Transition from Perceptech to VoPay

This page explains the process and steps to follow to transition the pre-authorized payments service from Perceptech (ACCEO) to Margill’s EFT partner, VoPay International Inc. (www.vopay.com), a Canadian company headquartered in Vancouver.

IMPORTANT: To ensure a simple and smooth transition, we suggest that you start the process with VoPay immediately after receiving the application invitation email from VoPay.

Transition stages:

- March 2024: Emails sent by Margill and Perceptech announcing the end of Perceptech EFT services offered to certain customers. Note that Perceptech, a subsidiary of ACCEO, is still in operation and continues to offer its EFT services to other Margill clients. The transition to VoPay only affects certain Margill/Perceptech clients.

- April 24, 2024: Email sent by Margill indicating the prices of services with VoPay and link to this explanation page.

- After April 24, 2024: Application invitation email sent by VoPay which sends to the application form for each Margill client. Please note that you will need to complete VoPay’s Application Form within 7 days after receiving the link or it will expire.

- VoPay Application Form: The form allows the VoPay Compliance team to conduct its compliance due diligence review. You will need to provide information and documents about your company including incorporation documents, shareholders, financial statements, banking data, etc. This review is exactly what any financial institution would require and therefore you must answer the questions diligently and truthfully of course.

- If you manage multiple legal entities within Margill Loan Manager (MLM), only one main application will be required but VoPay will request additional information on each entity. If shareholders differ between entities, compliance due diligence will be required for each entity.

- Once the application form is completed, you will need to sign the VoPay service agreement.

- The compliance team will study your file and calculate the required reserve amount if necessary. If data is missing, VoPay will then send a request for additional information.

- Once the due diligence and credit risk review is completed, the VoPay account will be activated and the client will receive its login details (see no. 9 below).

- Estimated time frame for the VoPay approval process: 2 weeks.

- IMPORTANT: Before making the transition to VoPay, you MUST ensure that your Borrowers’ data follows certain formats. See the “Mandatory data at VoPay which was not mandatory at Perceptech” section.

- We estimate that transactions will be able to begin at VoPay around mid-June 2024 with the June version 5.6 of MLM. The exact date is to be determined. Even if this seems far away now, it is strongly recommended to begin the transition process ASAP.

Last Perceptech transactions

- On some date as of mid-June 2024, once your account is set up with VoPay, you will need to decide to submit your final transactions to Perceptech. Only submit transactions for a collection date (Date X) close to the current date and not for a full month.

- You will need to notify Perceptech of your last transaction date by sending an email to [email protected].

- Perceptech will then place your account in “suspended” mode but will remain active. This means you will no longer be able to submit transactions and if transactions were present after Date X, these transactions would not be collected by Perceptech. Any transaction after Date X must be submitted to VoPay.

- A Perceptech account that was placed in “suspended” mode nevertheless allows the verification of rejected transactions up to 90 days after Date X. Your account will therefore be definitively closed 90 days after Date X. The monthly fees will apply during these 90 days and any rejected transaction will be billed normally by Perceptech.

Definition

Date X: Date of the last collection date at Perceptech. Must be before October 31, 2024

- In MLM, a tool will allow you to specify Date X and a search will be carried out to check if transactions after Date X are in the system. These transactions will be identified and the tool will eliminate the “Payment submitted to Perceptech by EFT” status for all these transactions after Date X. You will therefore need to submit these transactions via VoPay.

Rejected payments with Perceptech

- As you know, a consumer has up to 90 days to dispute a debit from their bank account. Thus, from the date of the last transaction with Perceptech (Date X), when you perform your usual payment rejection check with the MLM EFT module, the module will verify for the rejections both at VoPay and Perceptech and this up to, at the latest, January 31, 2025 (i.e. 90 days after the end of the Perceptech service).

- For this mechanism to work, you will need to install the latest version 5.6 of MLM (this update will be automatic for clients on the Margill Cloud). We will notify you when this version becomes available.

Changes required in MLM

- Mandatory data for VoPay which was not mandatory for Perceptech

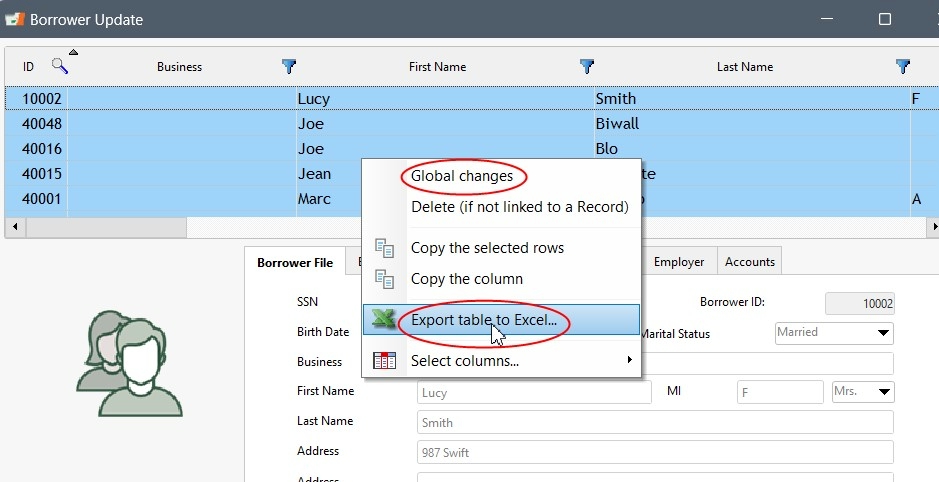

- We suggest starting the limited data cleanup below immediately since for the transition to VoPay, you will need to adapt some fields which must be submitted to VoPay. This data will need to be modified in your Borrowers. You can make changes easily through Global changes. These fields are now mandatory and must be in the following formats:

- Province: Must be a valid two-letter provincial or territorial code (alpha code). Ontario = ON, British Columbia = BC, Alberta = AB, Quebec = QC, etc.

- Note that in MLM (Version 5.6 of June 2024) contains a procedure by which even if “Ontario” (or Ont or Ont.) was entered from the Borrower’s province, when sending to VoPay, the province submitted will be converted to ON. Nevertheless, it is suggested to use standardized nomenclature (note that a menu can be created for the Province, Country and even City for the Borrower in Tools > Settings > Field Scroll Menus).

- Country: Must be a valid two-letter country code as defined by ISO 3166-1 alpha-2. Canada = CA

- City: These special characters are not allowed: Comma, underline and parentheses.

- Postal Code: Must be in standard A9A 9A9 format with or without the space.

- Additional information:

- Province: Must be a valid two-letter provincial or territorial code (alpha code). Ontario = ON, British Columbia = BC, Alberta = AB, Quebec = QC, etc.

- For Cities and Postal codes, we suggest first exporting all Borrowers (Borrowers window and right mouse click) and correcting via an Excel sheet, then reimporting via Global changes and Excel.

-

- Perceptech / VoPay mode

- Starting mid-June 2024 (exact date to be determined and you will be notified) the June MLM version 5.6 will be available. This version will allow a hybrid Perceptech / VoPay mode. This mode will allow you to do the following operations while continuing to submit your transactions to Perceptech. This hybrid mode will be activated by the transition assistant in the Settings > Pre-authorized payments section (more detail to follow).

- Enter VoPay account information while keeping Perceptech’s

- Verification of Perceptech transactions submitted in the future – we want to avoid such transactions being in MLM after Date X

- Monitor of rejected payments at both Perceptech and VoPay.

- Starting mid-June 2024 (exact date to be determined and you will be notified) the June MLM version 5.6 will be available. This version will allow a hybrid Perceptech / VoPay mode. This mode will allow you to do the following operations while continuing to submit your transactions to Perceptech. This hybrid mode will be activated by the transition assistant in the Settings > Pre-authorized payments section (more detail to follow).

Transition example when you receive payments every day:

- For monthly or payments every 7 days, the transition is quite straightforward. This example provides for the worse case transition scenario…

- Your VoPay account has been activated, you have activated Margill’s Perceptech / VoPay hybrid mode, and you have updated the Borrower data (Country, Province, City, Postal code).

- The date today is June 18, 2024 and you decided that Date X will be June 21.

- On June 17, you had submitted the EFT via Perceptech for the June 19 EFT

- On June 18, you had submitted the EFT via Perceptech for the June 20 EFT

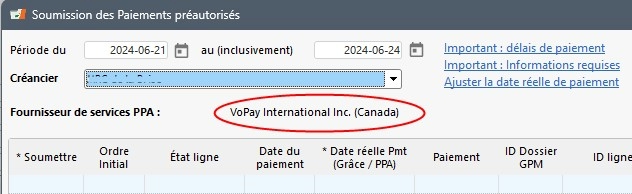

- On June 19, you indicate in MLM that you wish to submit via VoPay. A button will be provided to make the change and you will need to enter your VoPay account information (sent by VoPay). Once this activation done, you submit your EFTs normally. You will see the change of provider in the EFT submission screen:

- On June 20, you submit your VoPay payments normally and do your rejected payment checks normally. MLM will automatically verify rejected transaction at both Perceptech and VoPay. The process will continue for 90 days and everything will be transparent to you. After 90 days from the last debit date, the Perceptech account will be closed.

Critical Dates:

- Transition date – process with VoPay to be begun as soon as possible

- End of Perceptech EFT debit service: October 31, 2024

- End of Perceptech EFT transaction rejections verification service: January 31, 2025

Need assistance:

Simply write to us and we will get back to you in person or by email, as you wish:

Margill Team: [email protected]

Perceptech Team: [email protected]

VoPay Team: [email protected]