Easily create and manage Covid 19 (Coronavirus) Emergency Business Loans with Margill Loan Manager Software

Federal, state and provincial governments, townships, cities and towns all over the world have created very generous loan programs to help businesses as they struggle with the global pandemic and the effect of confinement.

These loans can take many shapes and finding the right software to properly create and manage these is not always easy. Excel, for all the respect I have for this great software, can do part of the job but struggles with many interest calculation items and exceptions that are the normal for these loans.

Here are various scenarios these loans can take and how Margill Loan Manager can be used to create payment plans adapted to the loan programs or to the borrower’s needs. Then Margill can easily manage or service the actual payments as they are paid… or not not paid…

Typical Covid 19 Emergency Business Loan scenarios:

- Interest throughout, deferred payments

- No interest for a number of months, no payments for a number of months, deferred payments

- Interest-only for a number of months followed by principal and interest payments

- Above options + seasonal industry cash flow (tourism, agriculture, etc.)

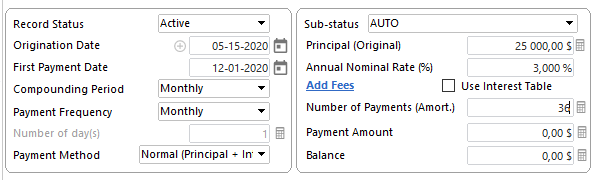

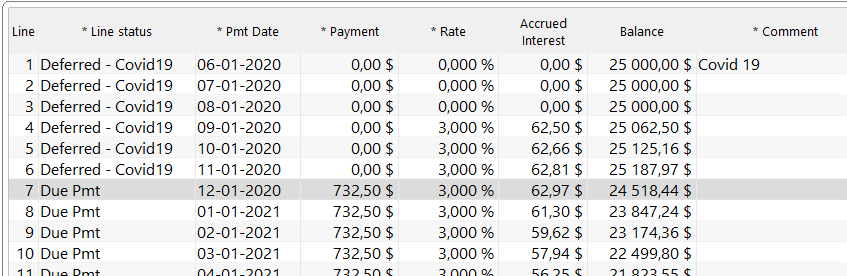

Interest throughout, deferred payments

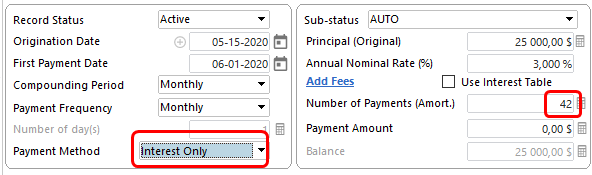

- Loan amount: 25,000

- Interest rate: 3%

- Loan starts May 15, 2020

- Deferred payments for 6 months

- 36 months to pay back principal and interest

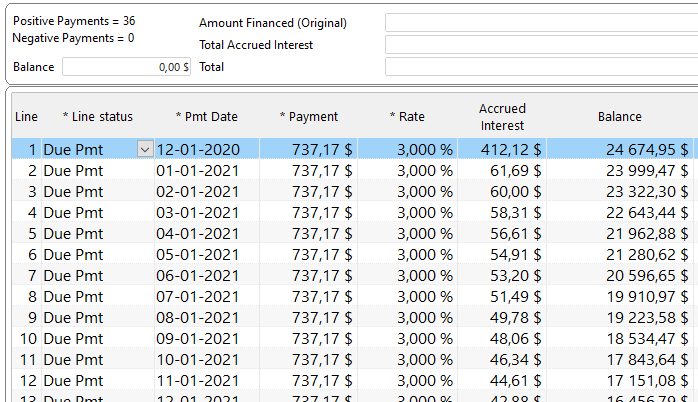

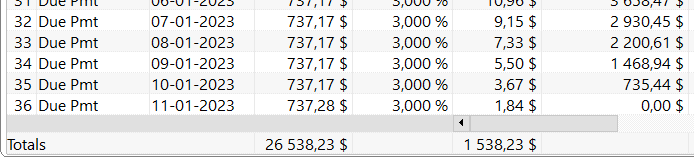

Result – notice first payment is December 1, so no payments from June 1 to November 1 inclusively:

+++++++++++

+++++++++++

We could have done this slightly different to see the first 6 months with no payments but this is not required since Margill extracts the accrued interest and balance at any date…

I would have entered 42 payments (36 + 6) and changed the first payments to 0.00 and recomputed the next 36 payments. A 10 second process.

A Comment can be added in the Comment column or we (you, the Margill Administrator) could have created a special Line status called “Deferred – Covid 19”, for posterity… Hmmm…

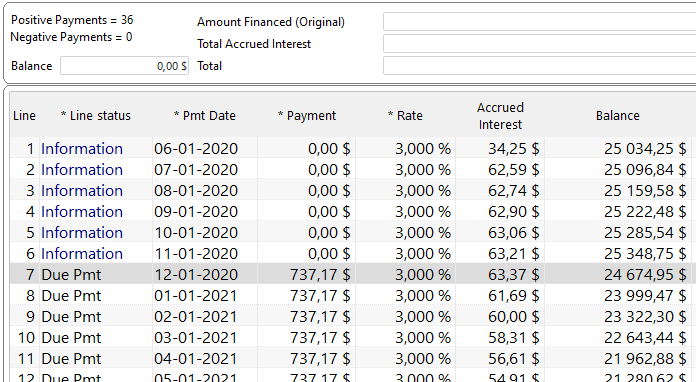

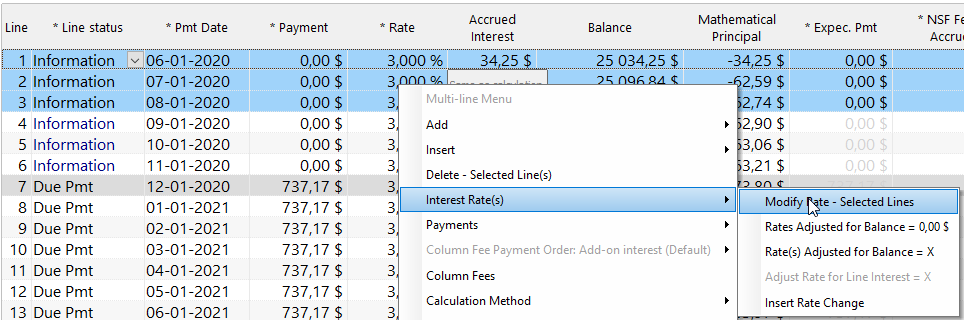

No interest for a number of months, no payments for a number of months, deferred payments

- Loan amount: 25,000

- No interest first 3 months

- Interest rate thereafter: 3%

- Deferred payments for 6 months

- 36 months to pay back principal and interest

We can take the results from the example above. Right mouse click to change the interest rate for the first 3 months to 0.00%:

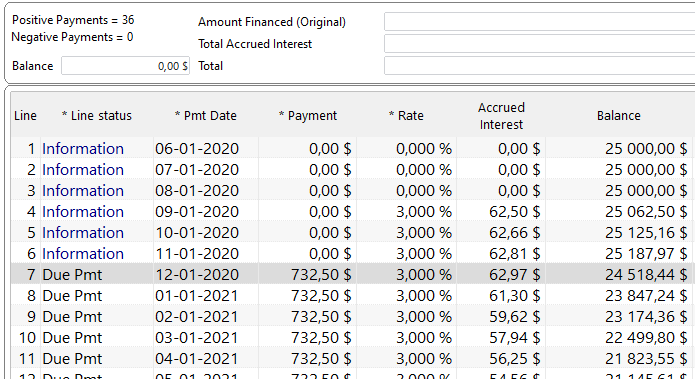

Select the 36 payments (as of line 7), right click and recompute the payments to give a 0.00 ending balance:

Final result (top half of 36 payment schedule only):

Notice the borrower saves about 5,00 per payment because of the 3 months with no interest.

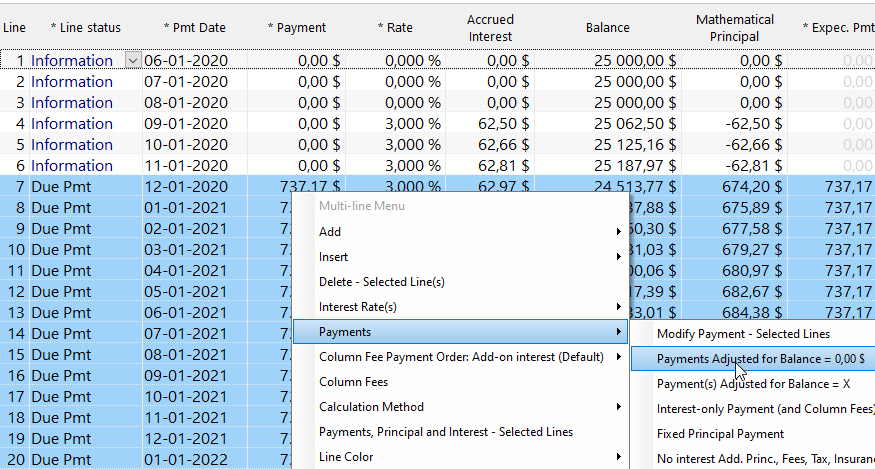

Interest-only for a number of months followed by principal and interest payments

- Loan amount: 25,000

- Interest rate: 3%

- Deferred principal payments for 6 months

- 36 months to pay back principal and interest

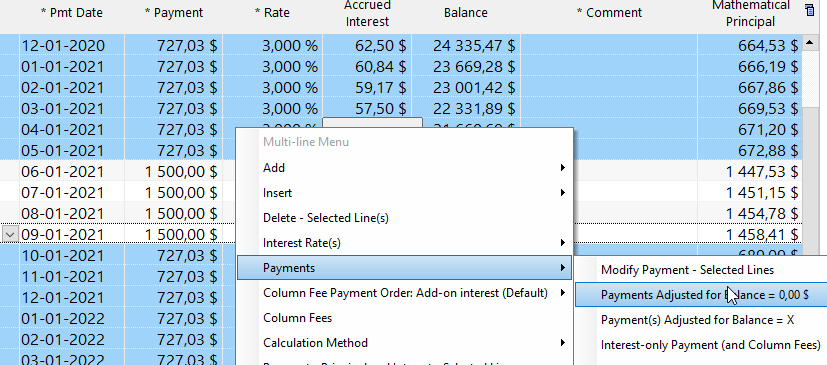

Entered 42 payments since 6 months are interest-only and 36 months P&I:

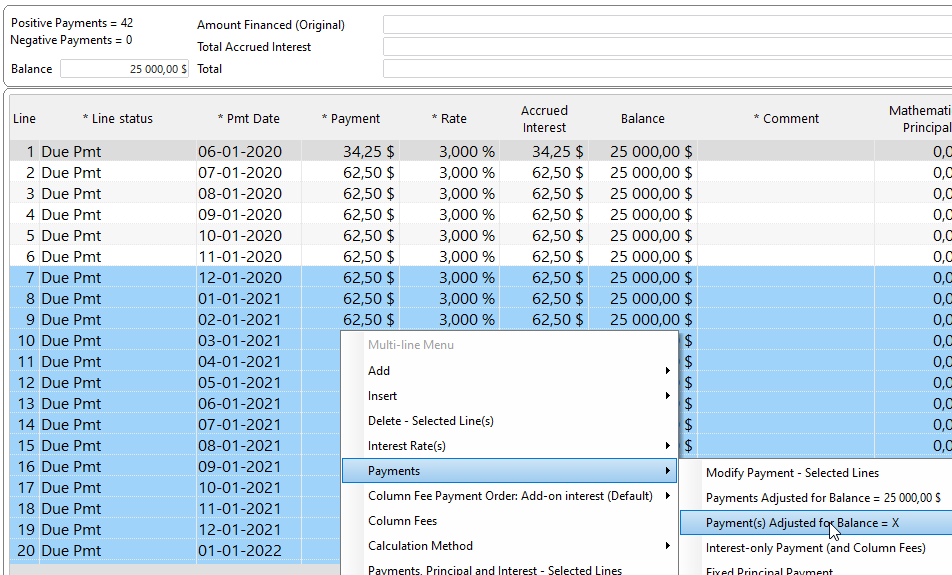

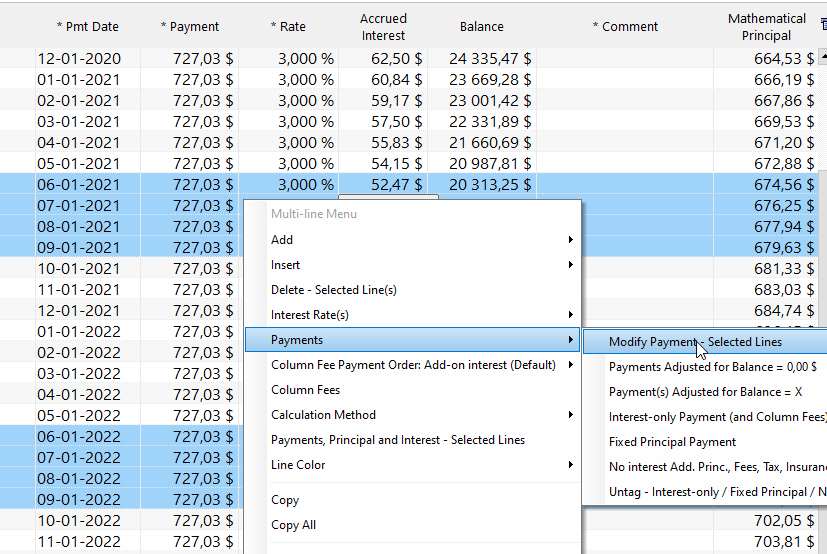

Select Lines 7 to 36 and “Payments Adjusted for Balance = X” where X will be 0.00

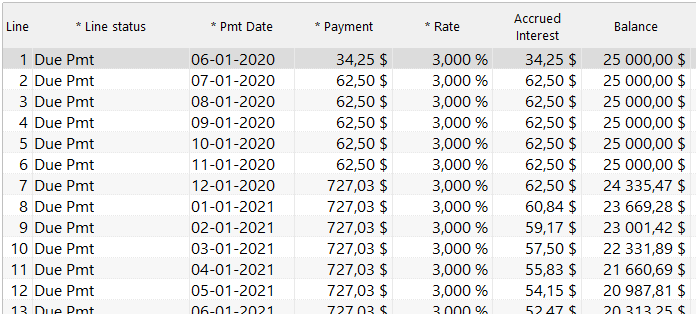

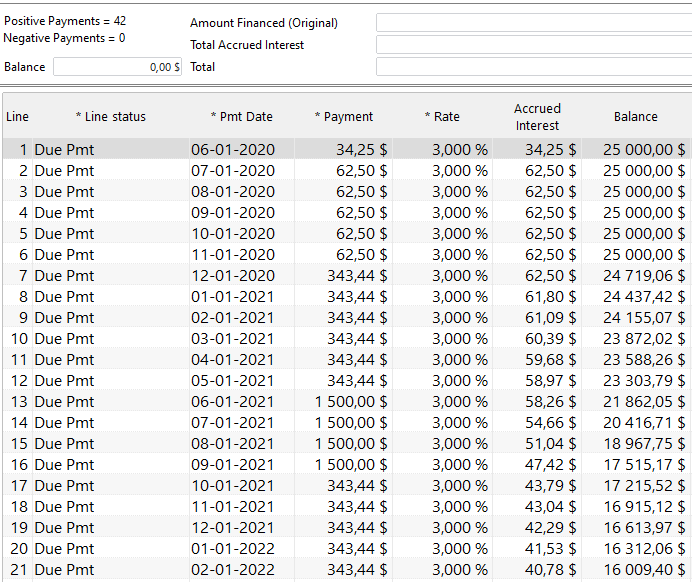

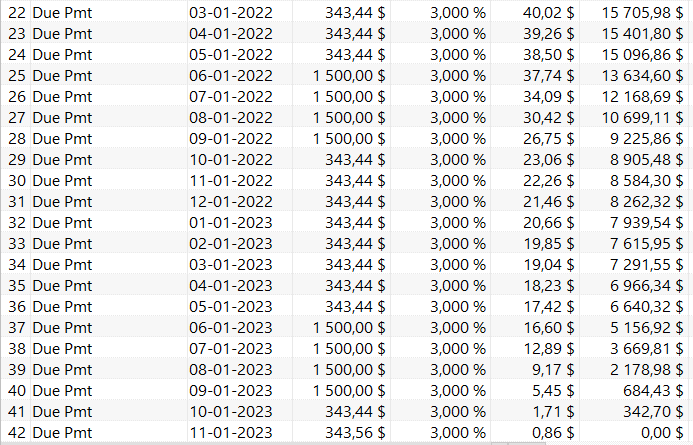

Final result (top of 42 payment schedule only):

Catering to seasonal industries with irregular cash flows

High cash flow months (next year we hope!) are June, July, August and September so borrower will pay 1250 per month:

Remaining payments adjusted for Balance = 0

Final payment schedule:

A host of other possibilities and mixes are available including fixed principal payments, interest-only payments in between lump sum payments, extra lump sum payments over time, early payoff, etc.

Adapt the payment schedule to the true needs of our struggling entrepreneurs!