Happy Holidays!

The entire Margill team wishes you, in spite of the current exceptional situation, a very Happy Holiday Season.

May 2022 be filled with happiness and health!

Photo Mira Kireeva – Unsplash

Photo Mira Kireeva – Unsplash

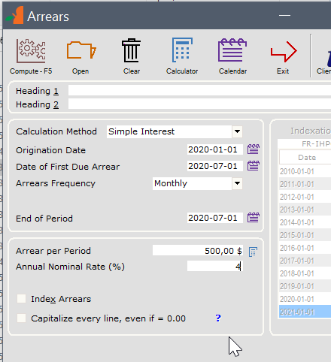

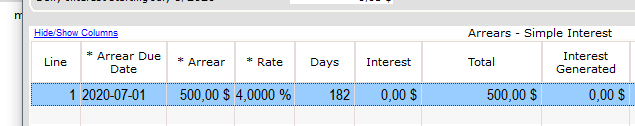

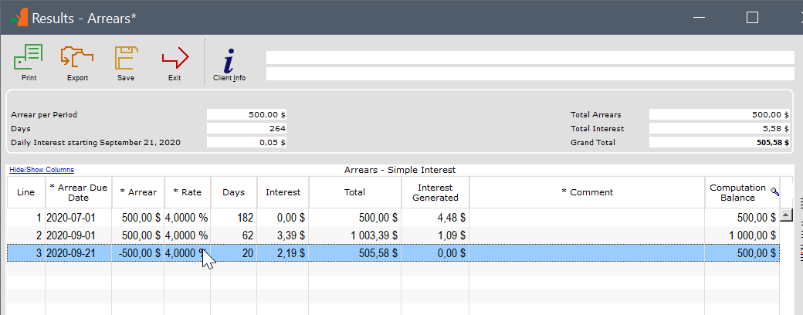

Question:

I am often faced with paying late alimony, and I want to be sure that the interest calculations they are hitting me with are correct. I pay 4% simple interest only on late or fractional payments. I am testing your software right now, and if I am say $500 short but pay it within 21 days the Recurring payments tell me that there is over $60 in interest, rather than the correct $1.15 ($500 late for 21 days at 4% simple annual interest). Is there another module I should be using for my application?

Answer:

In this webinar, we are looking into what’s new in version 5.3 including increased automation and customization.

This is followed by a sneak peek at upcoming version 5.4 (available in November 2021), again with new automation aspects as well and many features you asked for.

Finally, we go over some aspects of the software that you may not know exist and that could help you in your day-to-day with Margill. Don’t miss this!

Question: How can I mass import “Unpaid” payments with an Excel sheet in Margill Loan Manager? I need to obtain the Outstanding payment amount too.

Answer: Usually, when payments are NOT made (so were skipped or the payments returned for non sufficient funds (NSF), on a historical basis, these would simply be ignored and only the Paid payments entered (even partial and late payments)

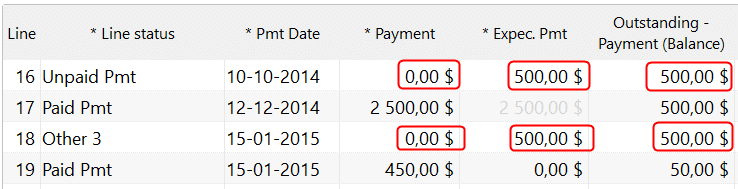

However, in order to count the number of Unpaid payments and to obtain the Outstanding amounts, it may be a good idea to enter payments lines of 0.00 and include the payment that SHOULD have been paid, thus allowing Margill to calculate the Outstanding payment amounts.

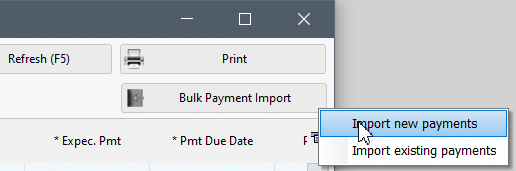

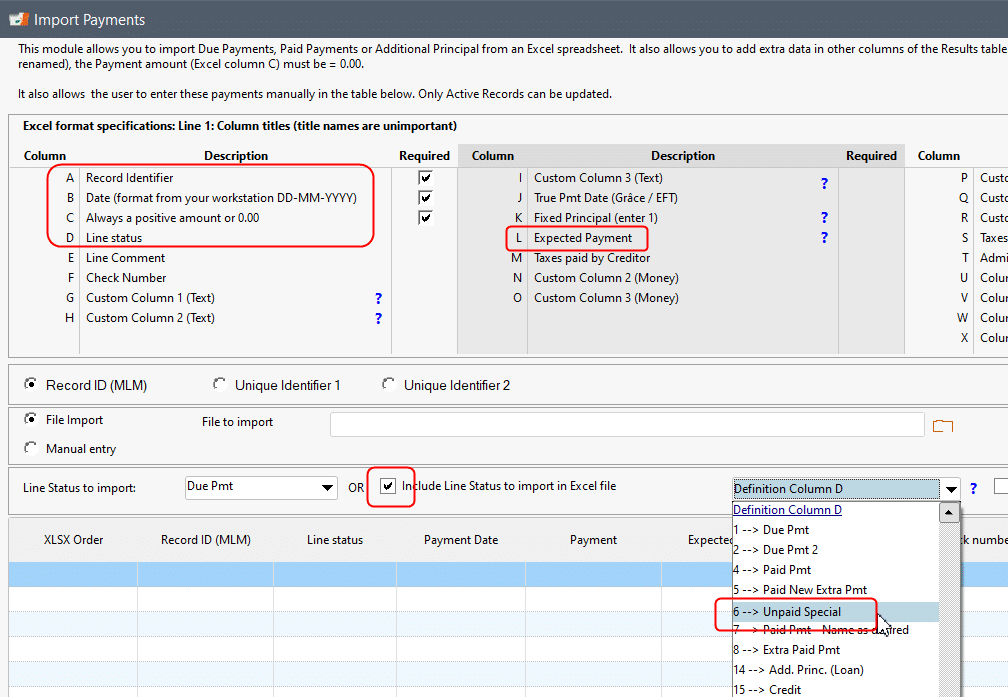

One would go through the “Post payment” tool under “Tools”. On the far right is the “Bulk Payment Import” button. You need “Import new payments”.

This mass (or bulk) import tool allows you to import payments (Paid pmt, partial pmt, late pmt, etc.) (as well as additional principal – a negative amount – and column fees and other information in the Results or payment table) but does not allow the import of Unpaid payments of 0.00. So we must be a little creative…

The tool does allow the import of what are called “Other” Line statuses. “Other” Line statuses never pay interest or principal – they are made to manage special scenarios and allow you to add more data in bulk such as Column Fees or other information in columns to the right. If the Outstanding amount was not important you could rename, for example, “Other 3” to “Unpaid” and mass import these. However, when “Other” is added, since this is not a real “payment”, no matter how it is renamed, an amount in the “Expected Pmt” column will not affect the Outstanding as an Unpaid Pmt does (see example below where Other 3 does not increase the Outstanding to 1000):

In the question at hand, the Outstanding amount is required, so we cannot use an “Other” Line status with a payment of 0.00.

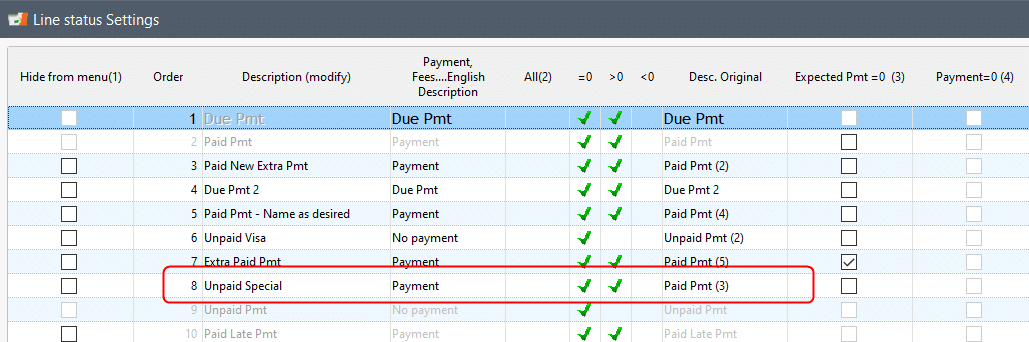

What can be done however, and this will be our solution, is to use a “Paid Pmt (x)” Line status, rename it to “Unpaid…” (renamed to “Unpaid Special” below) and mass import this Line status with a payment of 0.00 and an “Expected Pmt” for the amount that was supposed to be paid.

Margill allows “Paid” type Line statuses with a payment of 0.00. A little odd I agree, but this allows for greater flexibility. Even with the name “Unpaid”, the payment must not necessarily be 0.00 as in a real “Unpaid” Line status (line 6 below “Unpaid Visa” where must =0)

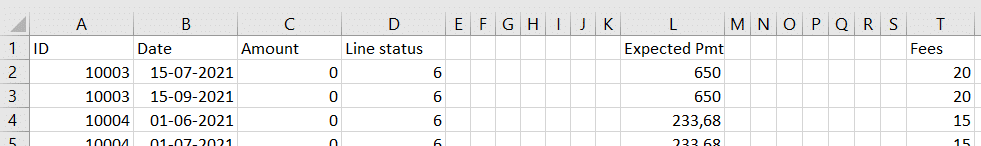

Once this Line status is created, in Bulk Payment Import > Import new payments, find the appropriate number for “Unpaid Special” (6 in this case – this is not the Line status order as in Line status Settings that vary depending on the order you desire). The Excel sheet must contain data and a header in columns A, B, C, D and L.

Here is the Excel sheet with only 2 loans. Notice I also added fees (column T for my Admin Fees)

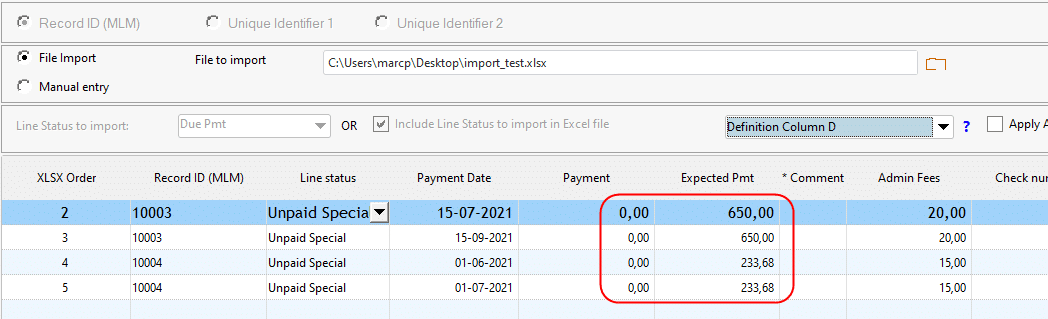

Bulk import window:

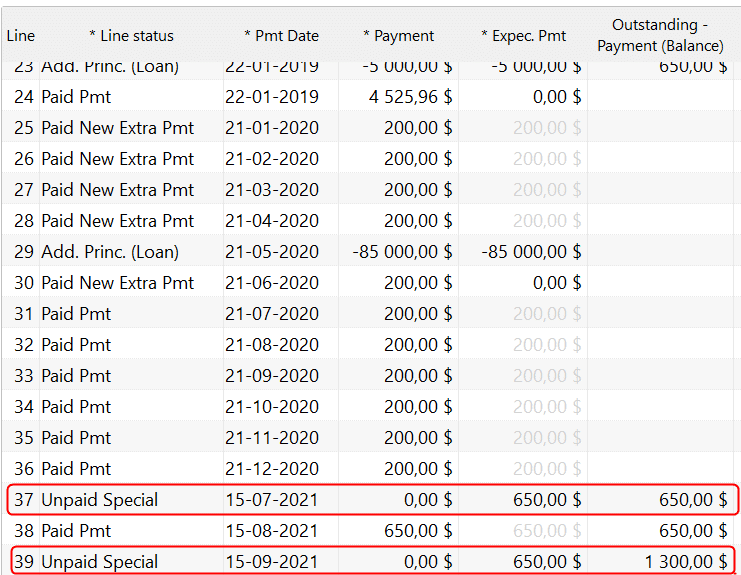

Final result in Record 10003 after pressing on “Insert lines” with an Outstanding of 1300:

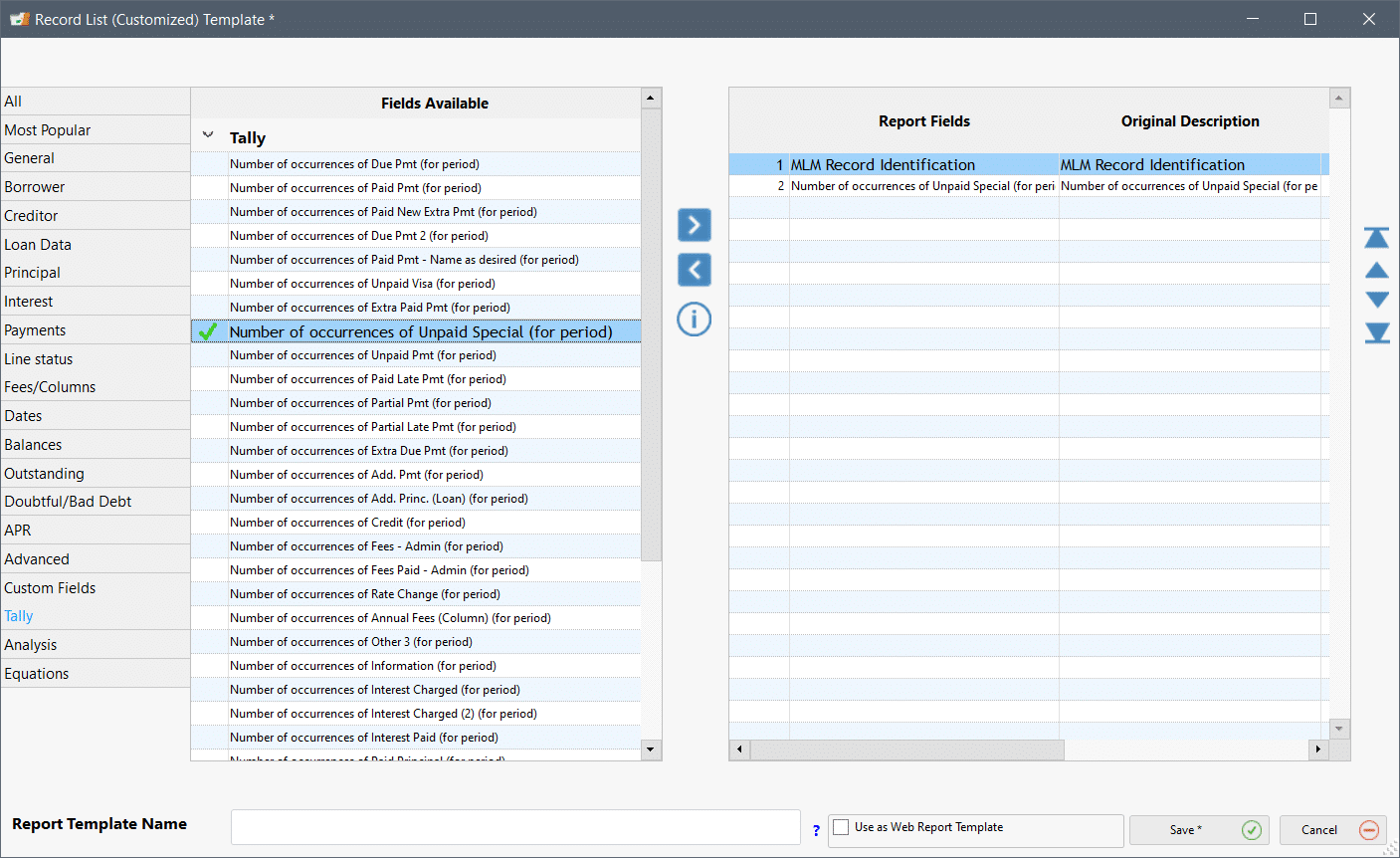

You can even get the number of each and every Line status through “Personalized Reports” > “Record List” (“Tally” theme):

An Act to amend the Criminal Code Bill-C-274 (the Bill) entered first reading in the House of Commons on May 11, 2021. The Bill would amend1 the definitions of “criminal rate” and “interest” in subsection 347(2) of the Criminal Code, while also repealing section 347.1, which had allowed certain exceptions for payday loans.

The Bill will be of interest to lenders, especially payday lenders and other non-traditional lenders, as the amendments proposed would lower the criminal rate at which interest charged or received is under the Criminal Code from 60% to 30%.

To continue to read the text by Me Joyce M. Bernasek and Me Ramz Aziz from the law firm Osler, follow this link.

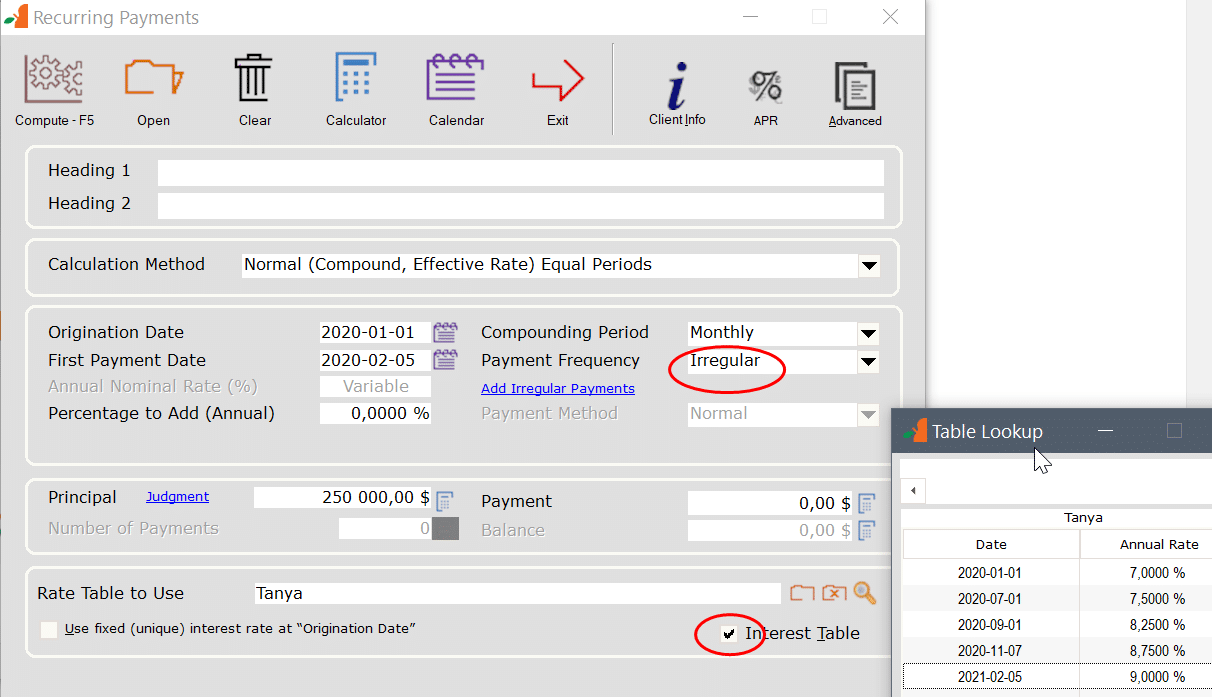

Q: Is Margill Interest calculator or Margill Law calculator able to create a compound interest calculation with irregular payments and interest rates that change over time?

So is my understanding correct that your software will be able to work out the balance owing in terms of an overdue loan with compounded interest based on the following example:

Initial amount o/s R 250 000 As at 1/01/2020 Interest rate 7%

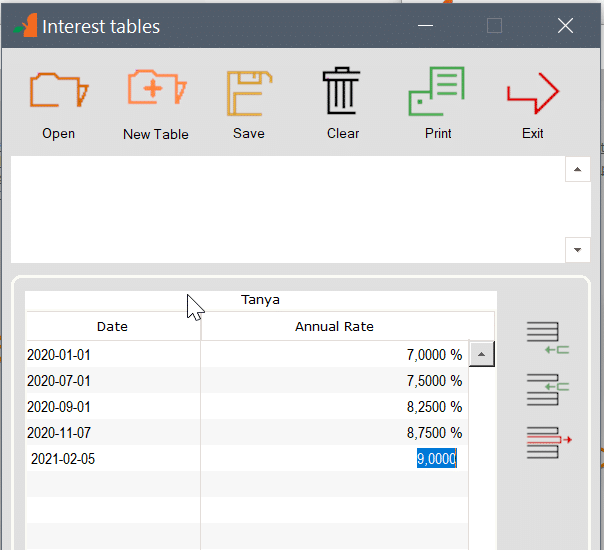

Interest rate changes as follows:

Format is DD/MM/YYYY

01/07/2020 7.5%

01/09/2020 8.25%

07/11/2020 8.75%

05/02/2021 9%

Payments received (R = Rands – South African currency):

5/02/2020 R 2 000

7/03/2020 R 5 000

1/04/2020 R 1 000

30/6/2020 R 500

5/08/2020 R 500

3/09/2020 R 500

15/01/2021 R 5 000

7/02/2021 R 2 000

What is the amount o/s as at today, with interest compounded monthly? Today we are April 30, 2021

A: Yes, very easily. Such calculations are the purpose of the software. Margill can do thus much more easily than with a spreadsheet and a lot let risk of error.

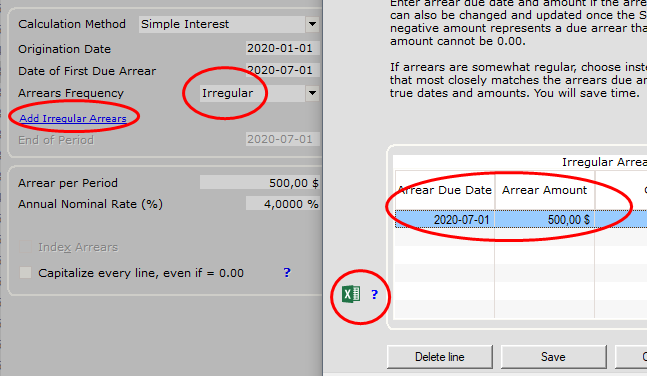

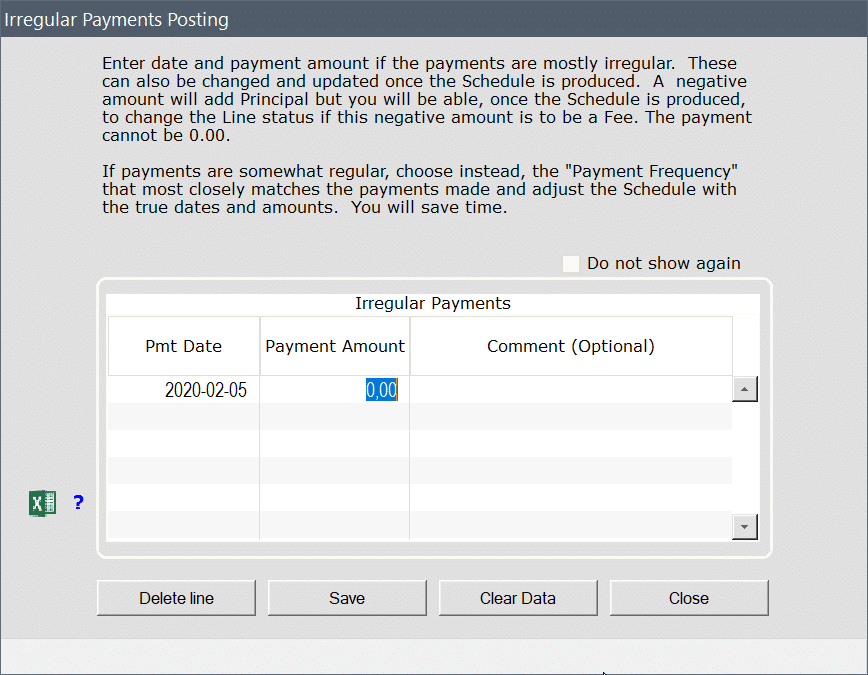

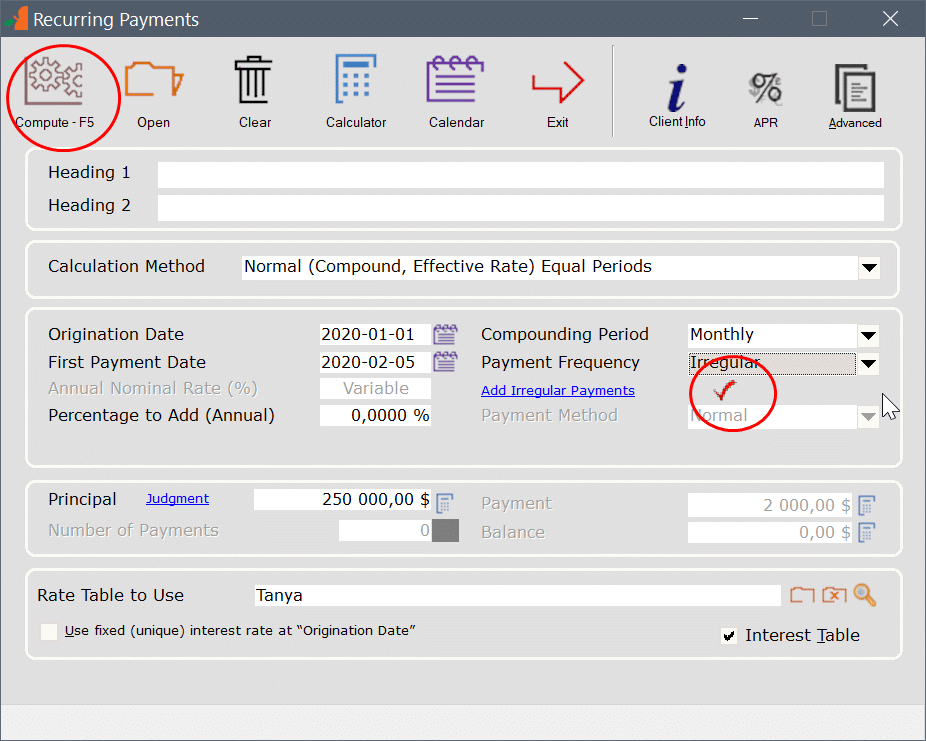

Now to enter the irregular payments, click on  . This window shows up.

. This window shows up.

You can either entre the payments manually in here (even add negative amounts that are principal increases):

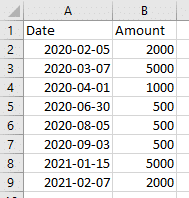

Even if there weren’t many payments, I created a small Excel sheet for the import – very useful when there are dozens, hundreds or thousands of payments:

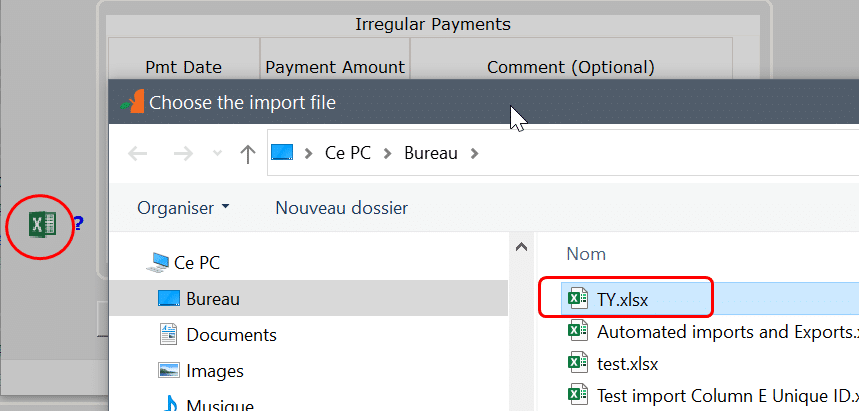

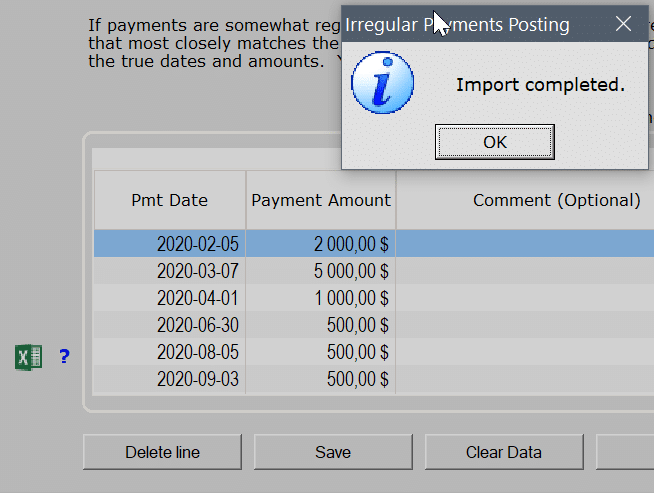

Then press on the Excel icon and select the Excel file:

Now Save and you get back to this window. Notice the check ![]() that shows there’s data in the Irregular payments. We are now ready to Compute the Results table.

that shows there’s data in the Irregular payments. We are now ready to Compute the Results table.

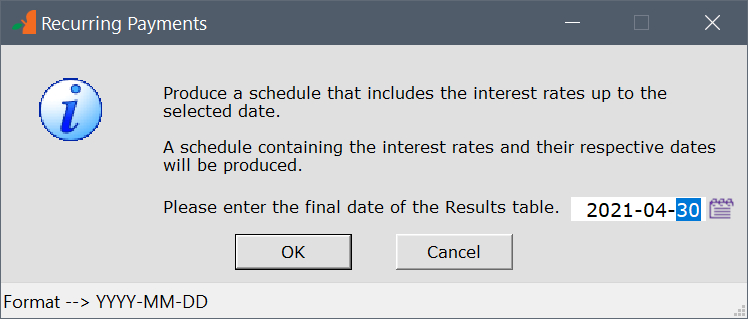

You will see this window appearing that asks until when do you wish to compute interest. I entered April 30. Interest will be computed until April 30 in the morning, not end of day.

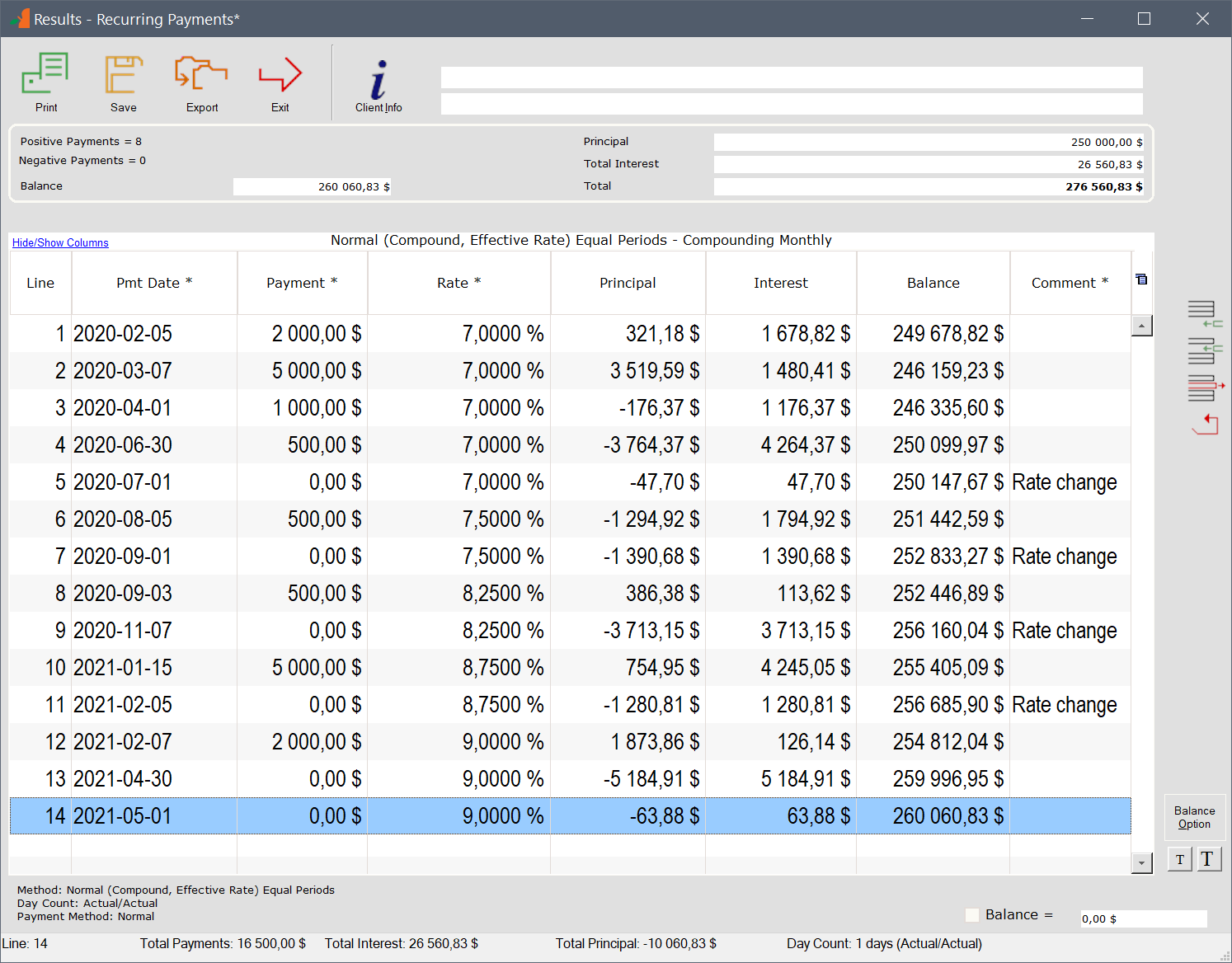

Press on OK and we have the results.

Notice I added a line at the end just in case I wanted the interest until April 30 end of day (midnight) – so added a line with May 1. Industry standard says first day included, last day excluded. Use the icons on the far right to add, insert and delete lines. There’s also an Undo button.

You can save and update this table as required – you can add lines, change payments, insert payments if by error you had forgotten one, add or change interest rates, etc. You can do just about anything with this calculation.

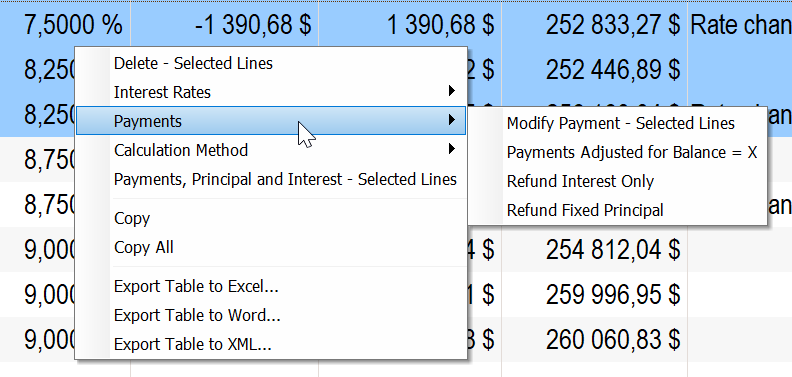

The right mouse click offers many options:

Hope this answers your questions…

Q: In the Loan Manager, is it possible to change a payment date for all loans at the same time? For example, I want to change the date from March 26 to March 27?

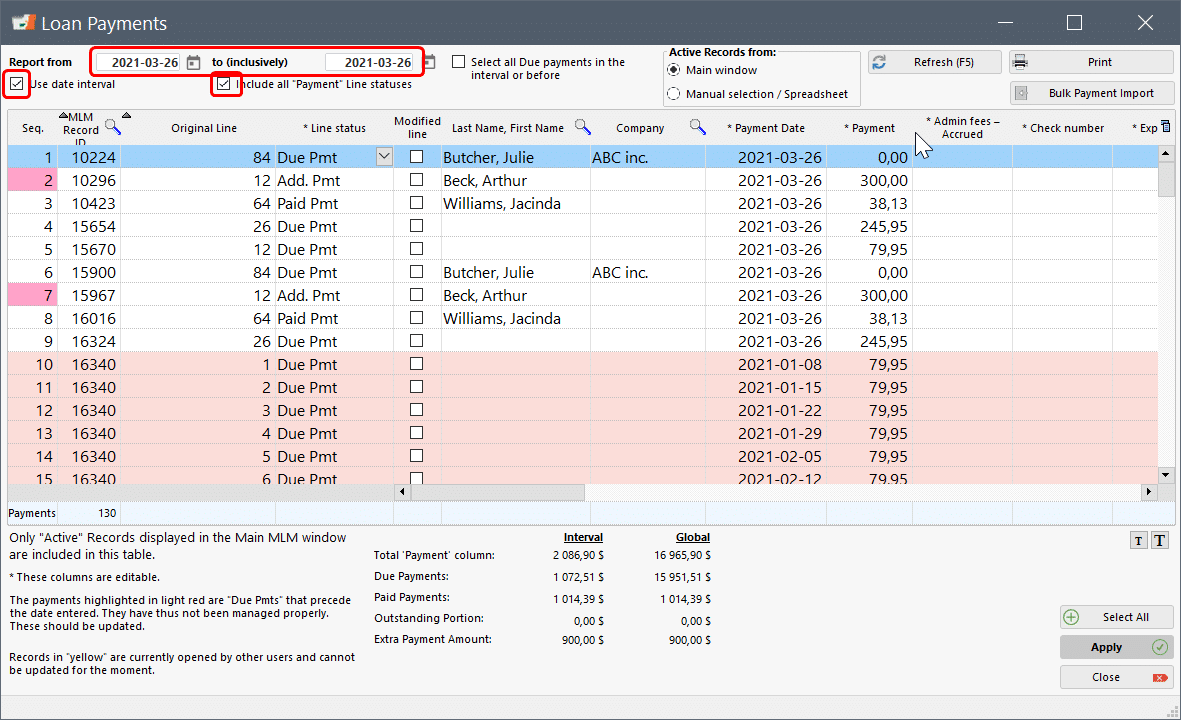

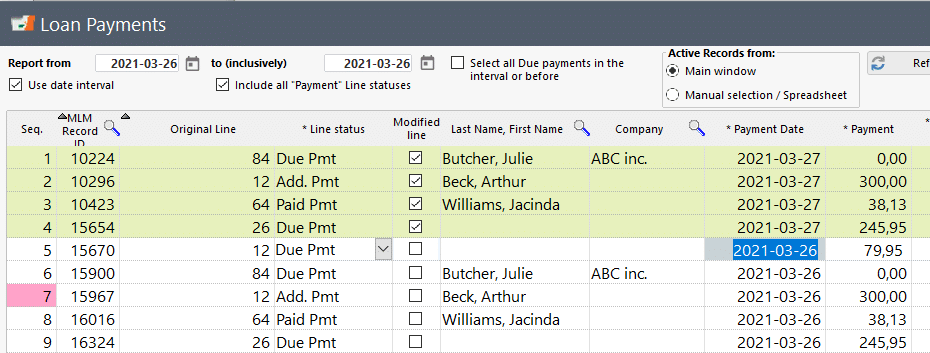

A: This can be done in batch but each date will have to be modified. You can do this for “Due Pmt” and “Paid Pmt” lines only.

In theory, you would change only the Due Pmt lines so therefore you don’t have to check “Include all Payment Line statuses”. In the following example, I checked the option but this is usually not necessary…

Afterwards, you need to copy and paste the March 27 date (the new date) and modify line by line (faster with Ctrl C and Ctrl V (copy/paste) compared to manually entering teh date):

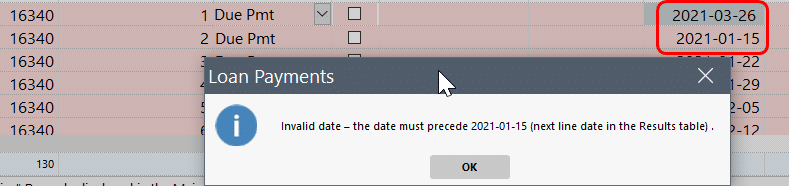

You will then be able to modify the dates and the lines will become light green. The chronological order of the lines must be followed:

Once the changes are done, click “Apply” and dates will be modified.

Last February 11, 2021, the Margill Team held a webinar to introduce the new features of the Margill Loan Manager software, version 5.2.

For those who have missed it or if you wish to see it again, here it is:

Osler law firm offers an excellent article regarding the London Interbank Offered Rate (LIBOR) which will eventually end. And even in these difficult times of the COVID-19 pandemic, there is no suggestion that LIBOR’s end will be delayed and should end, as expected, on December 31, 2021.

A text by Andrew G. Herr, Lisa Mantello and Joyce M. Bernasek that you can read here.

Financial institutions, including banks, asset/fund managers and insurers, as well as established FinTech businesses and start-ups, have been presented with major disruptive events with the advent of COVID-19 and national lockdowns, and with the impending risk of global or regional recessions.

In May and June, a group of attorneys from the law firm Norton Rose Fulbright undertook a survey of a range of banks, asset/fund managers, insurers, established FinTech businesses, FinTech start-ups and venture capital and consulting firms across the globe. You can consult the key findings of this survey.

To read the article, follow this link.