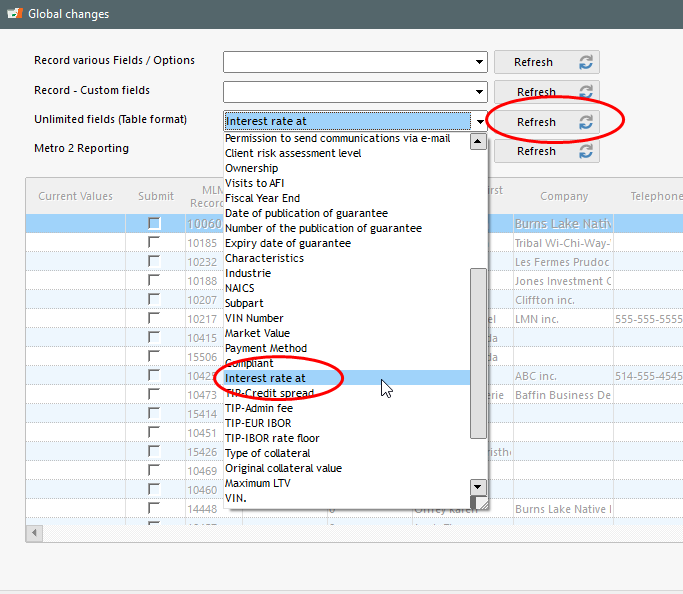

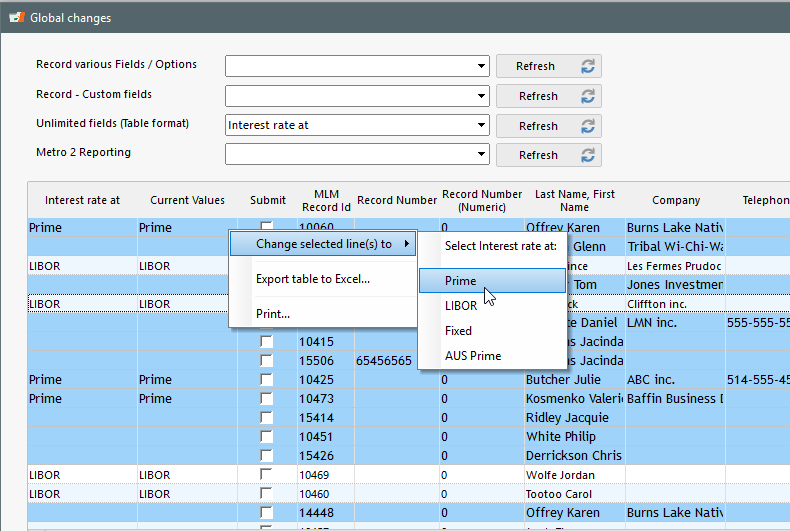

This window will appear showing the various fields that can be changed.

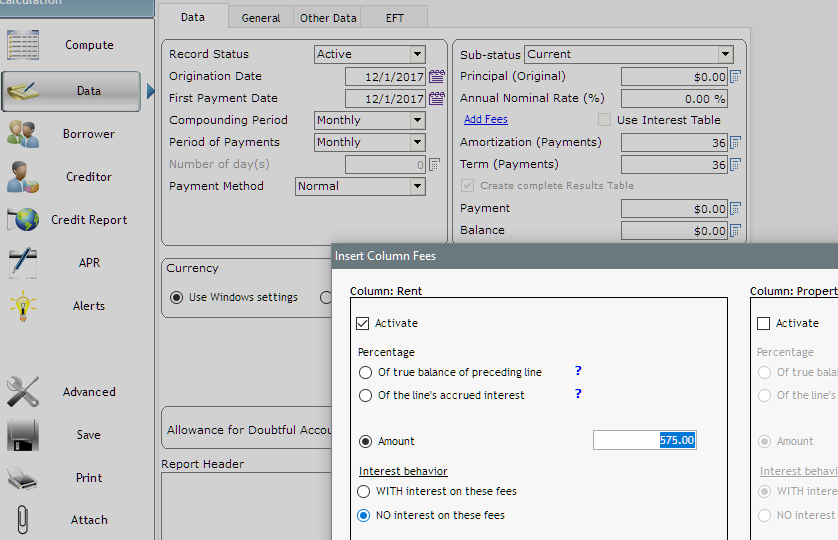

There are over 30 fields that can be changed plus all Custom fields.

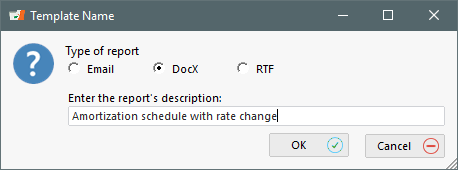

Select the field you wish to add data to (or change data) and press on Refresh. You can only add data to one field at a time.

Your can then highlight the Records and with the right mouse click add/change the data in bulk. Case being, you will see existing data and can replace these or not. Use the Ctrl or Shift key and mouse to pick and choose the desired lines.

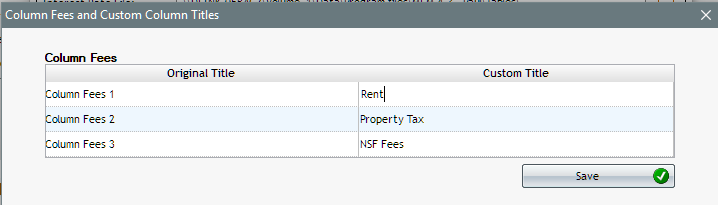

Below is the option when a scroll menu exists for the Custom field. If the field was a Text field for example, you would simply enter any text (no menu).

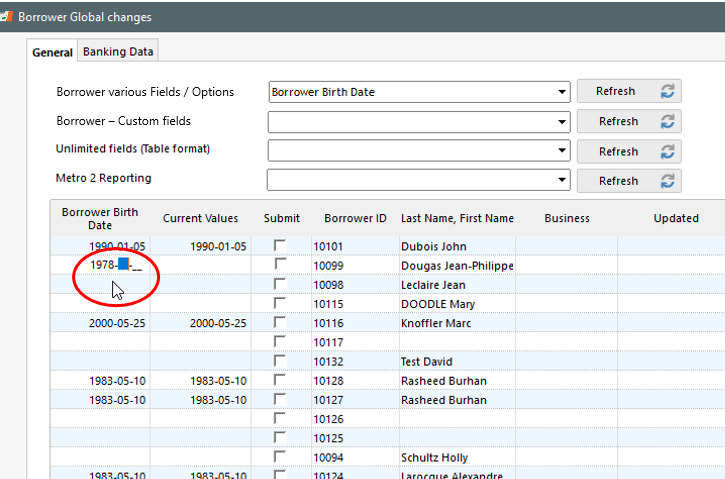

If the data is never the same, for example, adding the date of birth for Borrowers, you can add the data line by line.

Once the data is entered or changed, press on Save (bottom right). The changes will be made.

Adding data via spreadsheet (Sorry not yet… but coming soon):

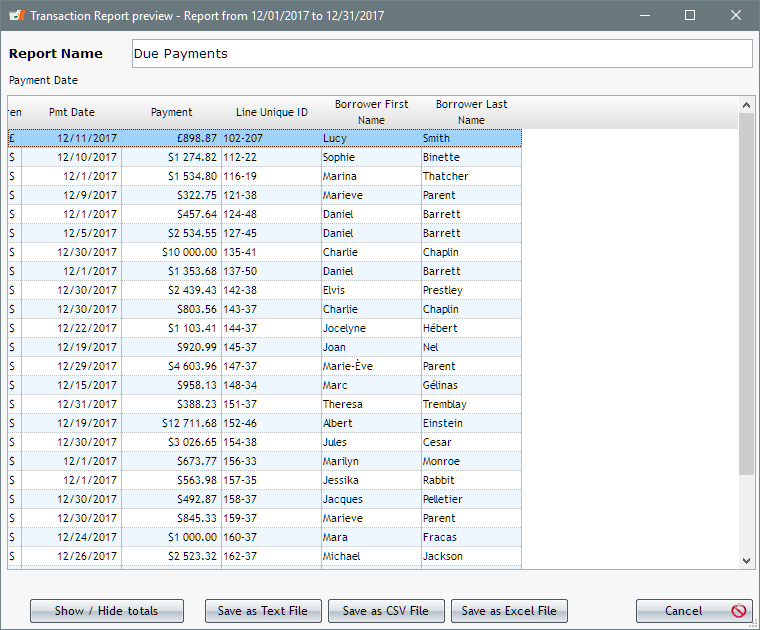

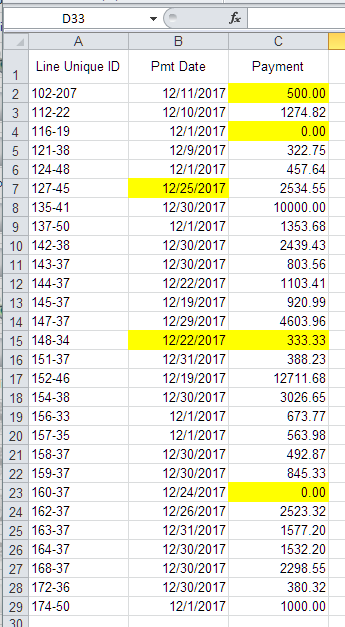

- In version 5.0.x coming up in a few weeks, you will be able to make these Global changes with a spreadsheet (Excel). All you will need are two columns (a loan Identifier – our “MLM Record ID” or one of the two “Unique Identifiers”. “File”, “File Number” and “Accounting ID” are not allowed since these may not be unique identifiers). It is strongly recommended to start using the Unique Identifiers offering much more versatility.

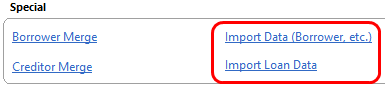

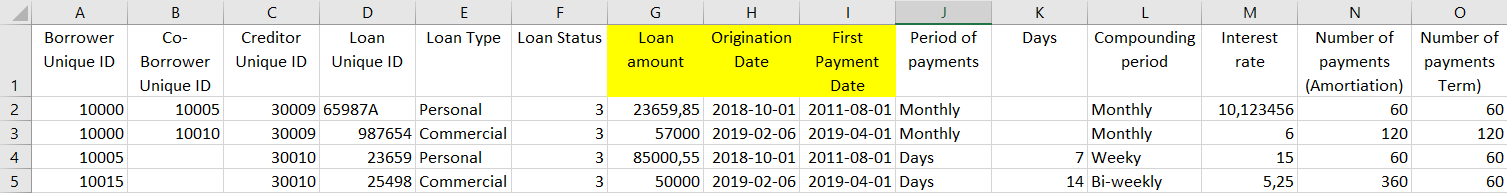

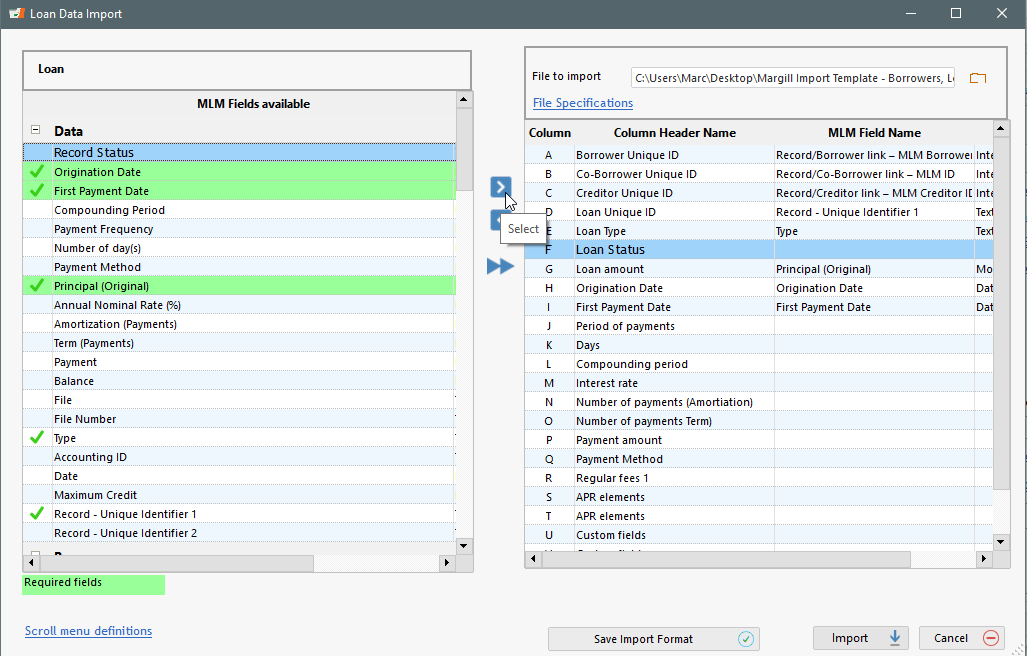

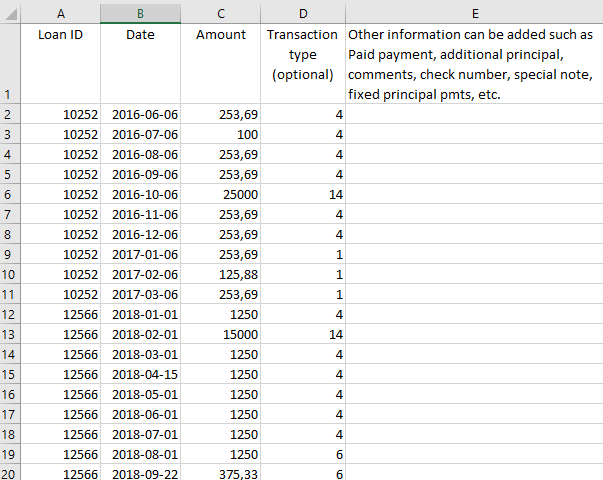

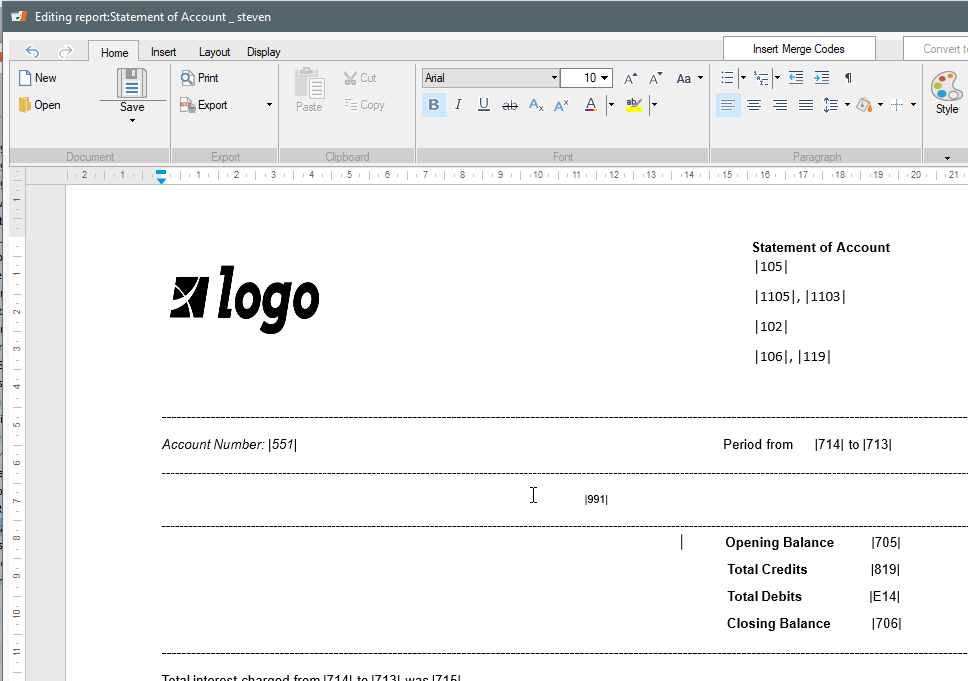

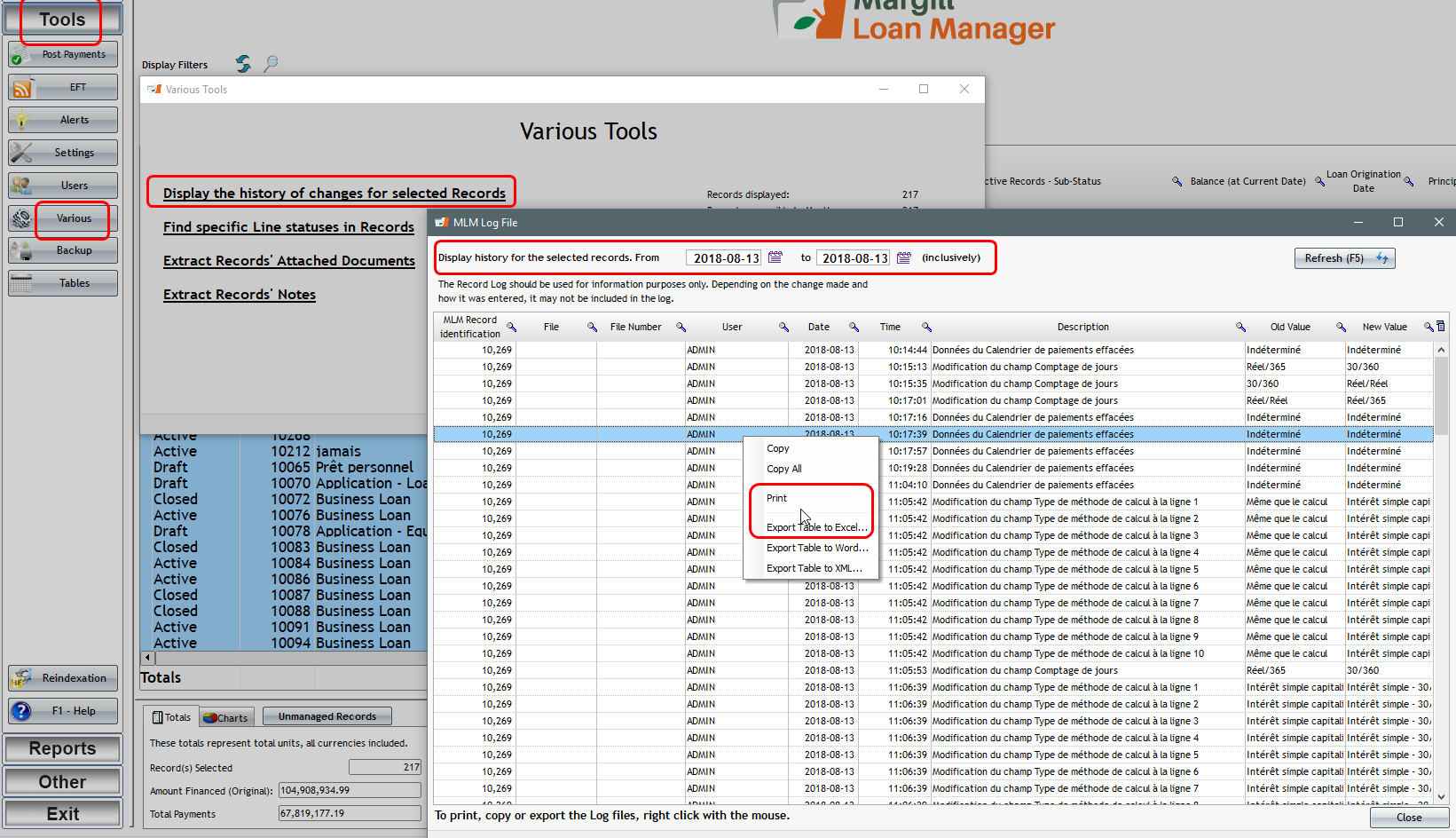

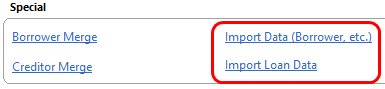

This is not the same as adding a new loan or Borrower in the database – this can be done through Tools, Settings, Special and:

See http://www.margill.com/en/mass-importing-existing-loans-and-borrowers-in-margill-loan-manager/

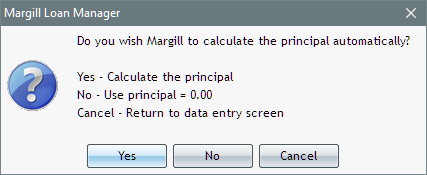

You can also use the Global changes for these practical changes:

- Change Active Records to Closed after your fiscal year end

- Activate Automatic fees

- Enable or disable the sending of email reminders to your Borrowers

- Activate the Electronic Funds Transfer for a bunch of Records at once

- Add banking data to your Borrowers

- Make corrections in bulk

- Add Metro 2 credit reporting compulsory data to the loans and Borrowers

- Update and change most Borrower data and their Custom fields