Typical questions before software purchase – Margill Loan Manager

Questions:

- We are a secured lender, our loans are secured against properties. Does the system allow us to input details of the property and loan to value against each loan? How do I do this?

- Will the system give me an overview of our loan book as a whole?

- Some clients pay monthly, some clients we deduct the interest payments from the loan on completion. Can I input these options?

- From an Excel spreadsheet can I input the loan book /data how do I do this /what information is needed?

- How do I start is there someone I can speak to (I am based in the UK)?

Answers:

Q: We are a secured lender, our loans are secured against properties. Does the system allow us to input details of the property and loan to value (LTV) against each loan? How do I do this?

A: Very easily. You can create as many custom fields as you like. You could create one with the secured property address, another with the value of this property, and finally create an LTV equation – very easy… See this other post: https://www.margill.com/en/can-obtain-loan-value-ltv-margill-loan-manager/

Q: Will the system give me an overview of our loan book as a whole?

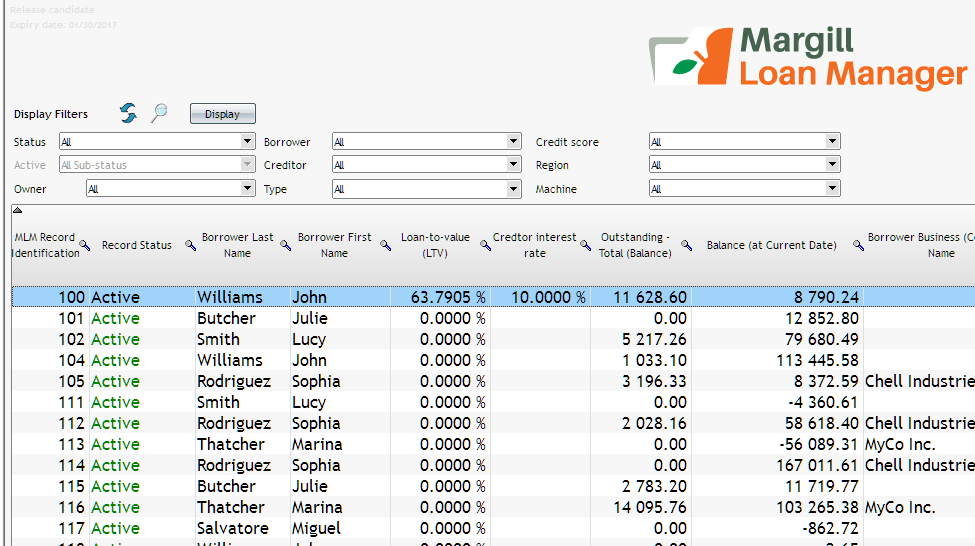

A: Of course. Our Main window allows you to see all your loans and various fields – over 1,000 fields actually but usually you would show only 10-15 columns – don’T want to be overwhelmed with data… You choose the fields you want to see in this window. Users customize their Main window (Tools > Settings > User Settings). You can then sort the loans in any way you want and display only certain loans as opposed to all loans in the database.

You can also produce a host of reports for your portfolio or part of it using the fields you choose to report on. You create your own custom reports. We provide a few templates as examples.

Q: Some clients pay monthly, some clients we deduct the interest payments from the loan on completion. Can I input these options?

A: A payment schedule can be completely customized to your clients’ needs and the ways they actually pay. You first set up how your clients SHOULD be paying – as agreed in the contract – and then, as they start their payments, you adapt to the actual payments: unpaid payments, partial, late, extra, lump sums, fees, etc.

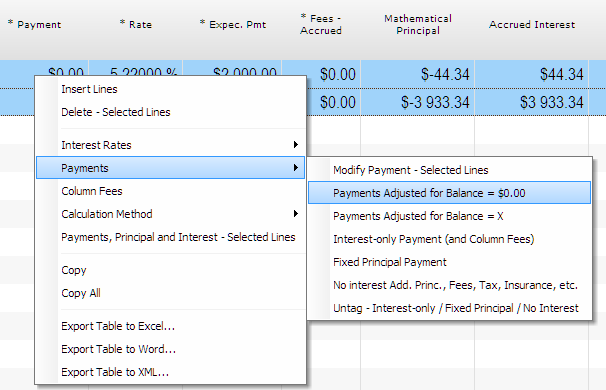

The right mouse click offers a host of options to customize a payment plan:

Q: From an Excel spreadsheet, can I input the loan book /data? How do I do this /what information is needed?

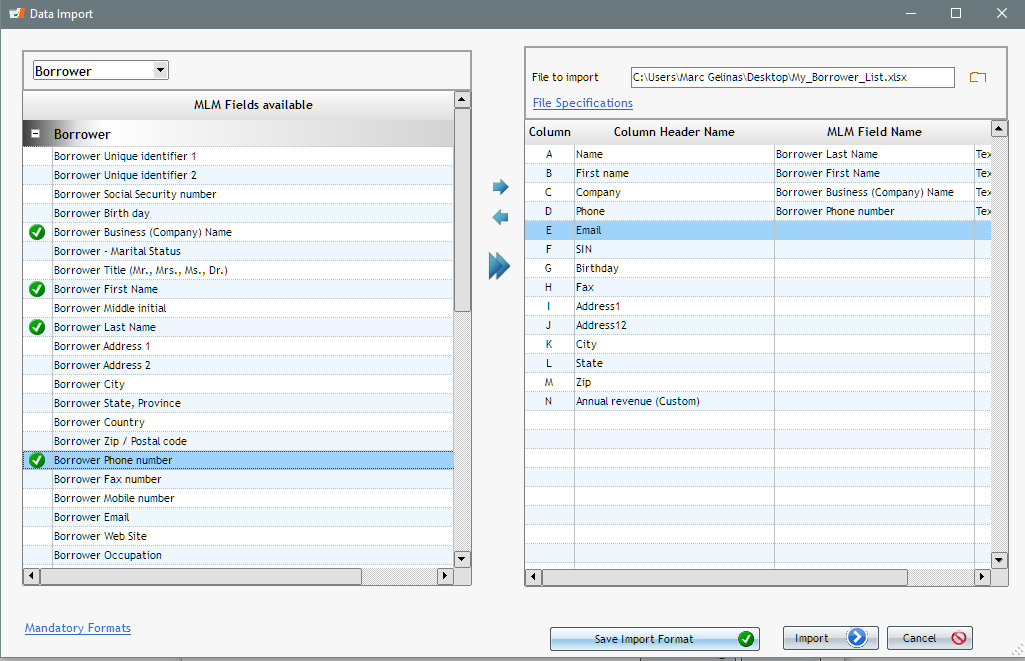

A: A wonderful aspect of Margill Loan Manager is its ability to import your existing Borrowers and Loans from a simple Excel sheet.

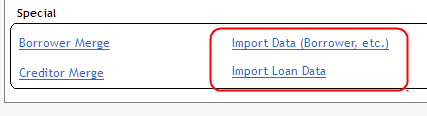

Go to Tools > Settings > Special:

Then map your Excel sheet to Margill fields and finally import. All done very quickly as long as your Excel sheet is well prepared (date formats, amounts, etc.).

The same general principle applies for the Loans, but these are a little more complicated since we would have to discuss whether the history is to be included, are your clients paying normally, were your calculations done properly, did you charge fees, are payment irregular… There is even a tool to import totally irregular payments, again via an Excel file.

Q: How do I start? Is there someone I can speak to (I am based in the UK)?

A: We sell our product in over 38 countries, so we would be happy to help you, no problem. We can set up an hour demo together via web presentation. Simply let me know when this would be convenient for you.

If you decide to purchase our software, we offer a free hour of setup/training with the normal system. More free setup/training time with larger systems.