Question: Our company does loans and rentals. Can Margill Loan Manager be used to manage rentals (monthly rents)?

Answer: As strange as this may sound for a loan servicing software, yes Margill Loan Manager can manage rentals.

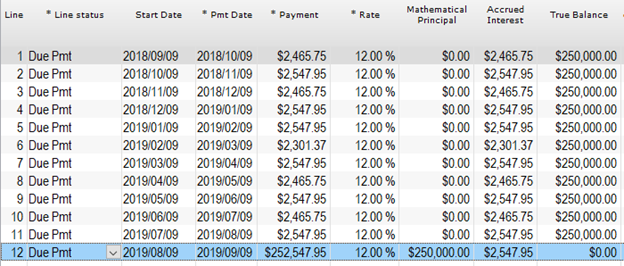

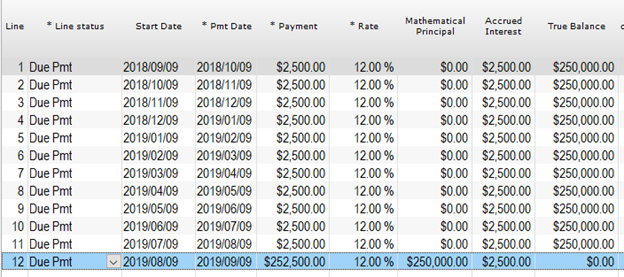

The difference between a loan and a rental is that loans begin with a principal amount borrowed that usually will decrease as payments are made for the interest and principal portions. Rent on the other hand, is due (accrued), and payable every month. So rent accrues usually on the first of the month and then is paid, hopefully, on the same day. Usually, interest is not charged on rent.

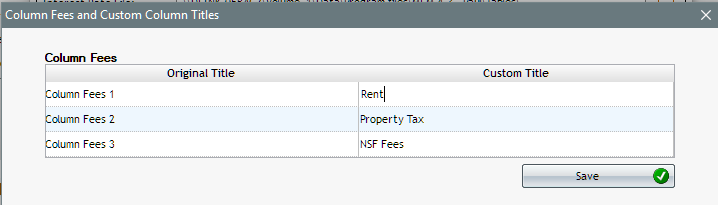

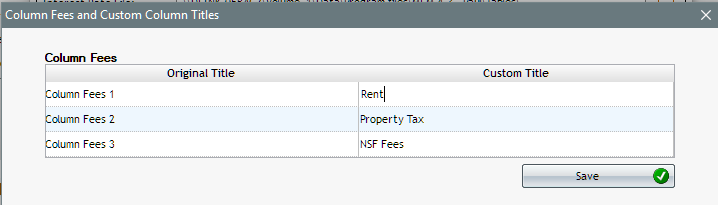

First, in Tools > Settings > Custom Column Titles, change the Column “Fees” title to “Rent”.

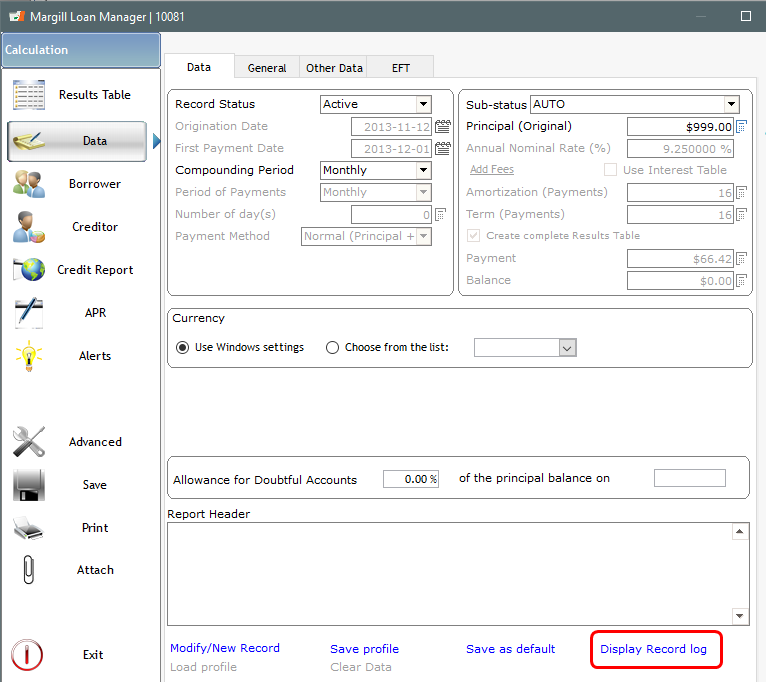

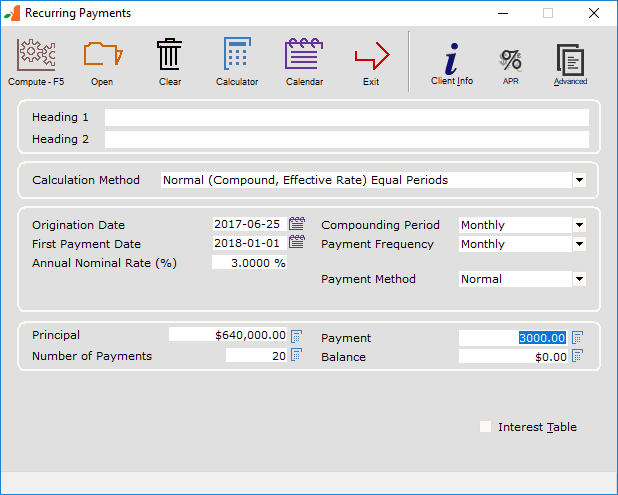

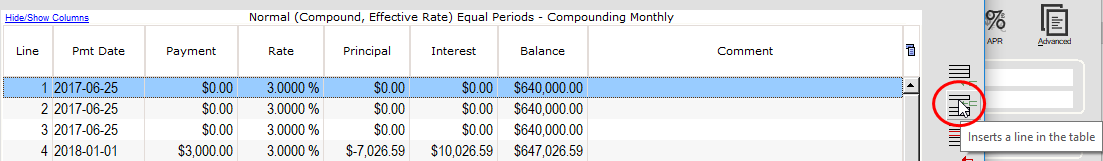

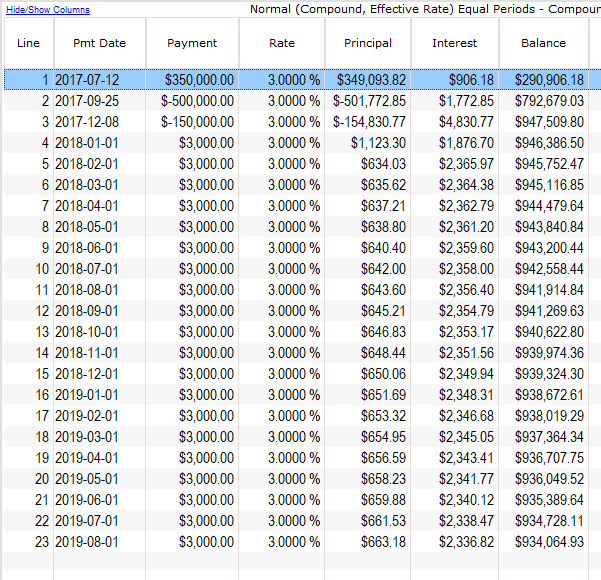

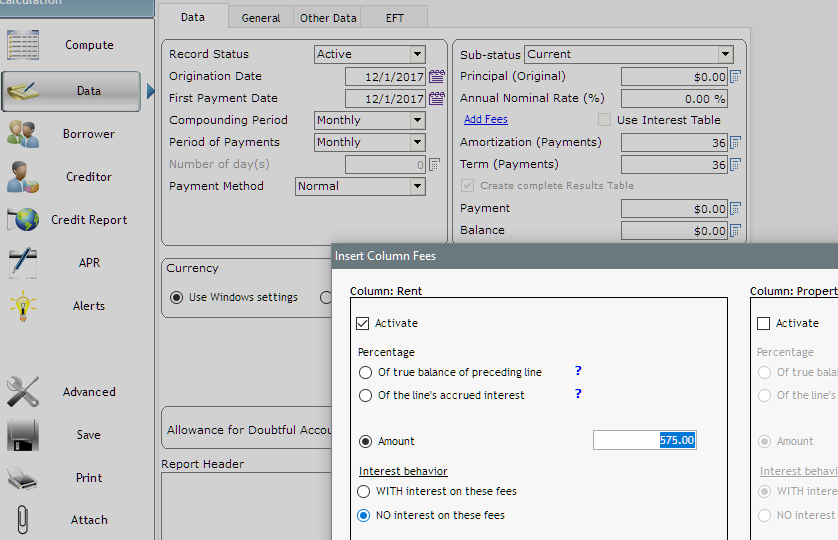

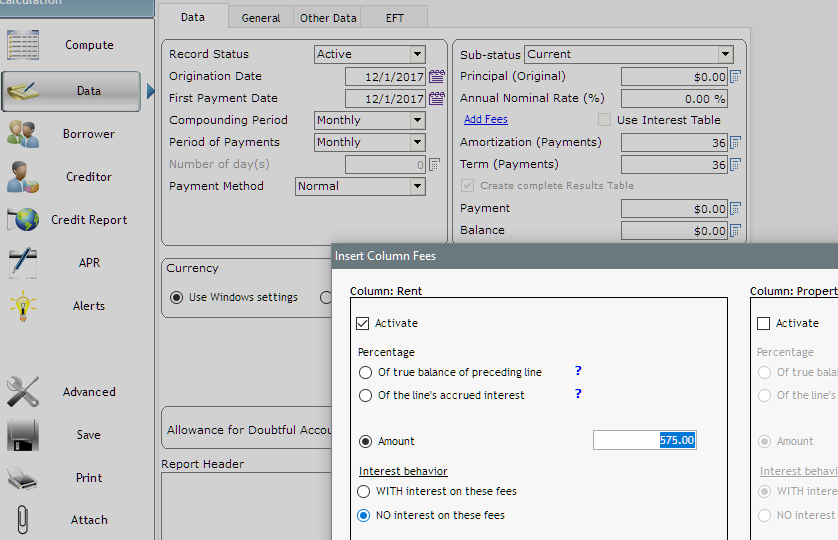

Create a new Record. Under Data enter the date at which the first rent is due. The same date should be entered in both Origination Date and First Payment Date. The rents are payable monthly. Principal (Original) should be 0.00 and since there is no interest on the rent, Annual Nominal Rate (%) should also be 0.00%. This is a three year rental for 575 per month. Press on “Add Fees” and a window will allow you to enter the monthly rent amount.

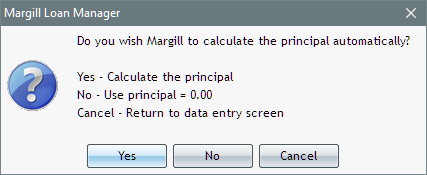

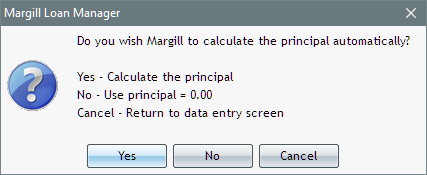

Then press on Compute and answer No to this pop-up. We do not want Margill to compute the Principal (remains 0.00).

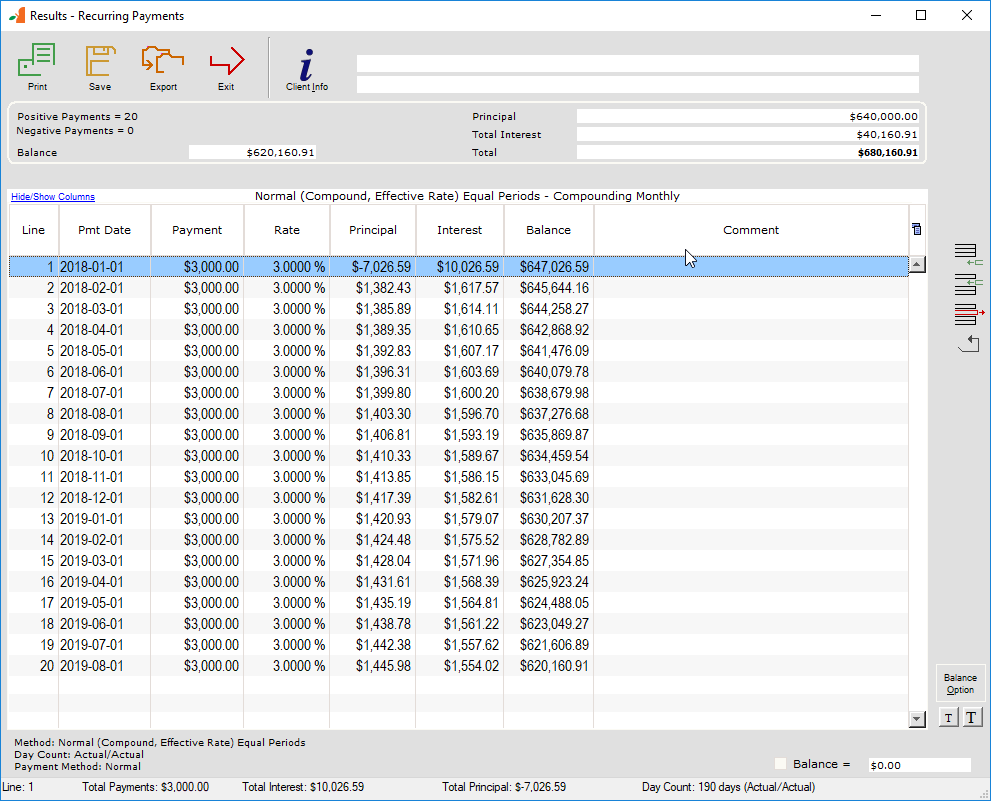

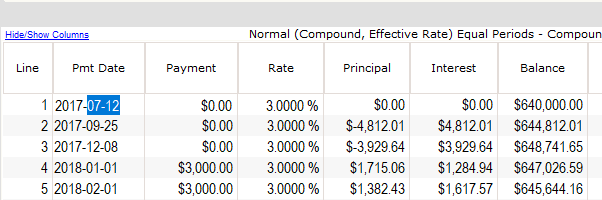

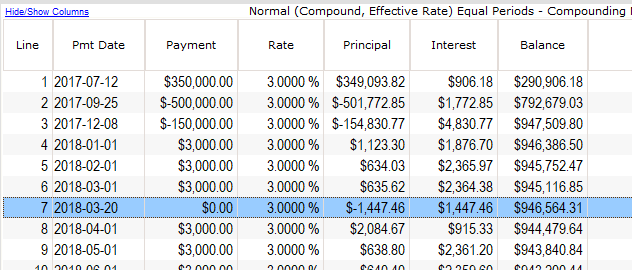

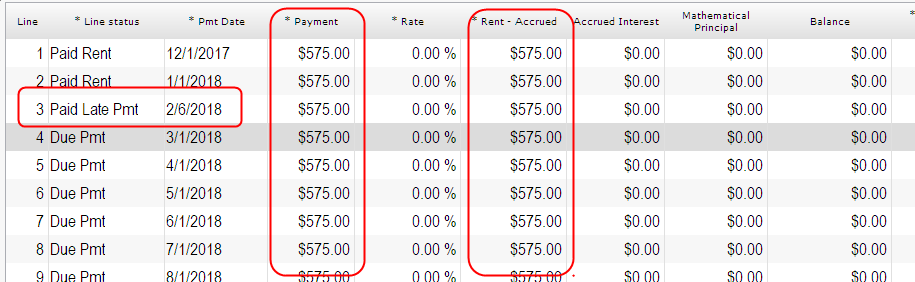

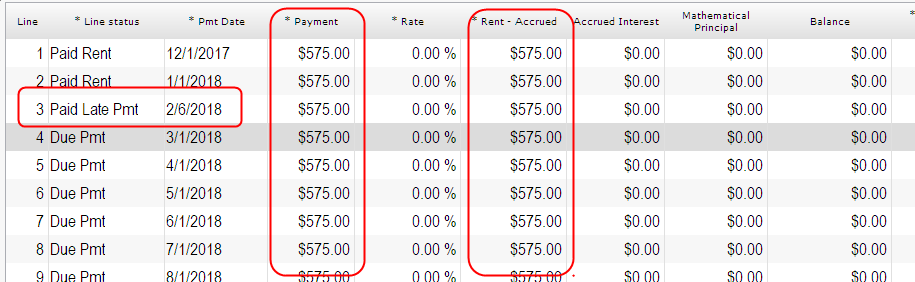

The rental payment schedule then appears. I moved my column called “Rent – Accrued” to the left to see it readily without needing to scroll to the right. The rent is “charged” with the “Rent – Accrued” and paid with the “Payment” column.

Notice on line 3 that my rent is a few days late. This does not change anything mathematically since interest is not charged, but this allows you to balance with your banking transactions. A partial rent amount could also have been entered and the schedule then changed based on what was agreed for later repayment between the “landlord” (or equipment rental) and the person who rents.

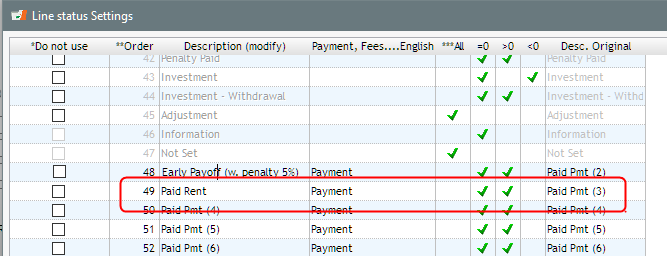

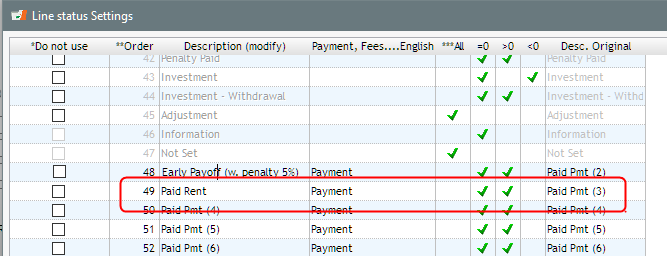

To be fancy, I renamed a Paid Pmt (x) Line status to “Paid Rent”. Go to Tools > Settings > Line status.