Is Margill Interest calculator or Margill Law calculator able to create a compound interest calculation with irregular payments and interest rates that change over time?

Q: Is Margill Interest calculator or Margill Law calculator able to create a compound interest calculation with irregular payments and interest rates that change over time?

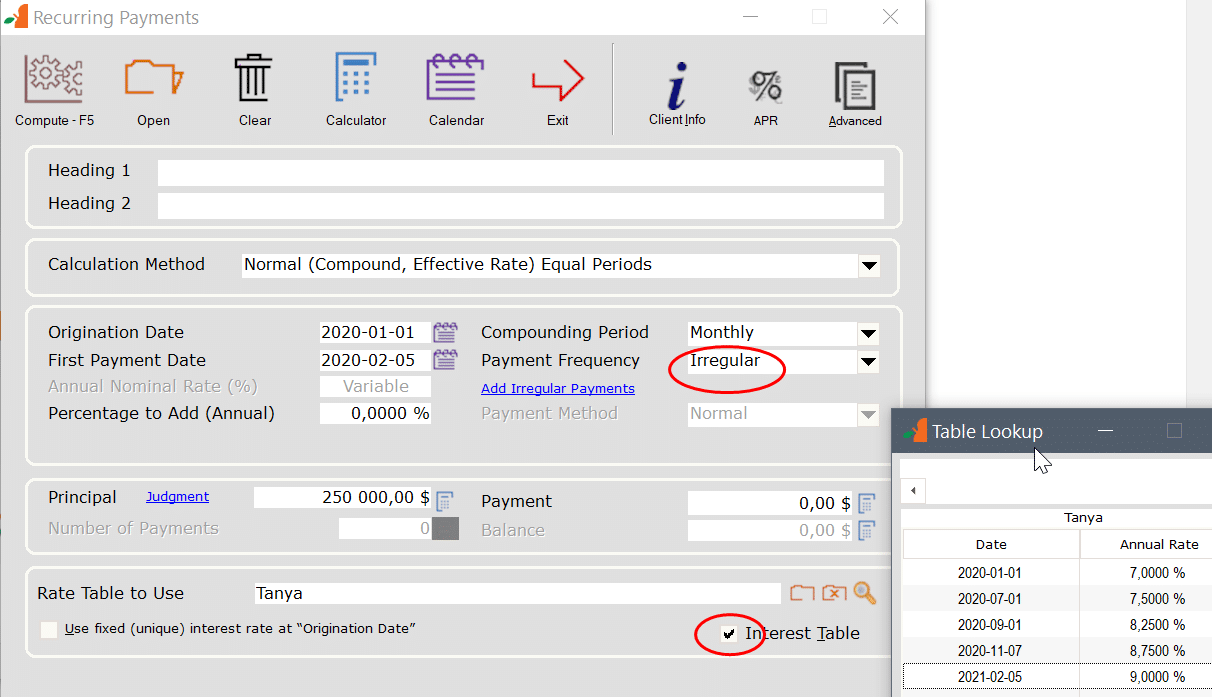

So is my understanding correct that your software will be able to work out the balance owing in terms of an overdue loan with compounded interest based on the following example:

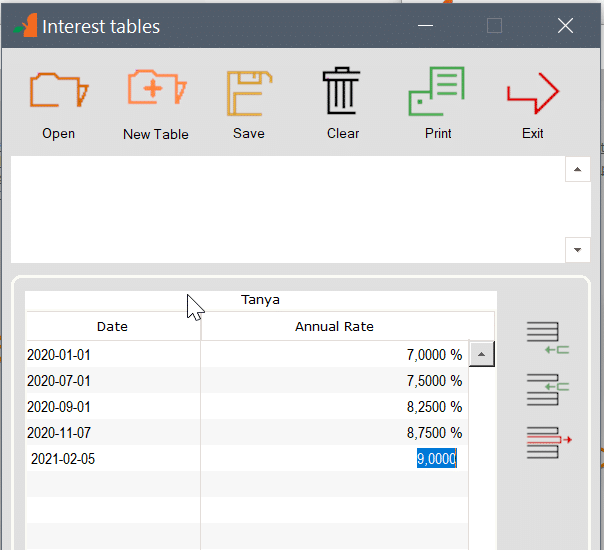

Initial amount o/s R 250 000 As at 1/01/2020 Interest rate 7%

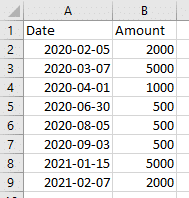

Interest rate changes as follows:

Format is DD/MM/YYYY

01/07/2020 7.5%

01/09/2020 8.25%

07/11/2020 8.75%

05/02/2021 9%

Payments received (R = Rands – South African currency):

5/02/2020 R 2 000

7/03/2020 R 5 000

1/04/2020 R 1 000

30/6/2020 R 500

5/08/2020 R 500

3/09/2020 R 500

15/01/2021 R 5 000

7/02/2021 R 2 000

What is the amount o/s as at today, with interest compounded monthly? Today we are April 30, 2021

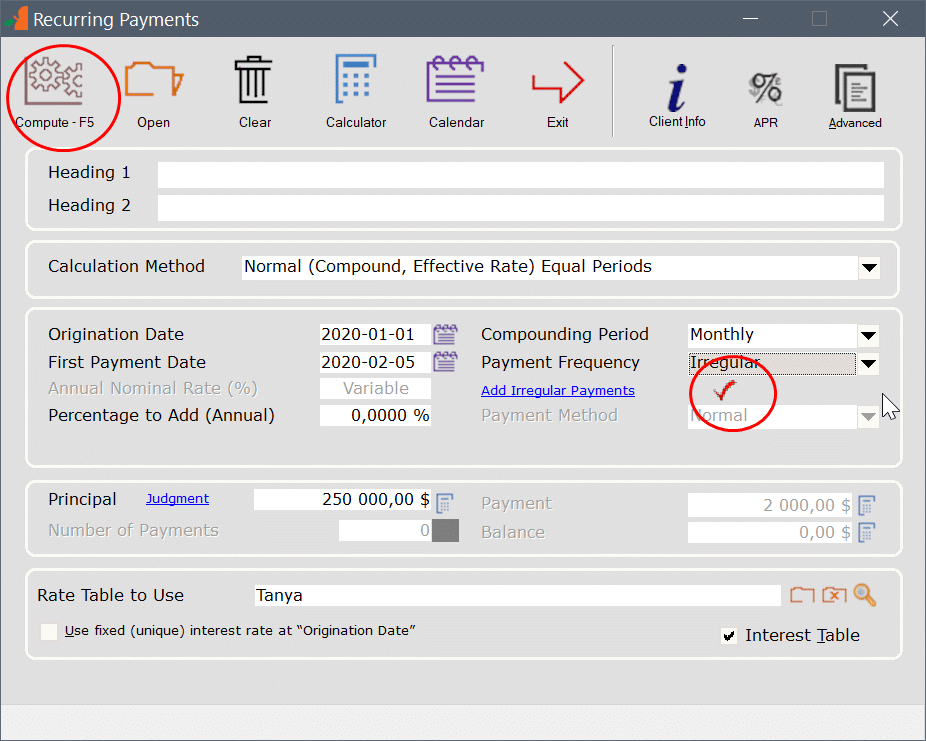

A: Yes, very easily. Such calculations are the purpose of the software. Margill can do thus much more easily than with a spreadsheet and a lot let risk of error.

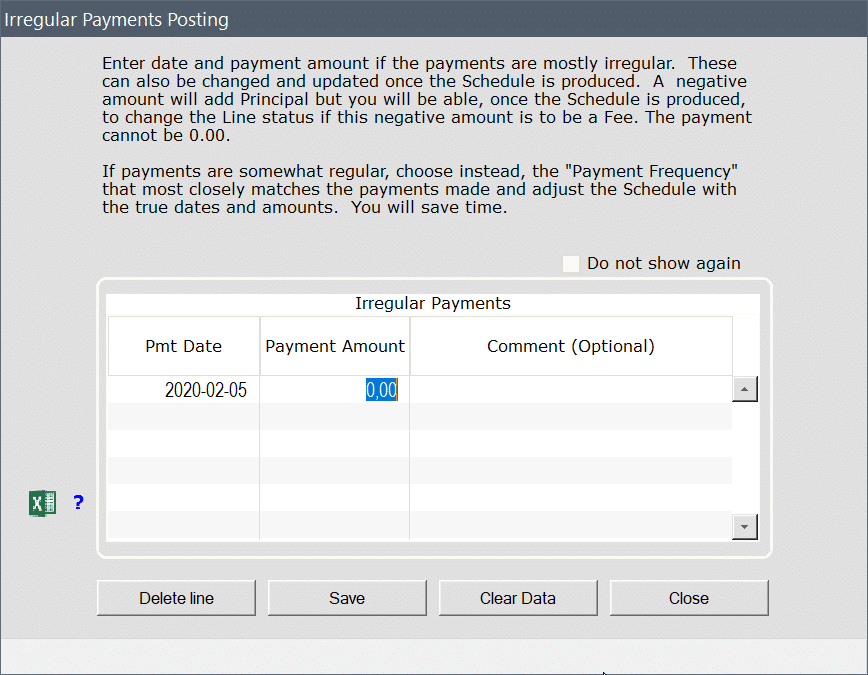

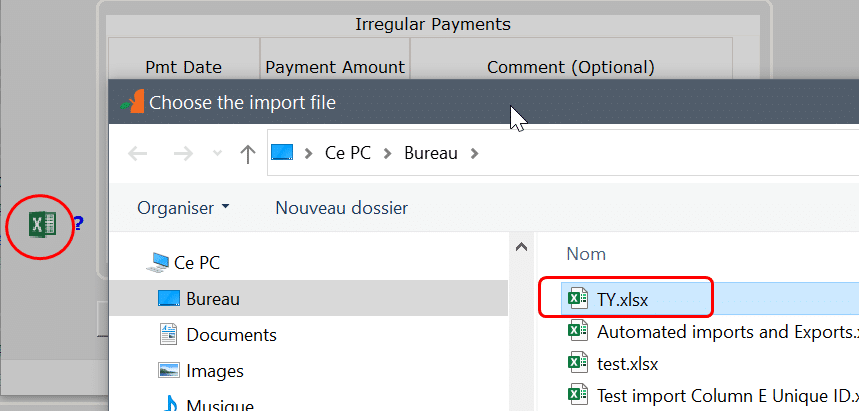

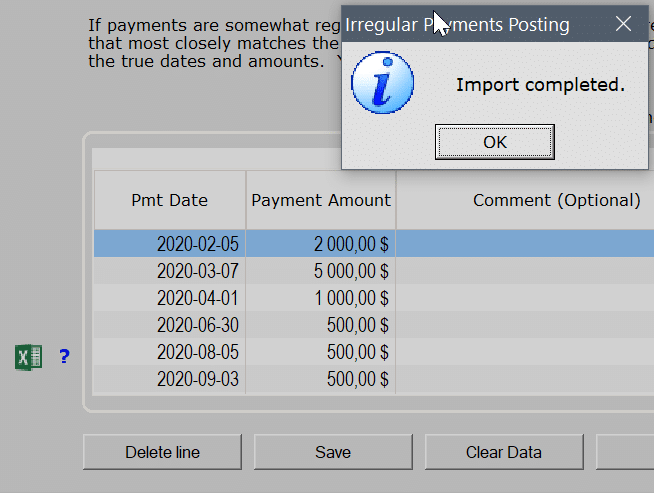

Now to enter the irregular payments, click on  . This window shows up.

. This window shows up.

You can either entre the payments manually in here (even add negative amounts that are principal increases):

Even if there weren’t many payments, I created a small Excel sheet for the import – very useful when there are dozens, hundreds or thousands of payments:

Then press on the Excel icon and select the Excel file:

Now Save and you get back to this window. Notice the check ![]() that shows there’s data in the Irregular payments. We are now ready to Compute the Results table.

that shows there’s data in the Irregular payments. We are now ready to Compute the Results table.

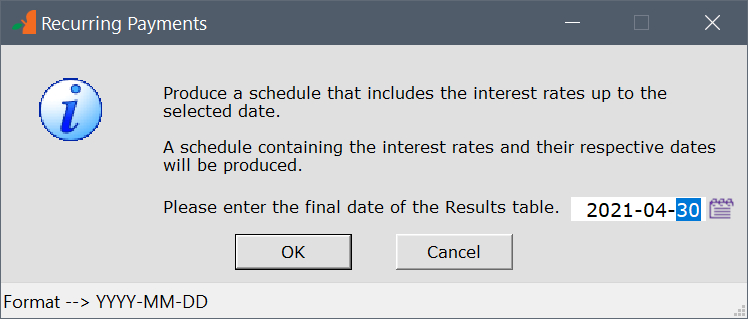

You will see this window appearing that asks until when do you wish to compute interest. I entered April 30. Interest will be computed until April 30 in the morning, not end of day.

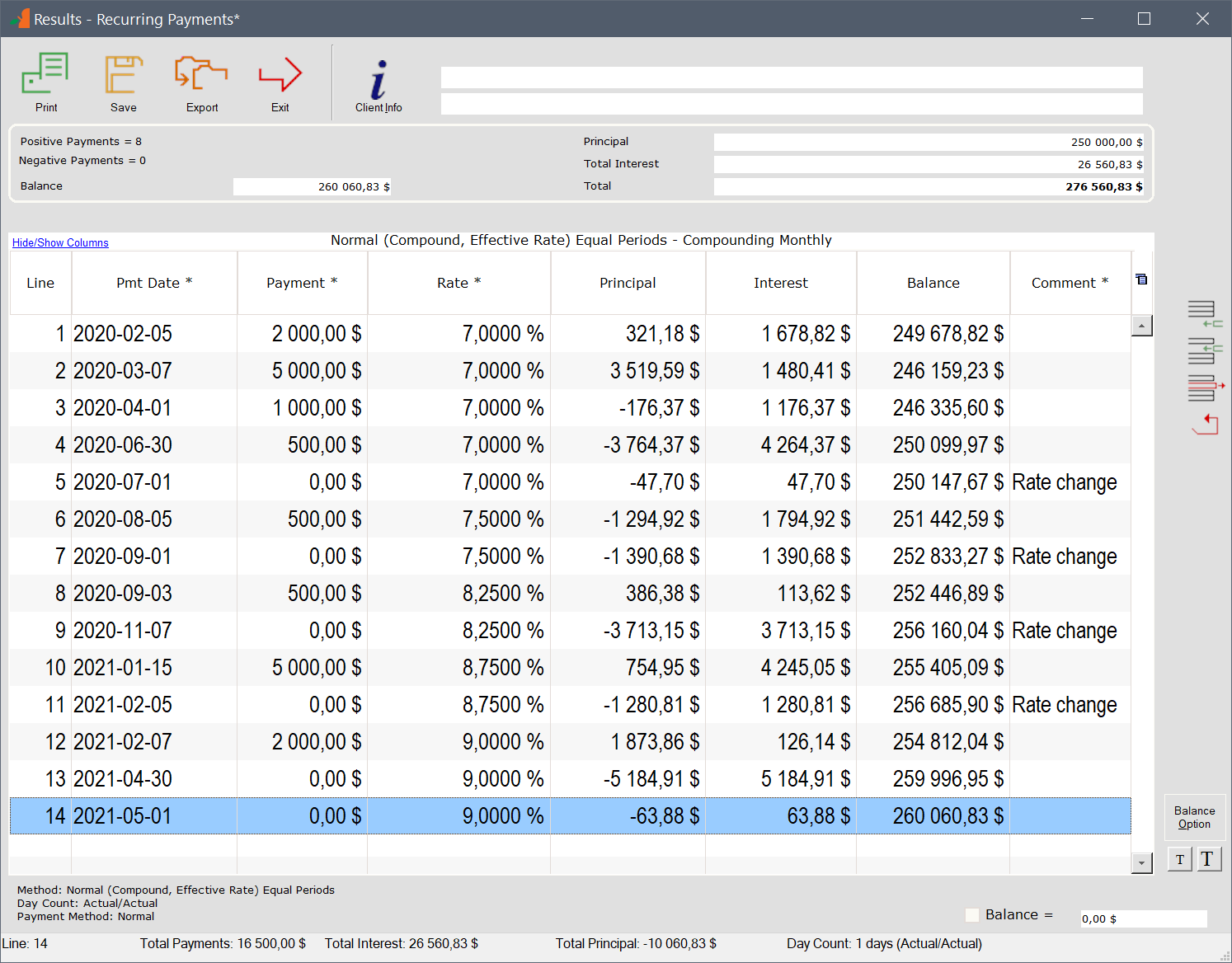

Press on OK and we have the results.

Notice I added a line at the end just in case I wanted the interest until April 30 end of day (midnight) – so added a line with May 1. Industry standard says first day included, last day excluded. Use the icons on the far right to add, insert and delete lines. There’s also an Undo button.

You can save and update this table as required – you can add lines, change payments, insert payments if by error you had forgotten one, add or change interest rates, etc. You can do just about anything with this calculation.

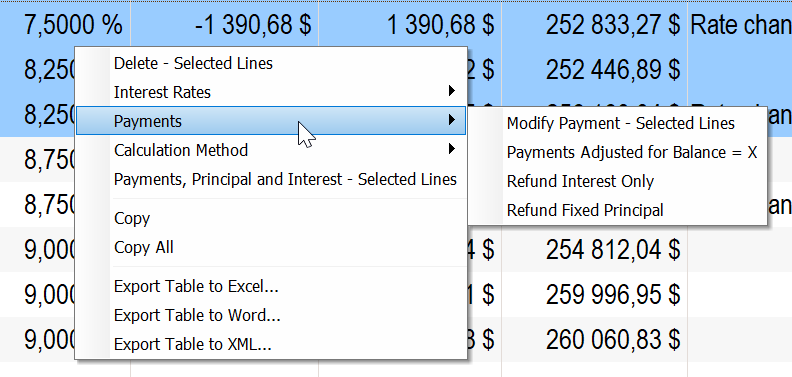

The right mouse click offers many options:

Hope this answers your questions…