Judgments

See also :

The dollar ($) has been used in these examples, but any other currency (€, £, F, ¥, R, DA, Rs… etc.) may be used.

Most of the calculations below may use Fixed (unique interest rates) or Variable rates.

Real-life examples:

Pre and post judgment (variable interest rates)

Interest following a judgment (unique interest rate)

Judgment collection including prejudgment interest and court fees that bear interest or not

Partial payments paid before the judgment

Collection of judgment awards by recurring payments

Late / unpaid salaries indexed according to an agreement

Hypothesis of a lump sum to be paid to the plaintiff instead of a structured settlement over time

Today value of an historical judgment (indexation)

Pre and post judgment (variable interest rates)

Input screen :

- Interest (x%) may be added or subtracted to the variable interest rates indicated in the interest table created –Percentage to Add (Annual).

- This added (or subtracted) interest rate can take effect at any time during the calculation – Eff. Date.

- The simple interest may be capitalized (compounded) at the anniversary date – __ Capitalize.

- Choose

any interest rate table among the many legal interest tables or create your very own.

any interest rate table among the many legal interest tables or create your very own. - You can see the interest table dates and rates by pressing on the

.

. - In some jurisdictions, the interest rate to be used is the rate at the start of the proceedings. Margill can do this by checking

.

.

Results screen:

- Can divide the Total Interest in a fixed rate portion and a variable rate (not shown in example).

- For example when the rate is 7%, 5% could be the legal (or contractual interest) and 2% an additional indemnity. When the rate is 9%, the additional indemnity would be 4%.

- Results can be exported to TXT format (Export button) or Word, Excel, XML (Web) (right click of the mouse).

- Results may be printed in a concise report.

Pre and post judgment interest (unique interest rate using the rate applicable at the start of the procedures among variable interest rates)

Input screen (bottom):

Simply check the box to use the rate at the Start Date. In this example, the rate on 05-05-1998 is 5%, thus the whole calculation will use 5% even if rates change afterwards.

Results screen:

Interest following a judgment (unique interest rate)

Input screen:

- The simple interest may be capitalized (compounded) at the anniversary date – __ Capitalize.

Results screen:

The Results screen will be like that above at a unique fixed interest rate of 8% in this example.

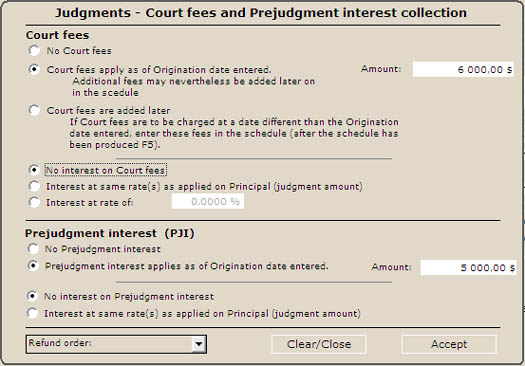

Judgment collection including prejudgment interest and court fees that bear interest or not

This highly sophisticated module offers a unique tool to easily collect judgment awards when prejudgment interest is already computed and/or court fees included in the amount due to the plaintiff.

Calculations can be done using simple or compound interest.

Example:

- Collection of a $75,000 judgment including prejudgment interest (already computed) and court fees

- Post judgment rates are variable (Texas rates in this example)

- Defendant agrees to pay $2,000 per month but does not respect this schedule (unpaid, late, partial payments)

- Include $6,000 court fees and $5,000 prejudgment interest (no interest on these). This is easily entered with theJudgment link above. Interest can also be added on these amounts. Court fees can be added at the Origination date or later on, at any time in the resulting schedule.

- We compute and if the defendant pays according to schedule, 47 payments will be required to refund the judgment award that includes postjudgment simple interest; court fees (no interest) and prejudgment interest (no interest)

- There is also a second part to the judgment ($15,250) with interest starting only on 09/17/2009

- Various events included and updated over time: missed payments, partial payments, returned checks, fees (no interest) new Court fees ($1000)(see Line Status that reflects what is charged and when and the Comments column in the schedule)

- Starting 03/01/2010, we decide to recompute the equal payments to repay the total amount owed in 38 months.

Margill can include just about any repayment scenario however complex!

Over 40 columns show what amount is paid when, all the while respecting the preset refund order:

- Interest on Court fees

- Interest on Prejudgment interest

- Interest on Other fees

- Interest on Principal

- Court fees

- Prejudgment interest

- Other fees

- Principal

Some of the columns available when scrolling to the right

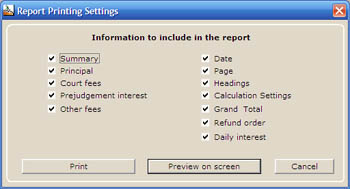

The reports include the summary schedule as well as separate sections for Principal, Court fees, Prejudgment interest and Other fees.

Partial payments paid before the judgment

In our example :

$50,000 judgment in which the defendant has made 3 payments before the judgment. What is the total interest due at the judgment date?

Use the Recurring payments (Amortization) calculation and Irregular payments. You will then be able to build your schedule. Simple or compound interest could be used. In this example, simple interest is used (Advanced icon).

Three payments before judgment: January 10, 1999, June 26, 2000 and November 11, 2003.

The judgment is pronounced on October 15, 2004. You must add each payment in the table (initially empty – “Period of Payments” being “Irregular”) to calculate the balance due and interest in the Results screen.

The judge may also decide to award various amounts at certain moments in time. In this case, insert negative amounts in the “Payment” column.

In the example below, we will see how to calculate the interest if the defendant (now debtor) agrees to pay what is owed at $6000 per month.

Collection of judgment awards by recurring payments

The defendant owes the plaintiff $68,782.18 on the day of the judgment.

Two approaches are possible:

1) Continue the above calculation (nice and neat to have all in one calculation). In this case, since we are using simple interest, we must (may) add the accumulated interest on the judgment date. In our example, the debtor pays $6000 on the first of each month. These amounts, the payment frequencies and the interest rates can be changed. Also, if payments are missed, these can be added to the schedule and the table is recalculated.

2) Make new payment schedule using $68,782.18 on the day of the judgment in the Recurring Payments (Amortization) calculation. The schedule can also be saved and edited.

Late / unpaid salaries indexed according to an agreement

Use the “Accrual by installment calculation”. See the Late / unpaid Salaries, Rent, Alimony page.

Late / unpaid and late rent

Use the “Accrual by installment calculation”. See the Late / unpaid Salaries, Rent, Alimony page.

Hypothesis of a lump sum to be paid to the plaintiff instead of a structured settlement over time

This is a fictional example with more or less arbitrary numbers to demonstrate how Margill can help:

The plaintiff (20 years old) was seriously injured as a student in university. He will not be able to work for the rest of his life. What lump sum should be paid today instead of a structured settlement, taking into account his revenue today as a student, as a worker and upon retirement?

- Revenue as a student is estimated at $1000 per month (for 2 years)

- As a worker, his salary would be $50 000 a year ($4167 per month). This amount is indexed at 2.0% per year up until 65 (for 33 years)

- Upon retirement the yearly revenue falls to 30 000$ in today dollars but indexed at 2.0% per year (10 years). $30,000 in 35 years would be worth approx. $57 600 with 2% yearly inflation. See calculation below ($4800 per month):

Let’s now do our calculation…

In this screen we have $1000 for 2 years (these were changed manually in the Present Value table – 24 changes). As we scroll down the Present Value table, we see the monthly installments change to reflect our hypotheses above.

|

Working age (2 years after accident) |

2% yearly inflation (salary indexation) |

Retirement age – amounts changed manually |

With a 3% discount rate (the discount rate may be fixed by law), the plaintiff should receive $1.53 million.

With a 2% discount rate, the amount would be $1.88 million.

Today value of an historical judgment (indexation)

What is the value TODAY of a 1983 judgment of $125 000?

In the US: $235 800

In Great-Britain (the £ should be the unit of course): £279 400

In Canada: $233 800