Numérotation automatique de factures

Q : J’ai créé une facture (par la Fusion de documents) dans Margill pour faire la facturation des frais de gestion annuels et j’aimerais savoir s’il est possible de faire la numérotation des factures automatiquement?

A : Quelques possibilités vous sont offertes dans le Gestionnaire de Prêts Margill

Première méthode :

En utilisant les Changements globaux afin d’importer vos numéros de factures directement dans les Dossiers de vos clients.

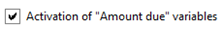

Débutons par créer un Champs sur mesure afin d’importer vos numéros de factures.

Dirigez-vous dans Outils > Paramètres > Champs sur mesure > Dossier > Champs illimités (format tableau)

À noter que si vous désirez conserver en mémoire les numéros de factures historiques, vous devrez créer un nouveau champ lors de chaque cycle de facturation (ex. Numéro de facture 2023)(ceci est moins pratique si les factures sont envoyées à chaque mois).

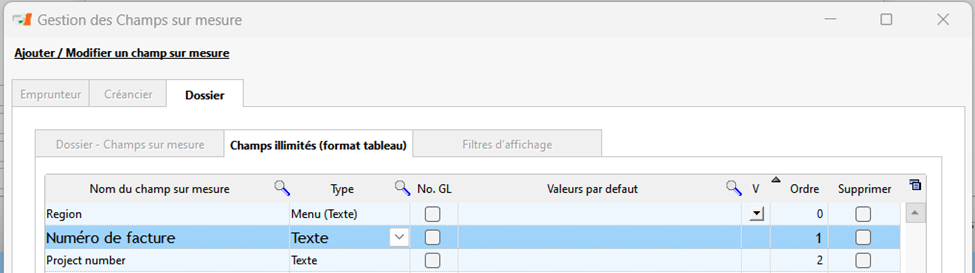

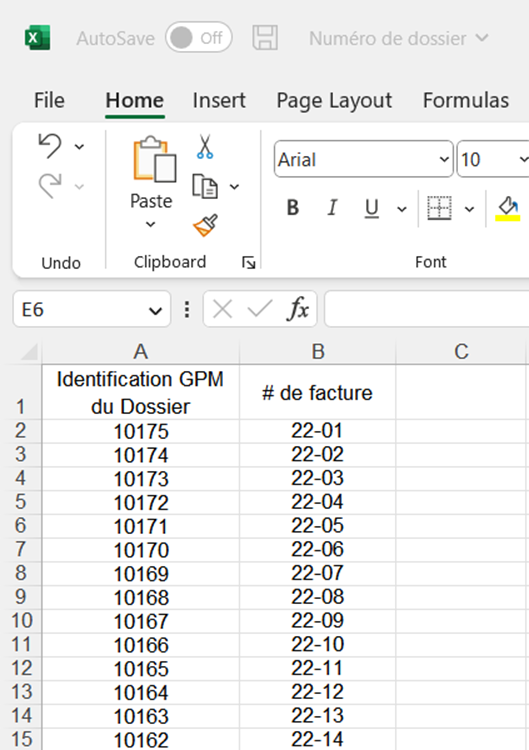

Une fois ce Champ créé, vous pourrez importer vos numéros de factures. Pour ce faire, il vous faudra une liste de vos numéros de Dossiers. Vous pouvez créer cette liste dans Rapports / Listes des dossiers et l’exporter en format Excel.

Une fois dans Excel, il sera facile d’ajouter vos numéros de factures dans le document.

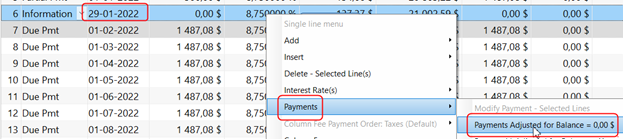

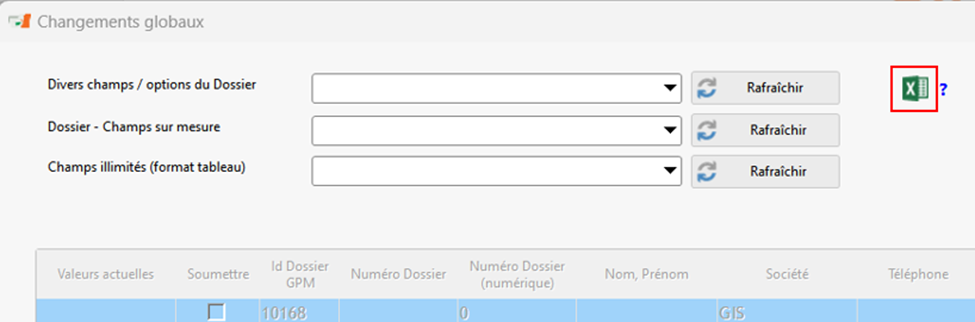

Maintenant mettons à jour vos numéros de factures avec l’outils de Changements globaux. Pour ce faire, cliquez avec le bouton de droit de la souris dans la fenêtre Principale de Margill et sélectionnez l’option de Changements globaux.

Lorsque la fenêtre s’ouvrira, cliquez sur l’icône Excel dans le haut de l’écran.

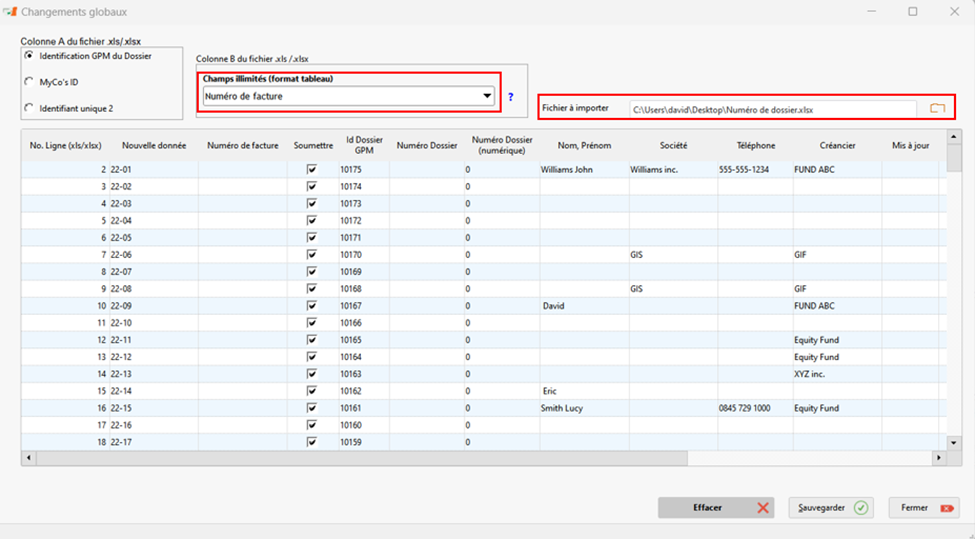

Par la suite, simplement sélectionner le champ Numéro de facture et le fichier à importer.

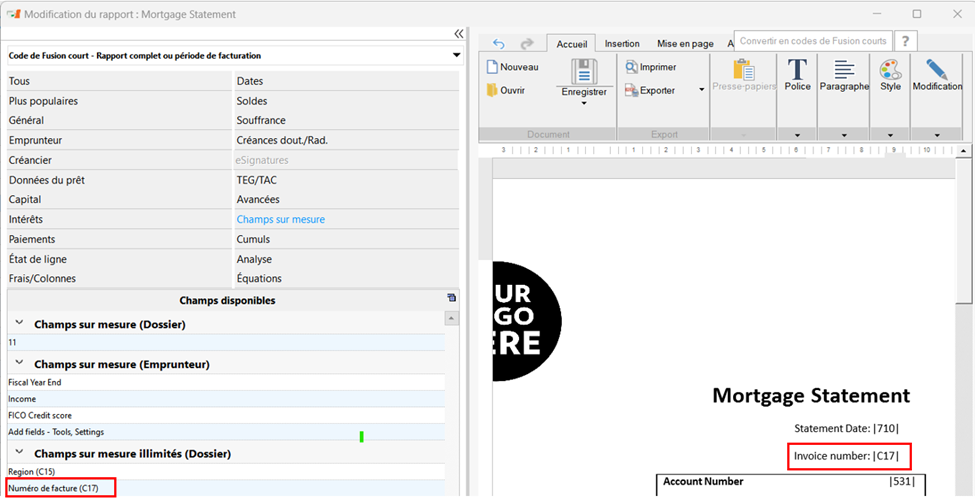

Maintenant, il vous sera possible d’ajouter ce champ à vos factures et états de compte.

Lors des prochaines facturations, vous n’aurez qu’à importer les nouveaux numéros de factures dans un nouveau champ (avec année et/ou mois) ou dans le champ existant (le numéro de facture sera modifié à chaque envoi).

Seconde méthode :

Vous trouverez que cette méthode est plus rapide et nécessite moins de manipulation. En revanche, le désavantage sera que vous n’aurez pas la même flexibilité que la méthode précédente.

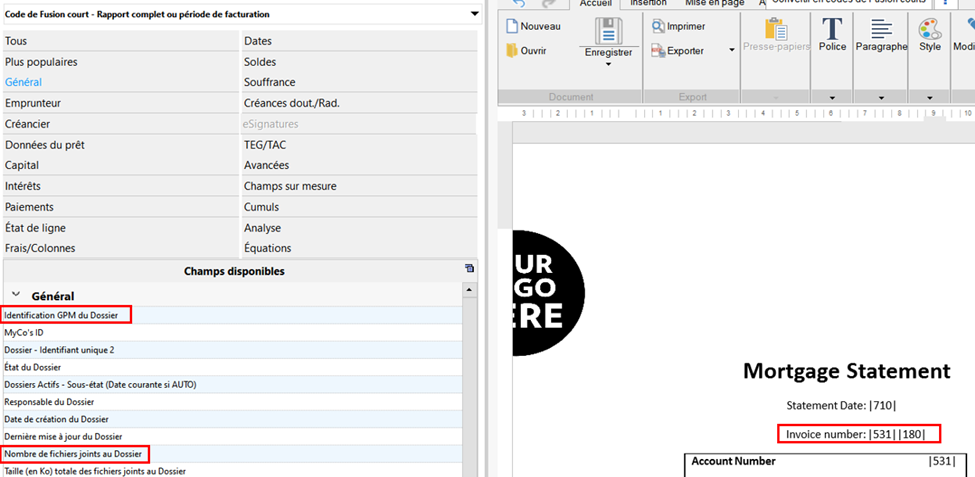

Cette méthode consiste à créer un numéro unique de facture à l’aide de l’identifiant unique de Dossier et, par exemple, le nombre de documents joints à chacun des Dossiers. Plusieurs autres options seraient disponibles tels l’ajout d’une date ou autre.

Pour ce faire, ajoutez les champs suivants à votre facture :

- Identification GPM du Dossier

- Nombre de fichiers joints au Dossier

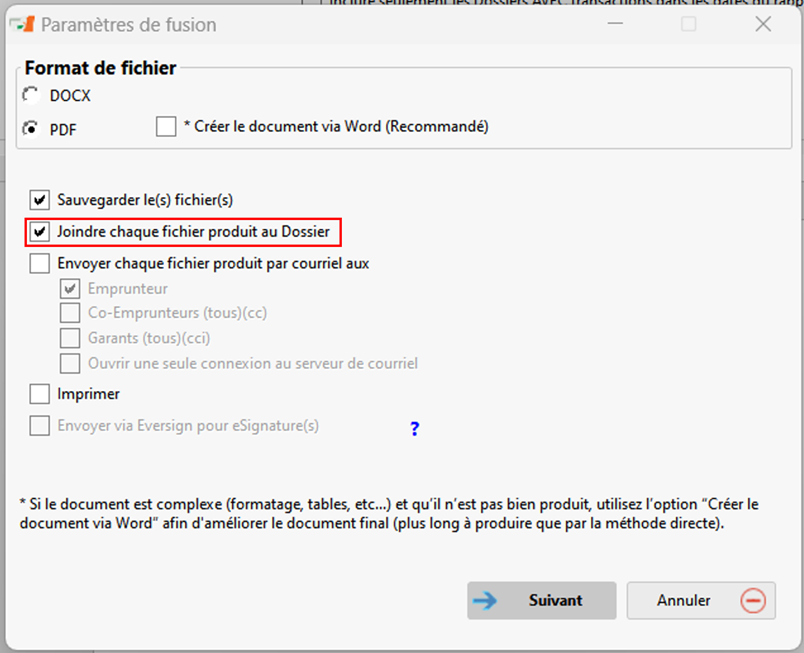

Maintenant, lorsque vous produisez vos factures, il sera important de cocher «Joindre chaque fichier produit au dossier», afin que la numérotation se poursuive correctement.

À vous de voir la technique que vous préférez afin d’obtenir les résultats escomptés. À noter qu’il est totalement possible de combiner les deux techniques. N’hésitez pas à contacter notre équipe si vous avez des questions concernant la Fusion de documents au [email protected].