Calculating interest on fees and expenses on the clients behalf – for Law firms

Question: We are a personal injury law firm that advances its clients and upon settlement we wish to calculate the interest on these fees that are added at different dates.

Answer: Margill products easily do these calculations and hundreds of law firms use Margill for this specifically or for their legal calculations (prejudgment / post judgment).

Depending on your volume, you could either use Margill Interest Calculator (low volume) or Margill Loan Manager (higher volume of accounts and transactions).

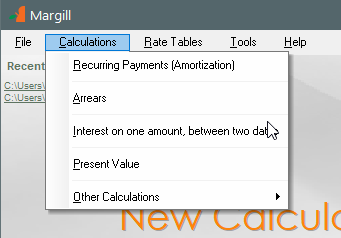

Margill Law Calculator:

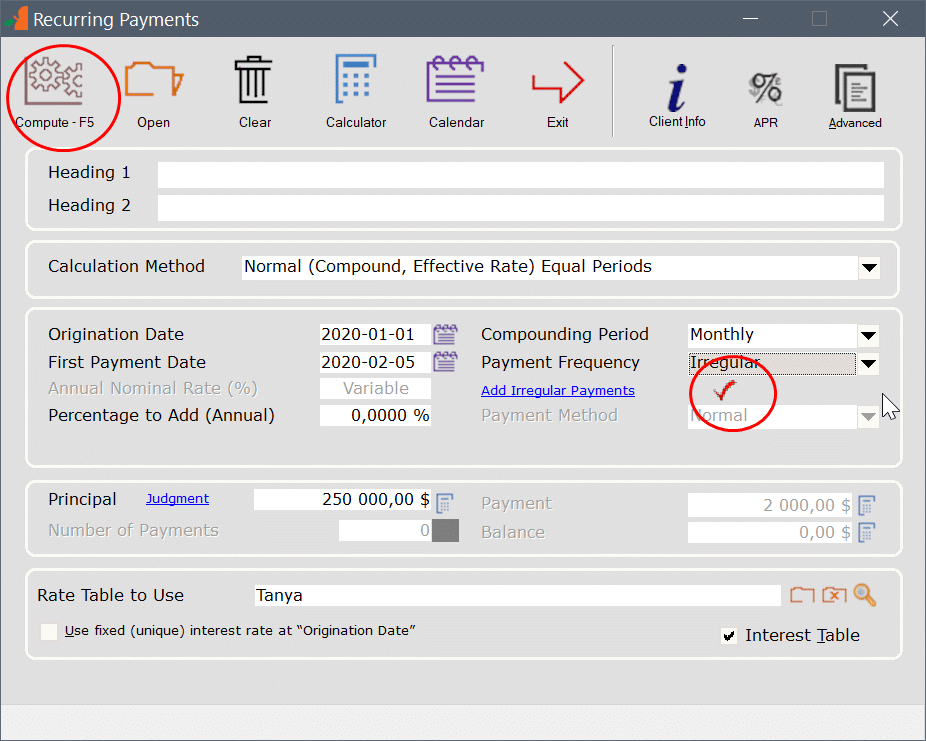

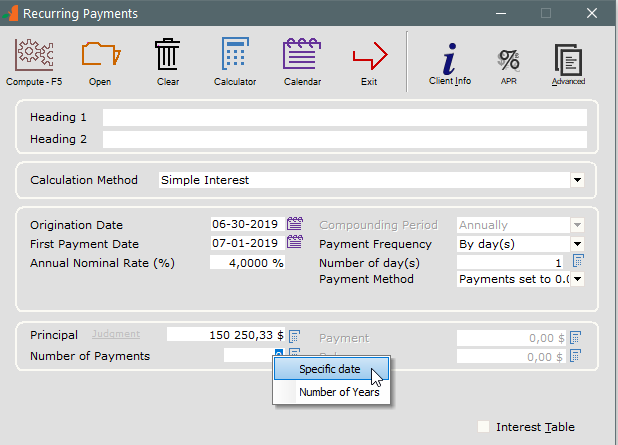

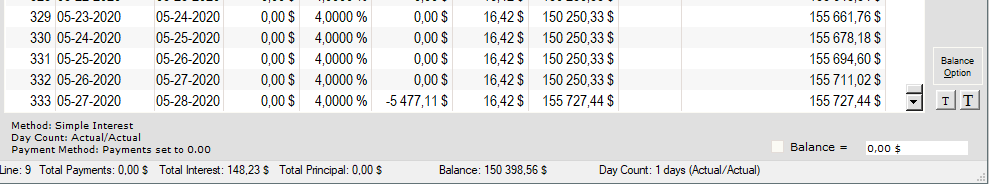

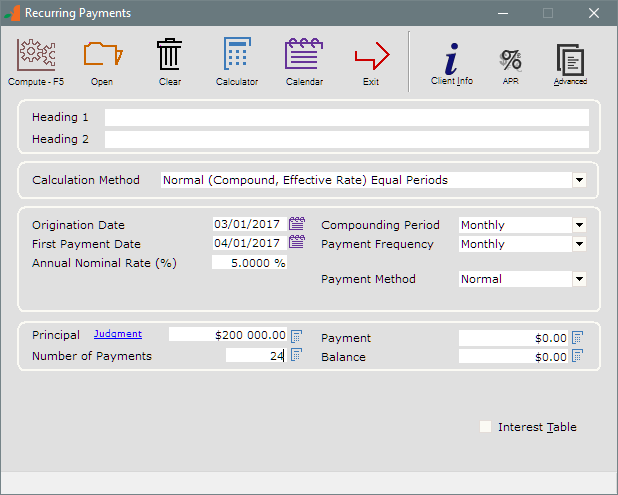

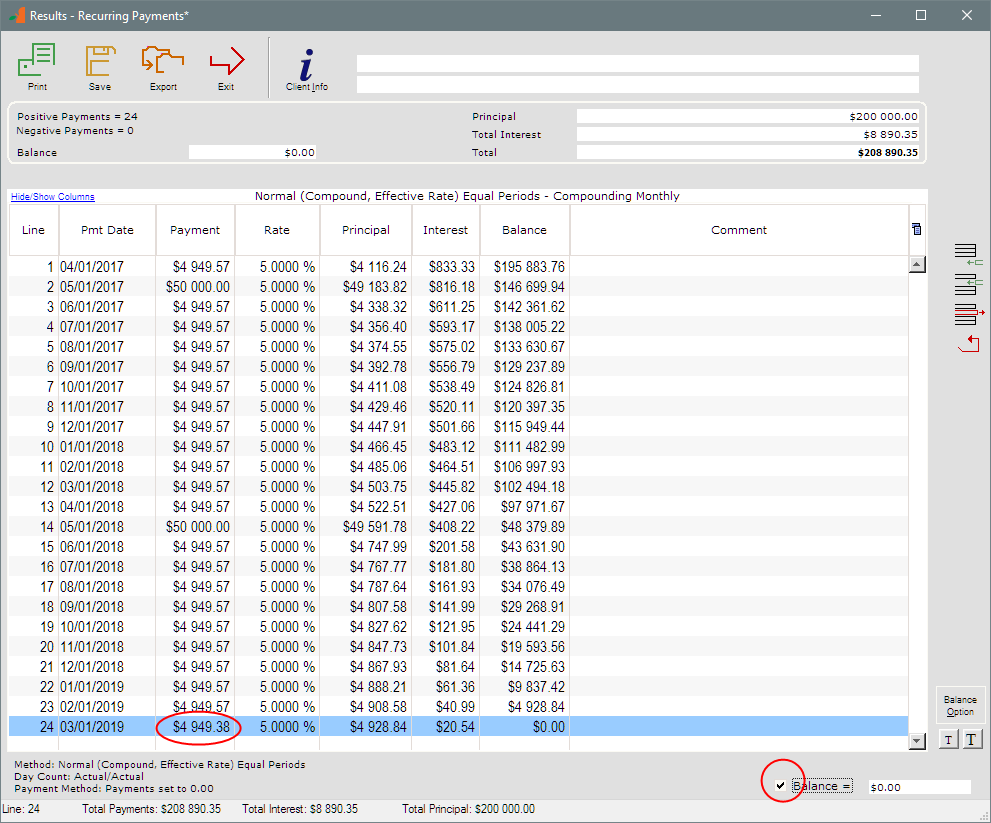

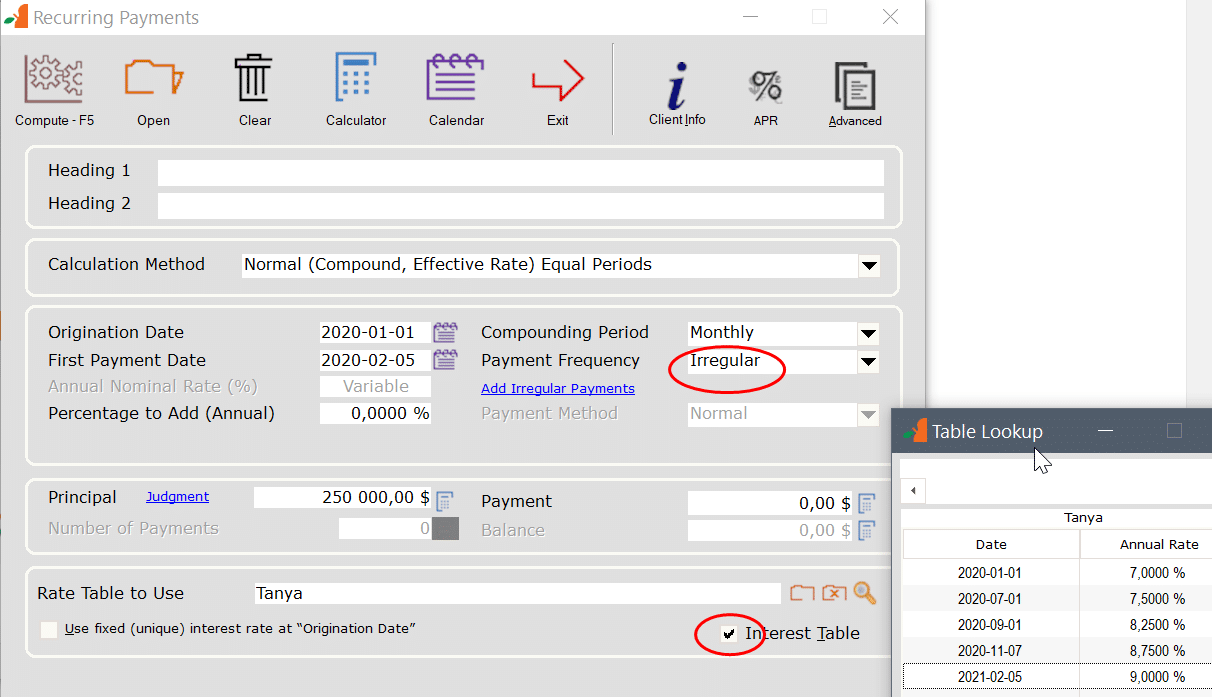

Use the calculation called “Recurring Payments (Amortization)”:

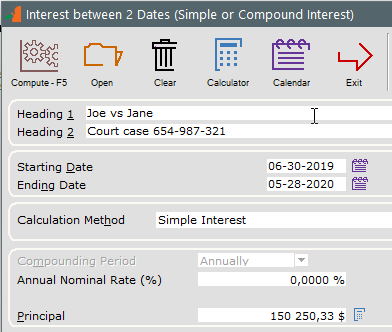

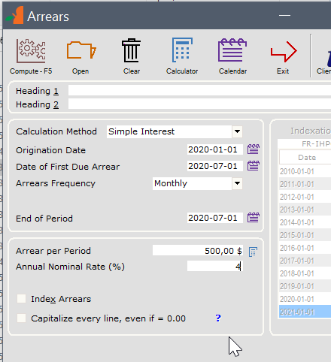

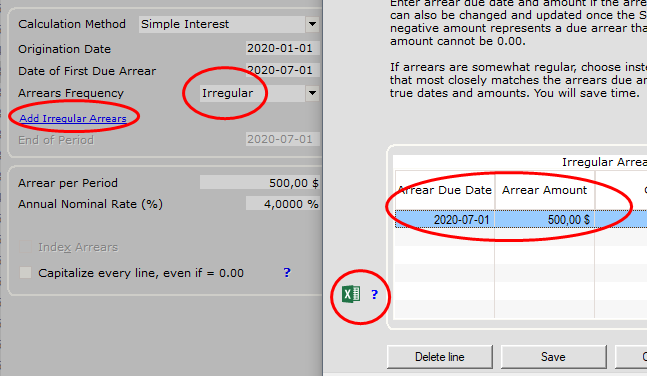

Calculation Method is usually Simple interest (not compound).

Origination date and First Payment Date would be when the first fees / expense is paid by the law firm.

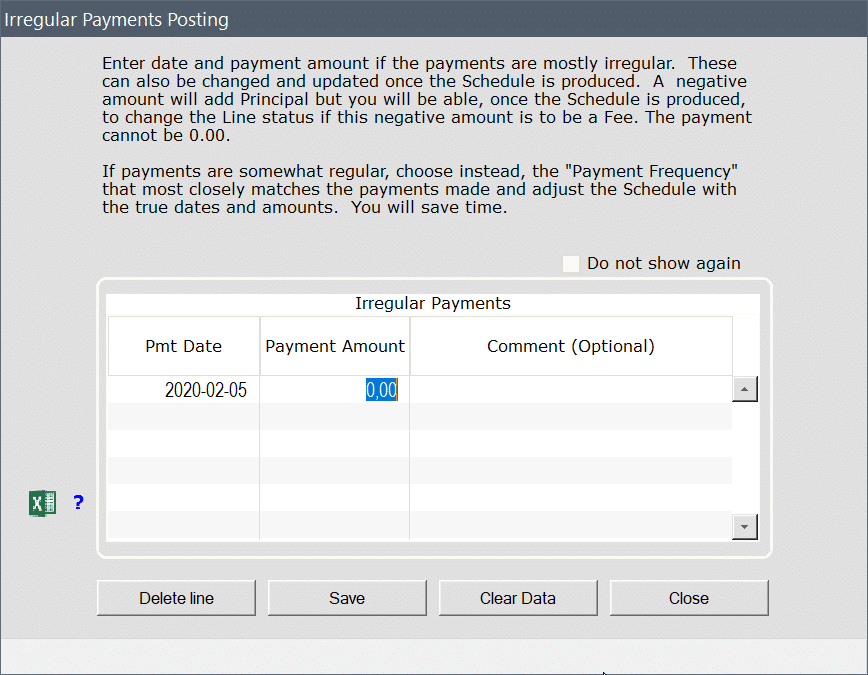

Fees are usually totally irregular so use the “Irregular” Payment Frequency.

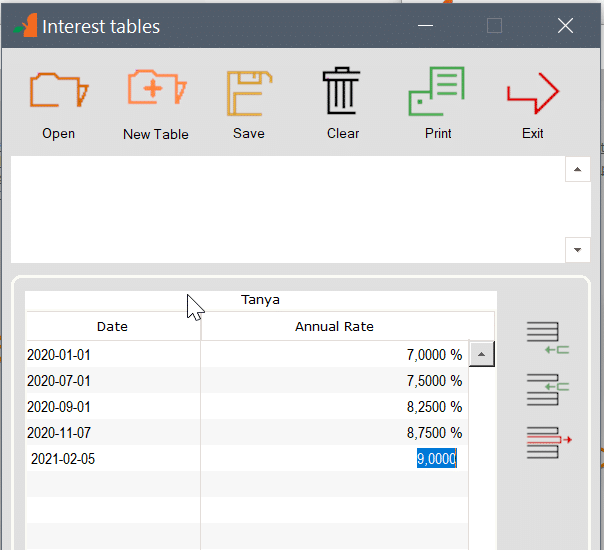

Rates can be fixed or even be tied to your bank’s interest rate (check Interest Table in this case – you would have to had created the interest table).

Click on “Add Irregular Payments” to add the fees.

Fees should be added as negative amounts (positive amounts are payments you would have made to your client – rare in these situations since the payment is made upon settlement). Enter the date at which the interest starts on these (some law firms will only charge interest 30 days after the amount is paid to the supplier). A comment can be added.

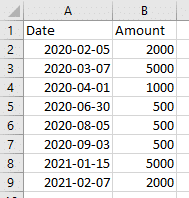

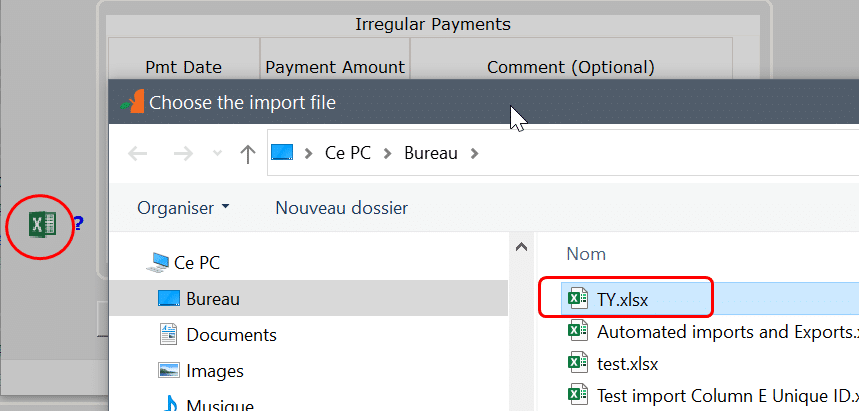

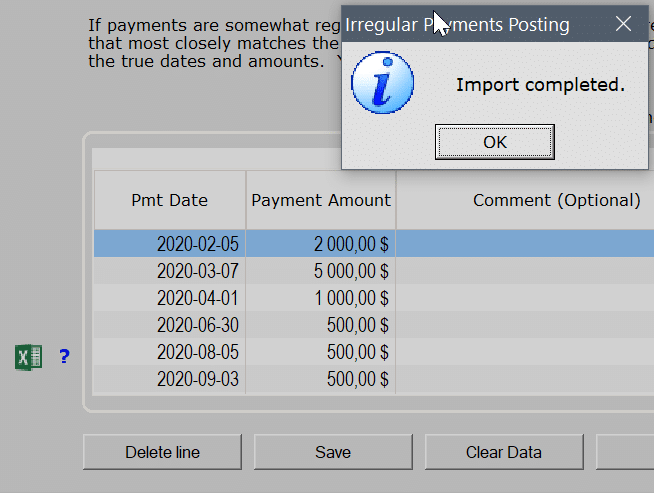

If you have many of these for a file, you can add them with a very simple Excel sheet with two or three columns (press on the ? to see the format).

Then click on Save.

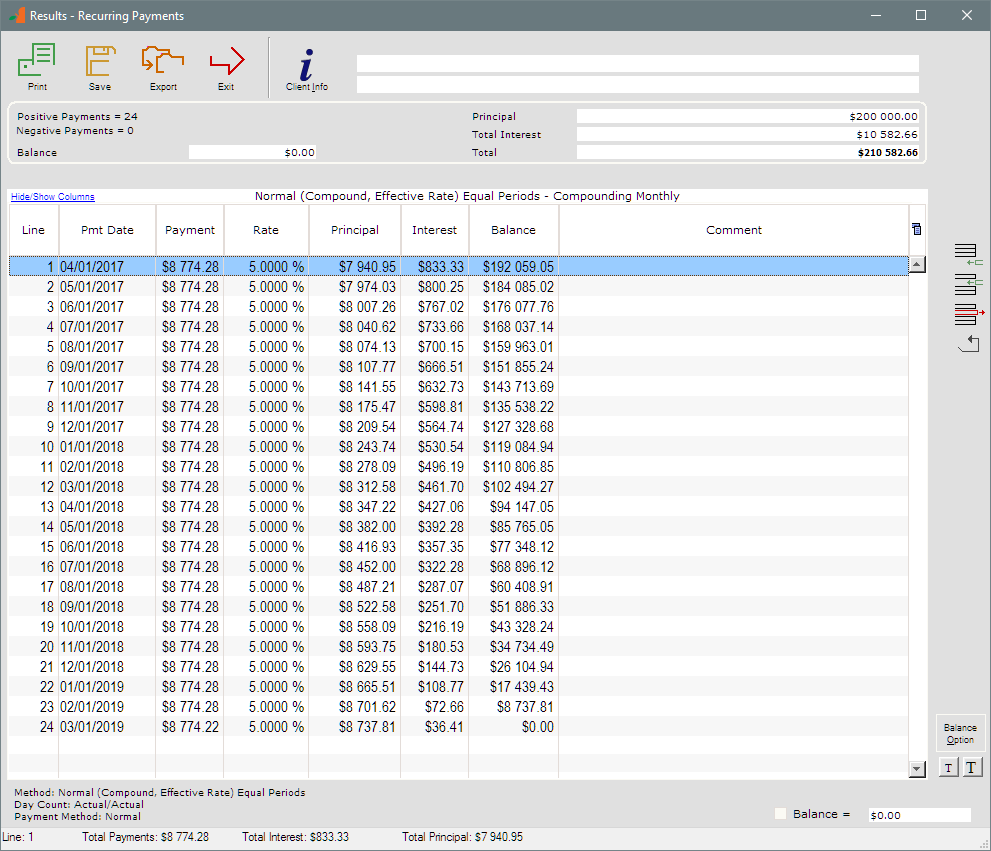

Then Compute to create the Payment schedule

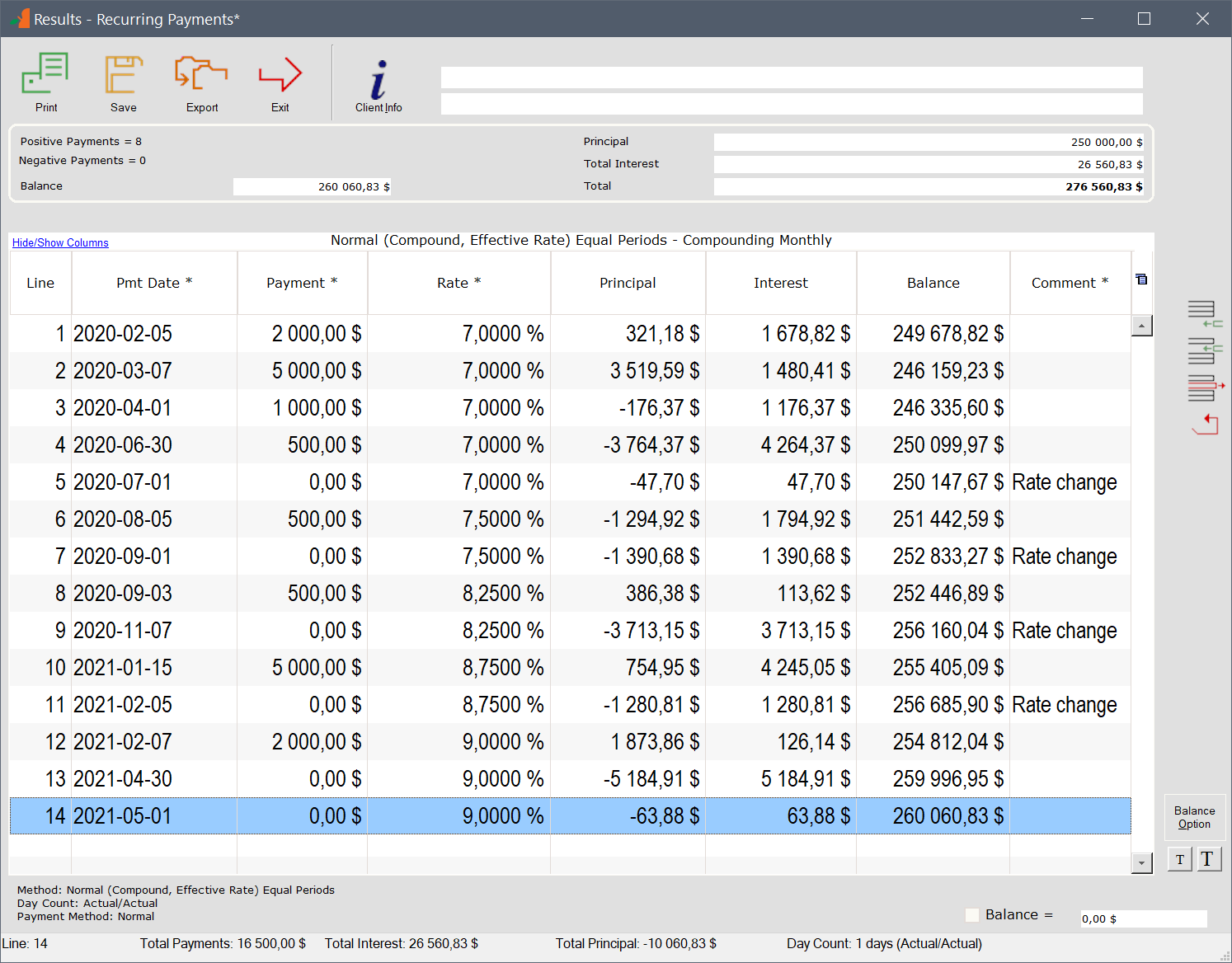

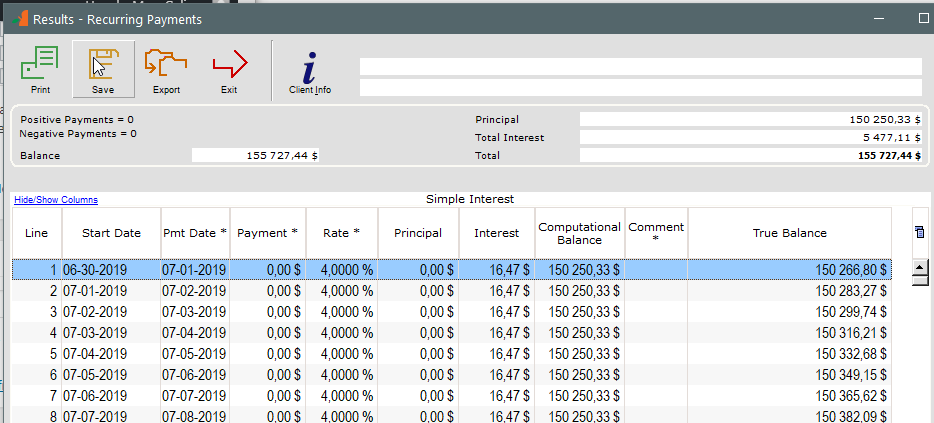

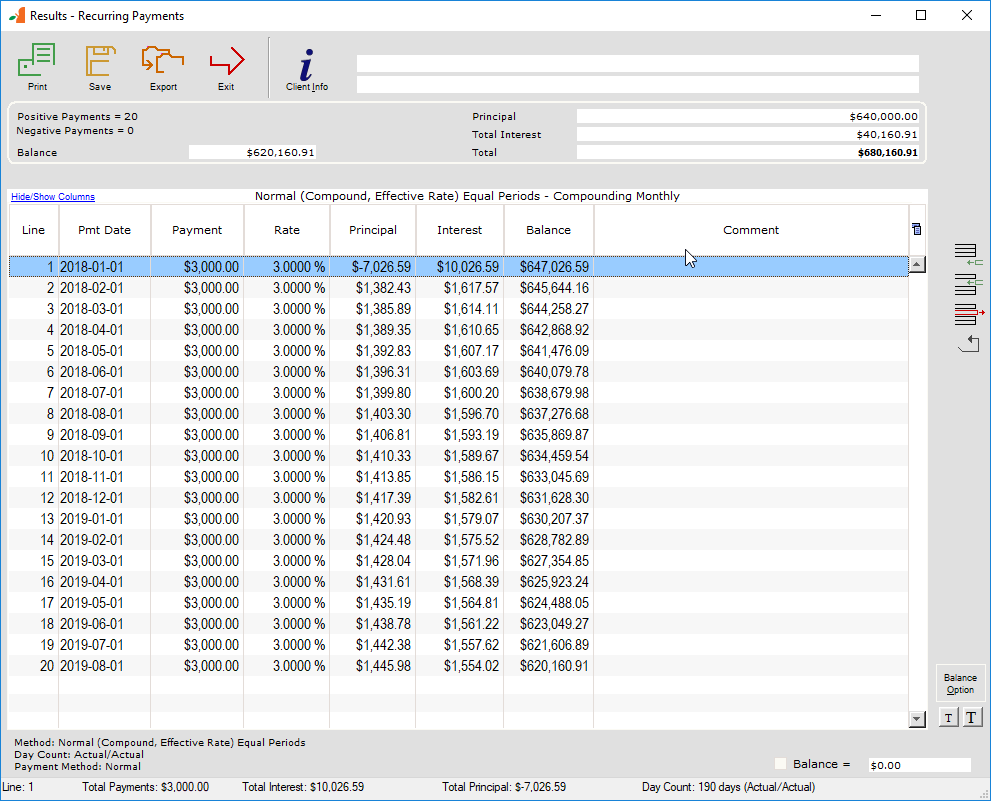

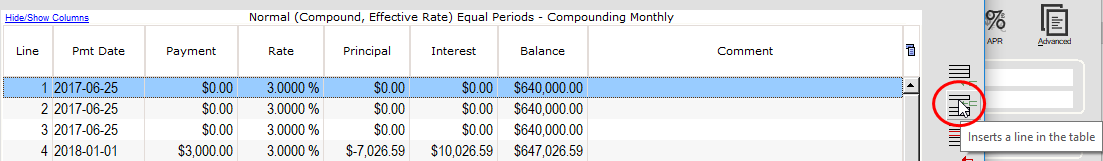

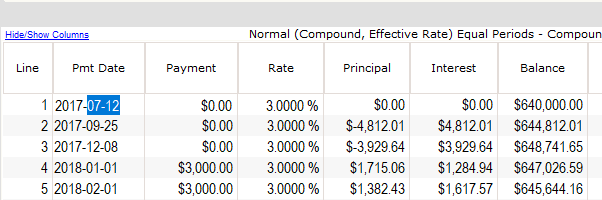

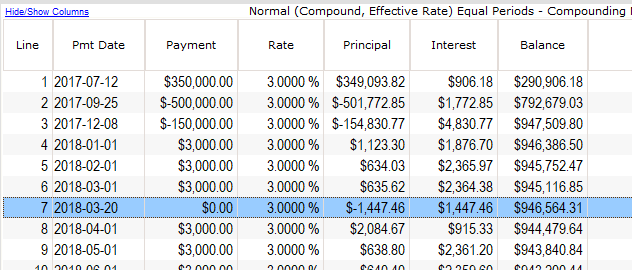

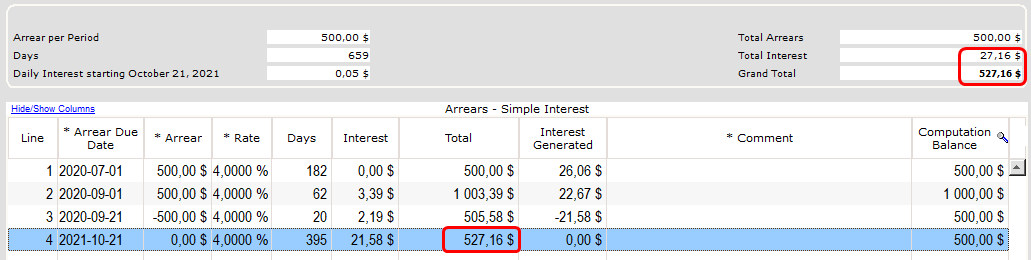

Schedule looks like this:

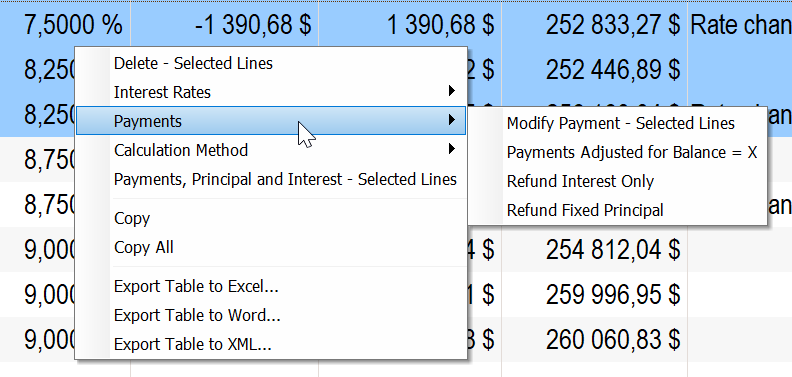

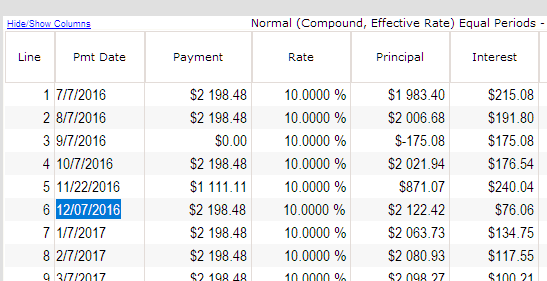

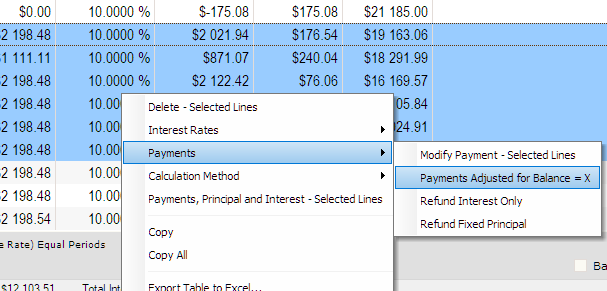

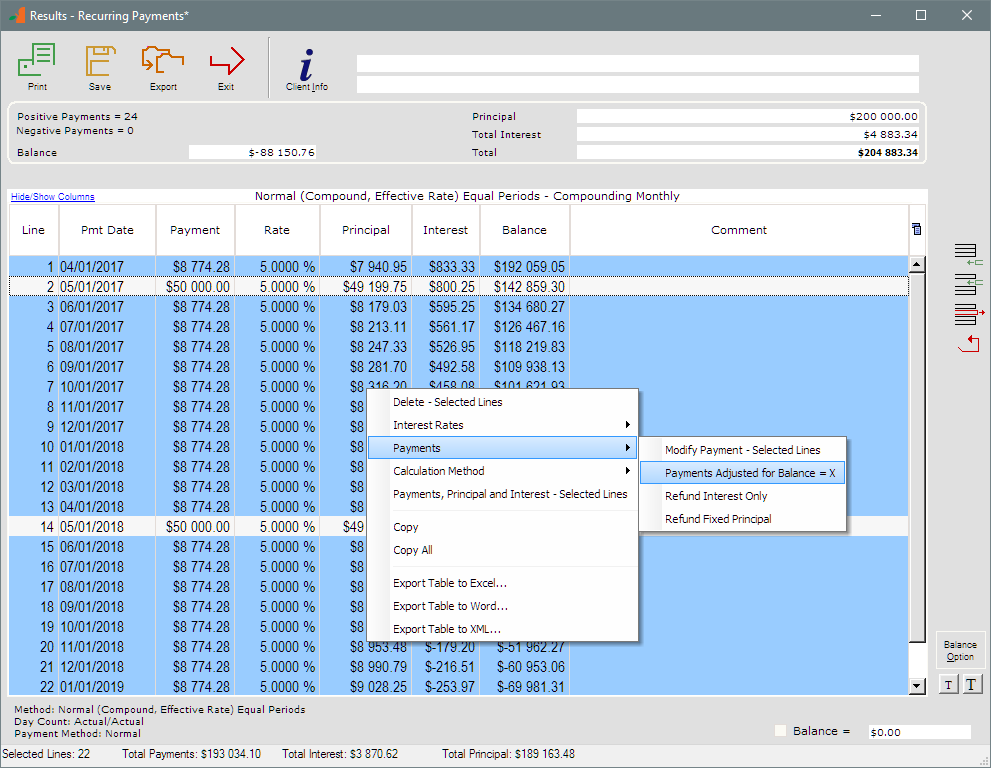

Now I want to calculate the interest until August 22. I had forgotten to add a fee of $222.22 on July 7 so I will add it here. Use the icons on the right or the right mouse click:

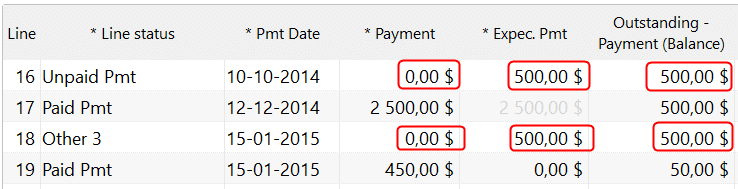

Notice there are no Payment amounts on lines 5 and 6 since the goal is simply to get a balance on these dates.

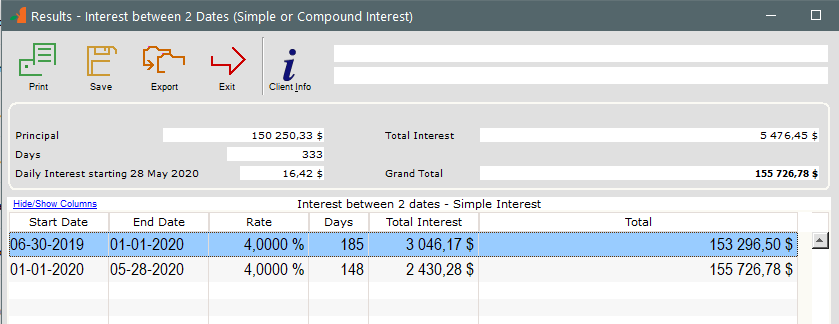

So total interest is $189.99.

You can save the schedule and update over time. use the Save button on top.

It’s that easy.

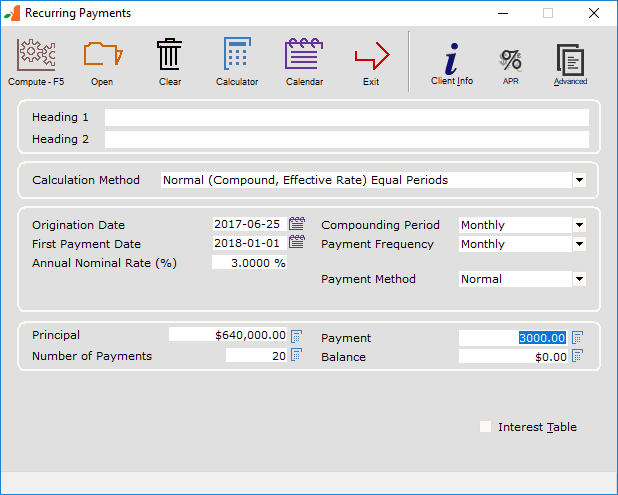

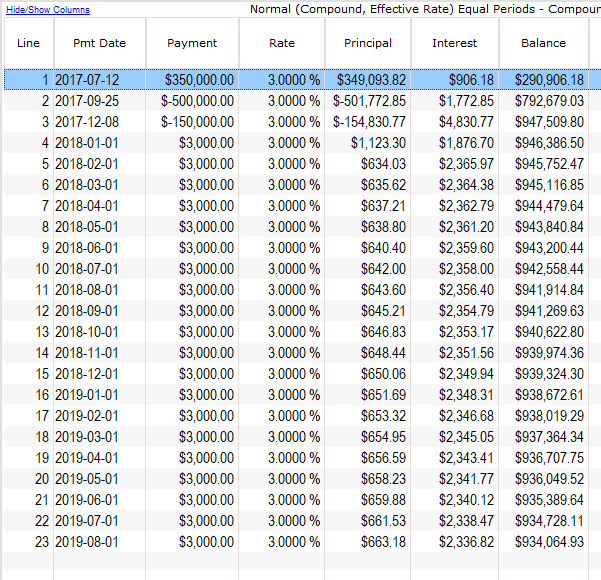

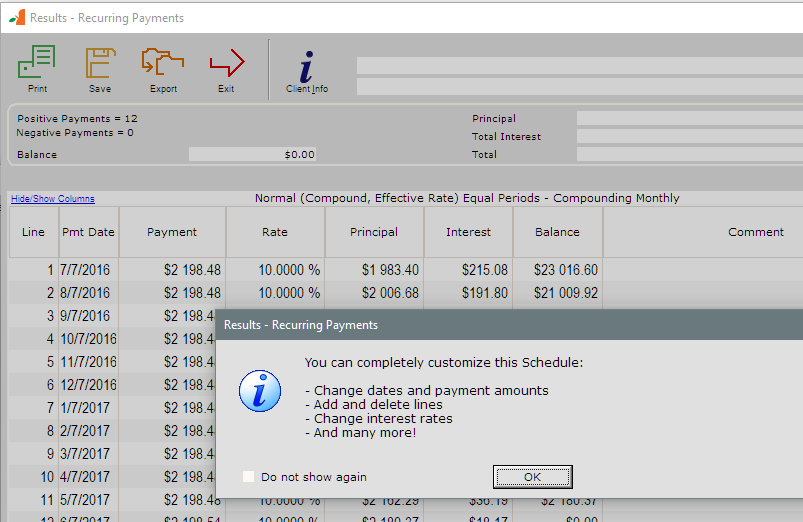

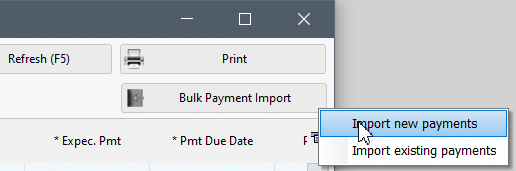

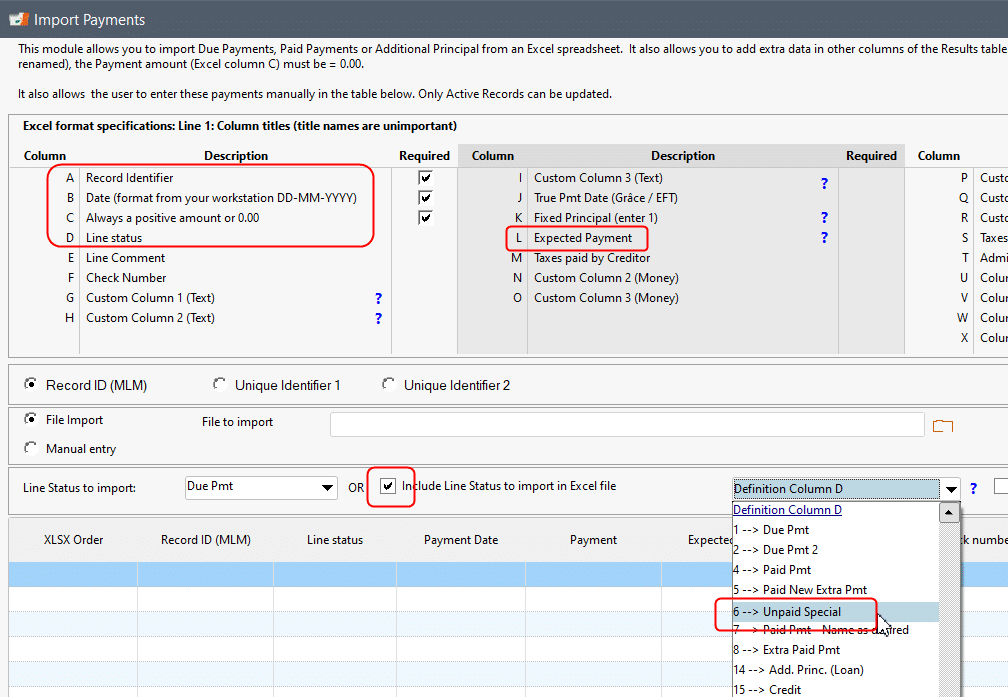

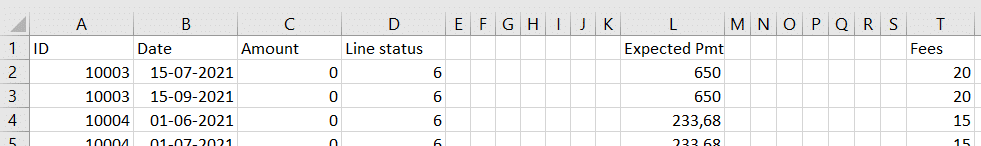

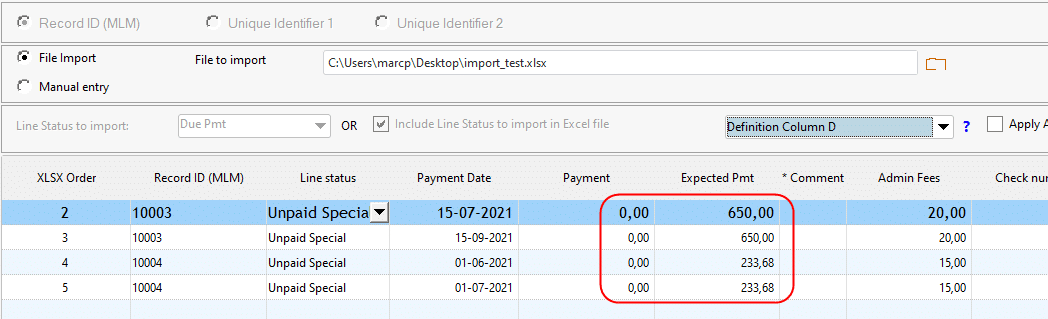

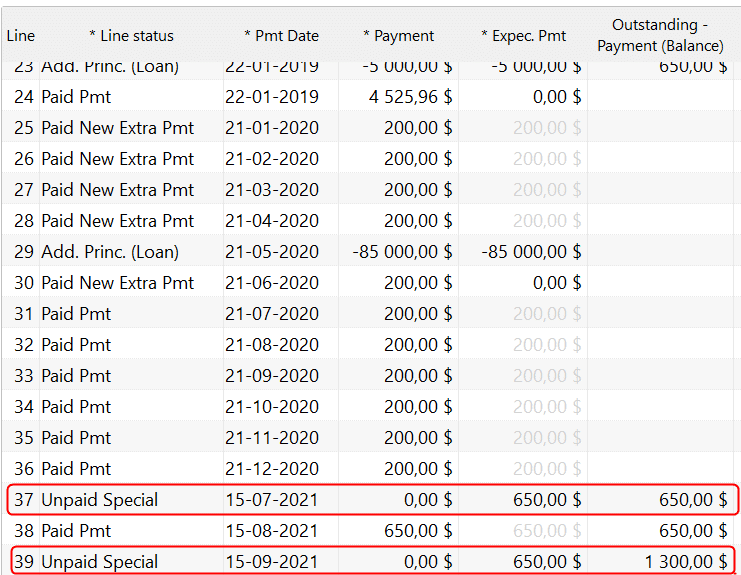

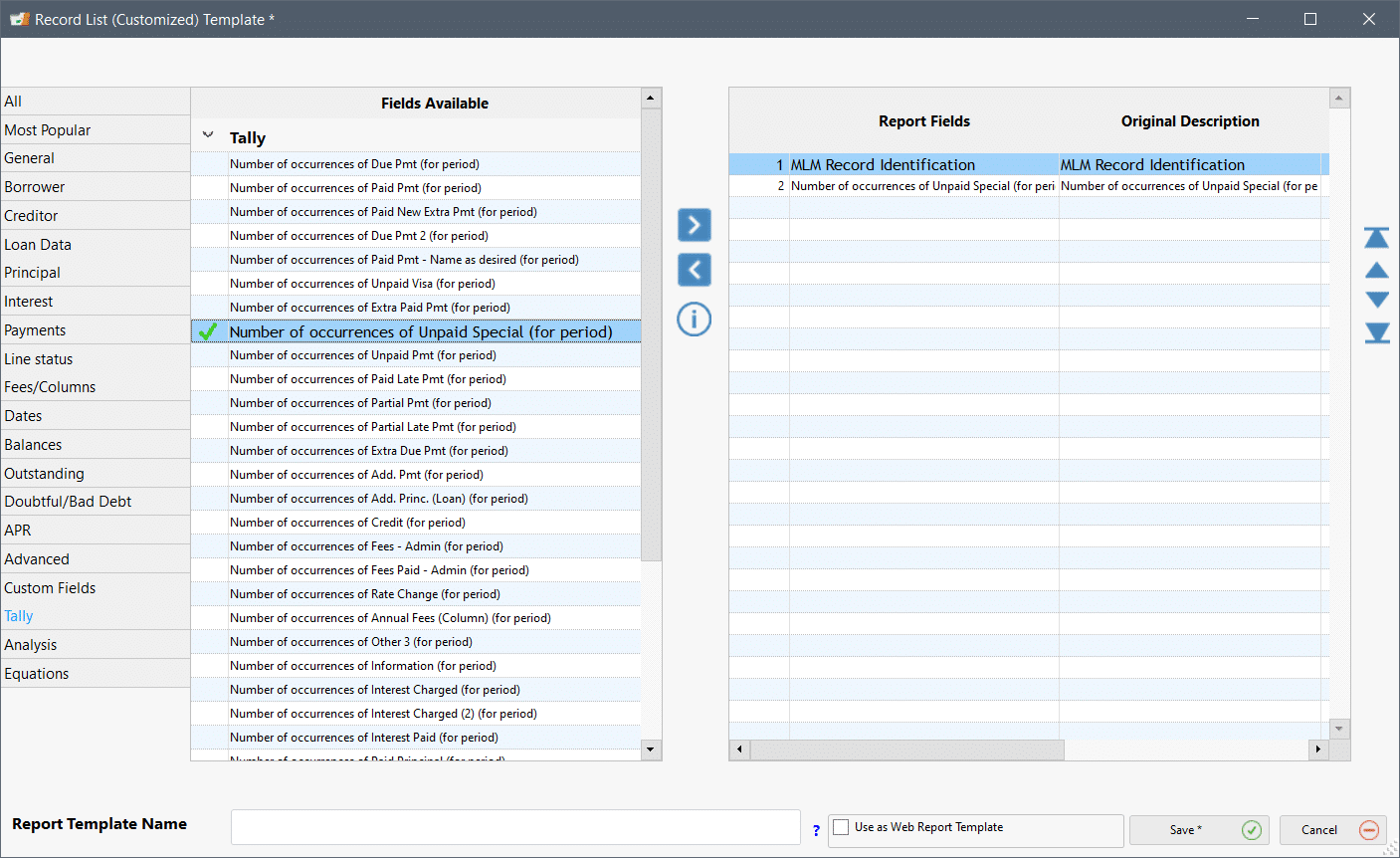

If you have a higher volume and wish to import hundreds of transactions on a regular basis, then the Margill Loan Manager is a powerful database that allows impressive options. Below is the Main window with all your cases and you can obtain the global “portfolio” balances at any date, create statements, send emails, mass import data, and so much more!

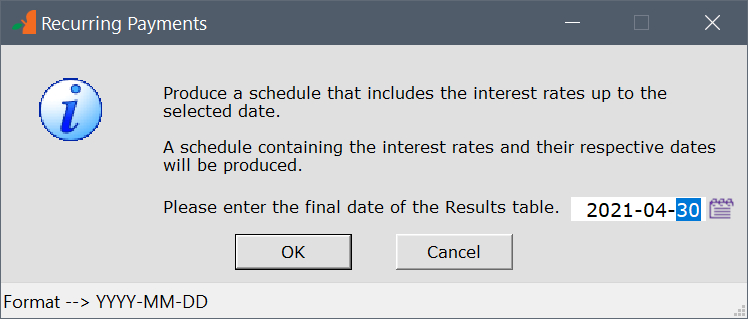

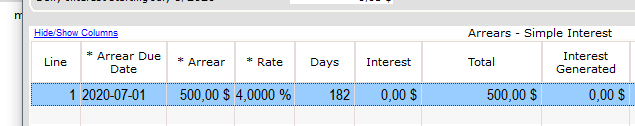

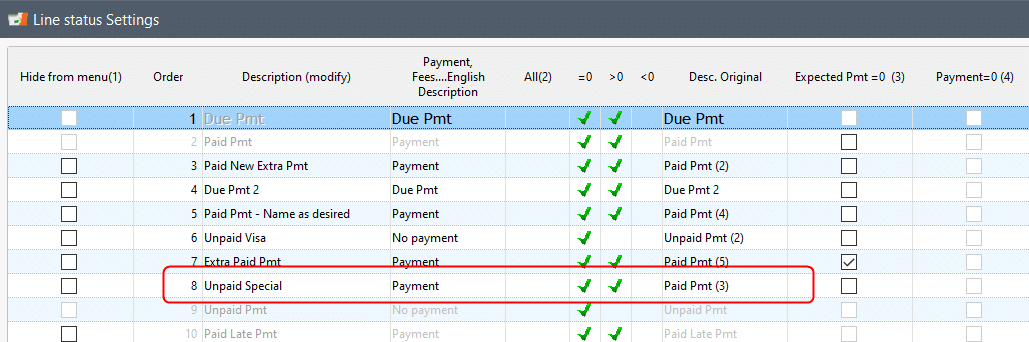

. This window shows up.

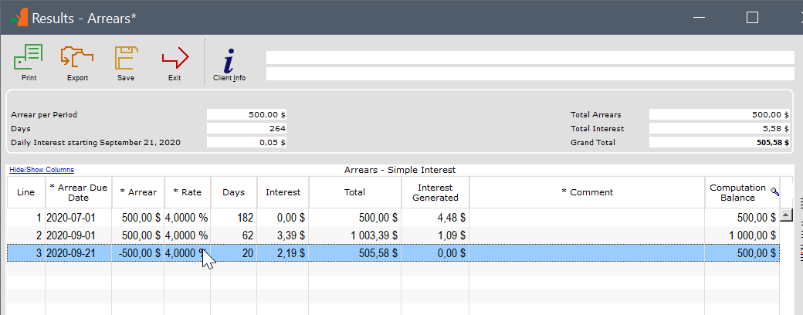

. This window shows up.