How can I mass import “Unpaid” payments with an Excel sheet in Margill Loan Manager? I need to obtain the Outstanding payment amounts.

Question: How can I mass import “Unpaid” payments with an Excel sheet in Margill Loan Manager? I need to obtain the Outstanding payment amount too.

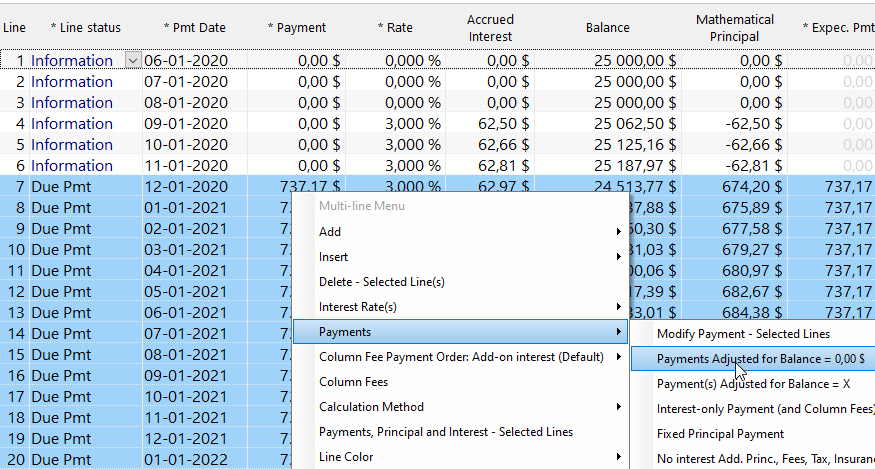

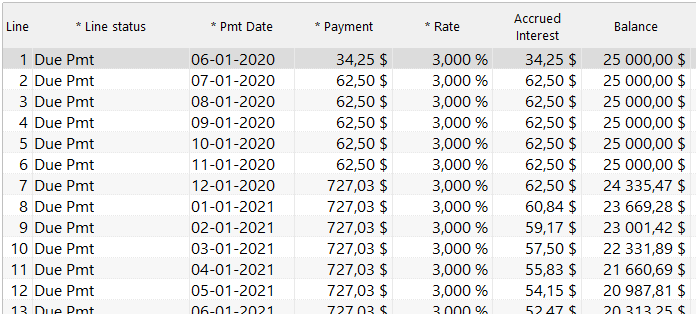

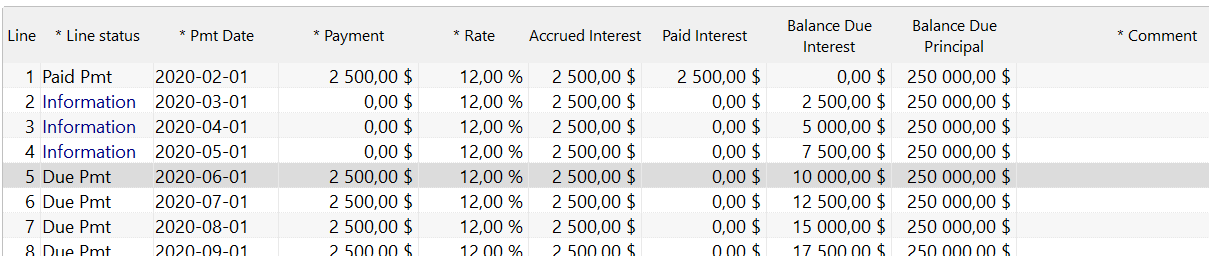

Answer: Usually, when payments are NOT made (so were skipped or the payments returned for non sufficient funds (NSF), on a historical basis, these would simply be ignored and only the Paid payments entered (even partial and late payments)

However, in order to count the number of Unpaid payments and to obtain the Outstanding amounts, it may be a good idea to enter payments lines of 0.00 and include the payment that SHOULD have been paid, thus allowing Margill to calculate the Outstanding payment amounts.

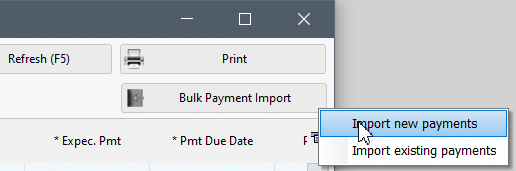

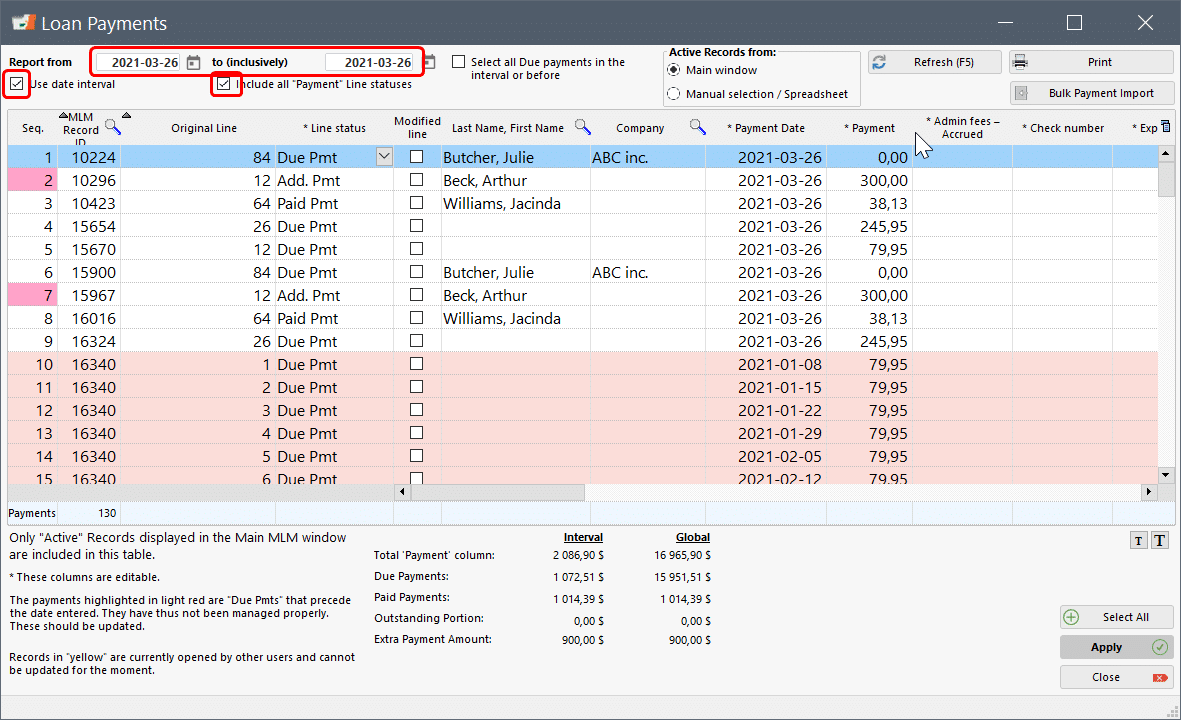

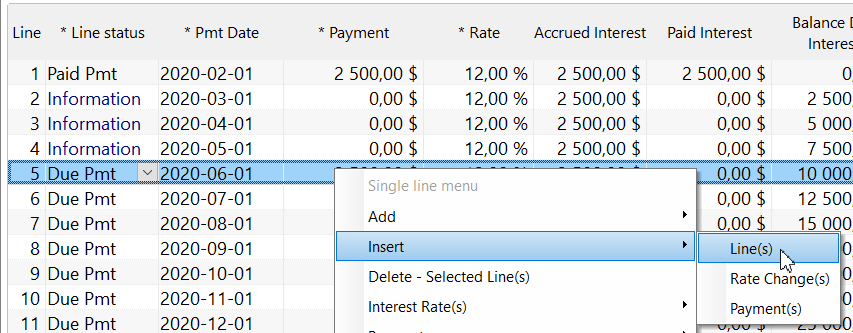

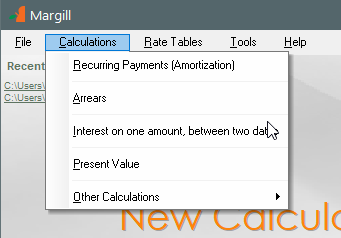

One would go through the “Post payment” tool under “Tools”. On the far right is the “Bulk Payment Import” button. You need “Import new payments”.

This mass (or bulk) import tool allows you to import payments (Paid pmt, partial pmt, late pmt, etc.) (as well as additional principal – a negative amount – and column fees and other information in the Results or payment table) but does not allow the import of Unpaid payments of 0.00. So we must be a little creative…

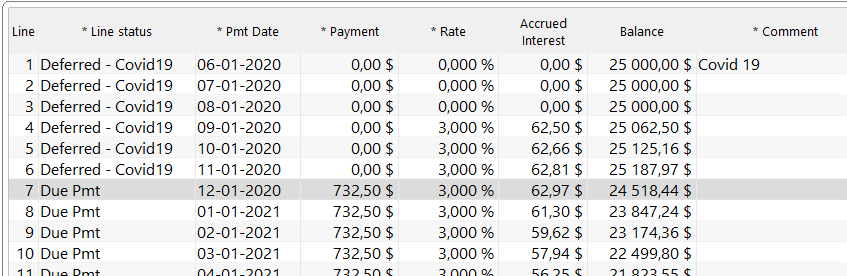

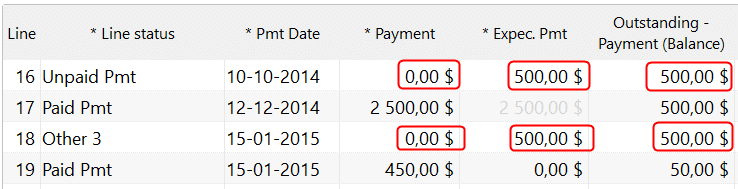

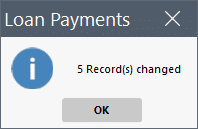

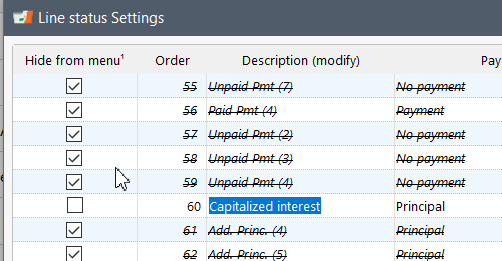

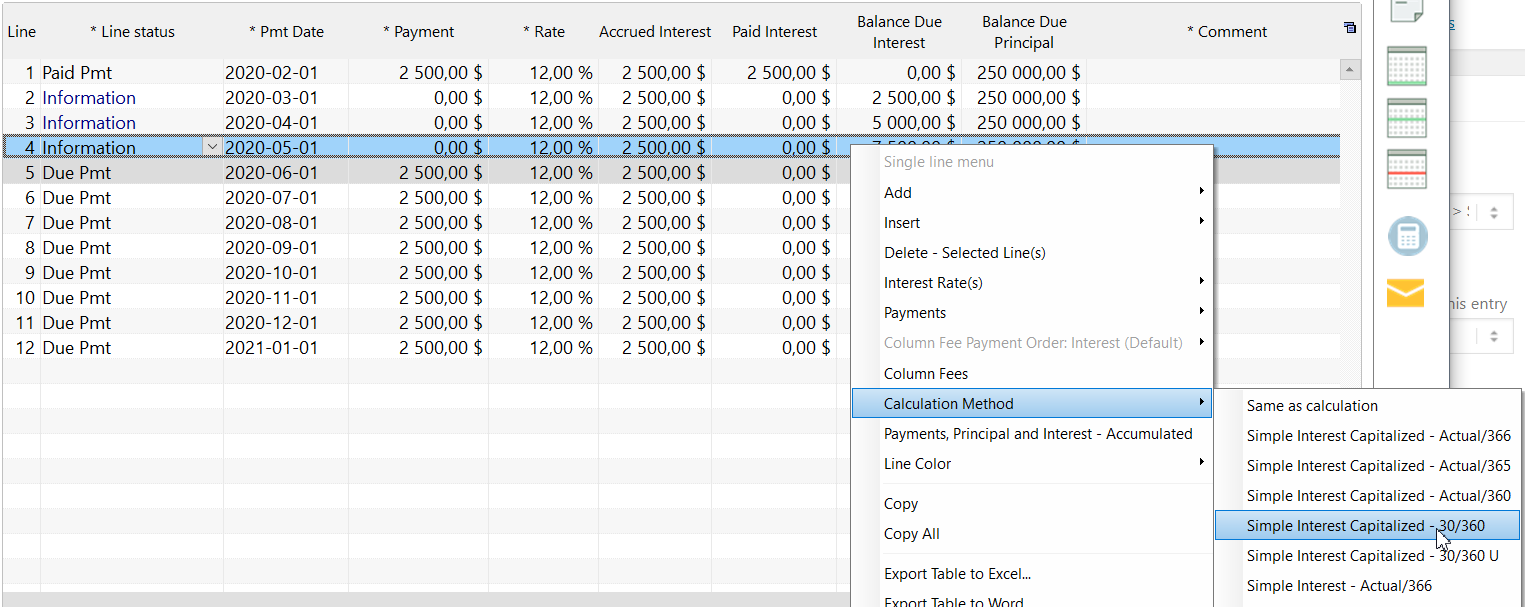

The tool does allow the import of what are called “Other” Line statuses. “Other” Line statuses never pay interest or principal – they are made to manage special scenarios and allow you to add more data in bulk such as Column Fees or other information in columns to the right. If the Outstanding amount was not important you could rename, for example, “Other 3” to “Unpaid” and mass import these. However, when “Other” is added, since this is not a real “payment”, no matter how it is renamed, an amount in the “Expected Pmt” column will not affect the Outstanding as an Unpaid Pmt does (see example below where Other 3 does not increase the Outstanding to 1000):

In the question at hand, the Outstanding amount is required, so we cannot use an “Other” Line status with a payment of 0.00.

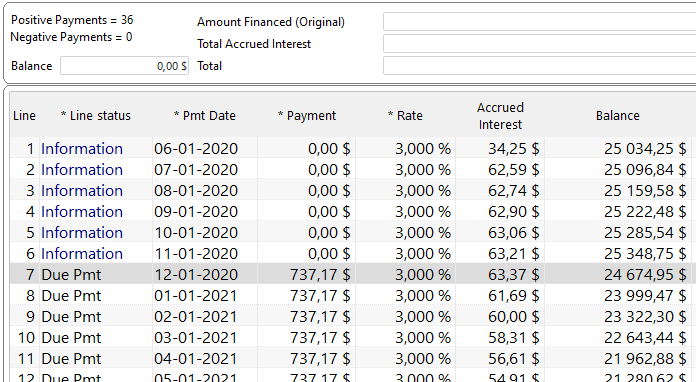

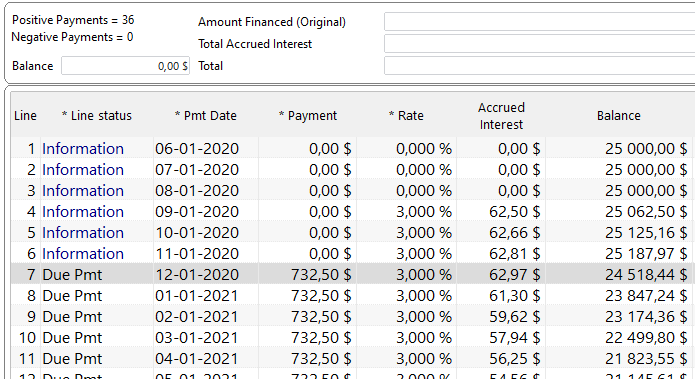

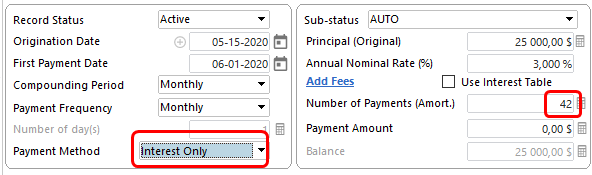

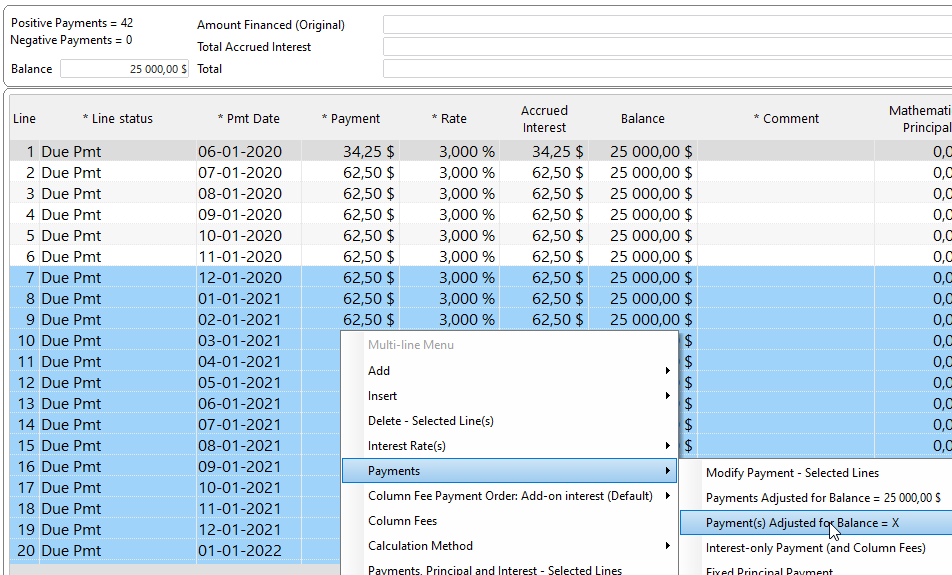

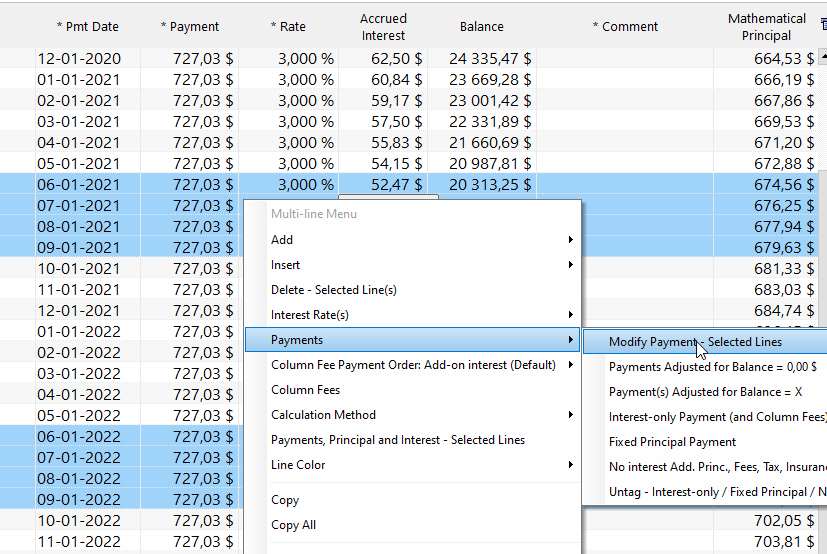

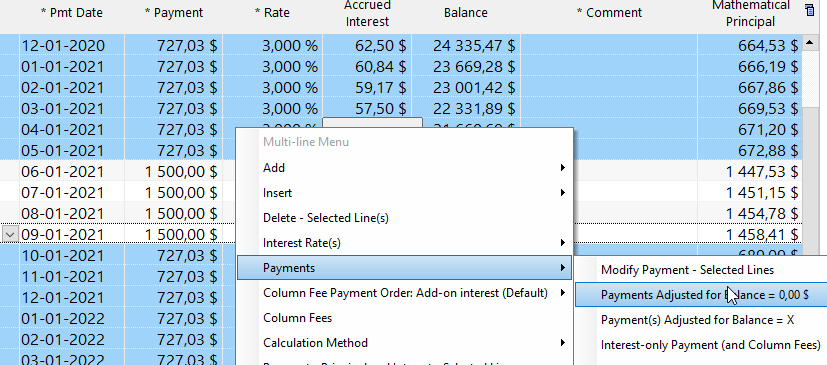

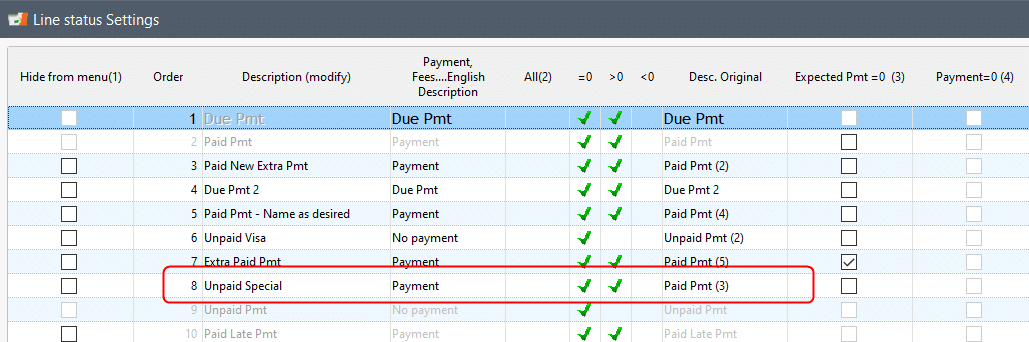

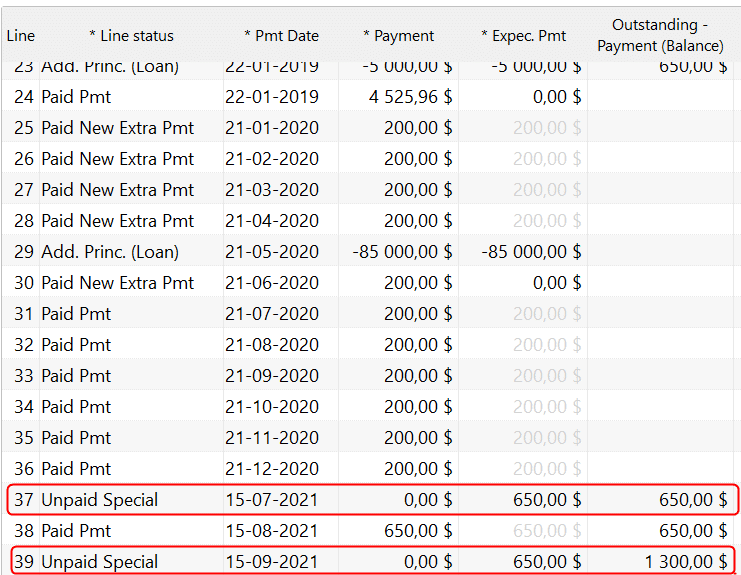

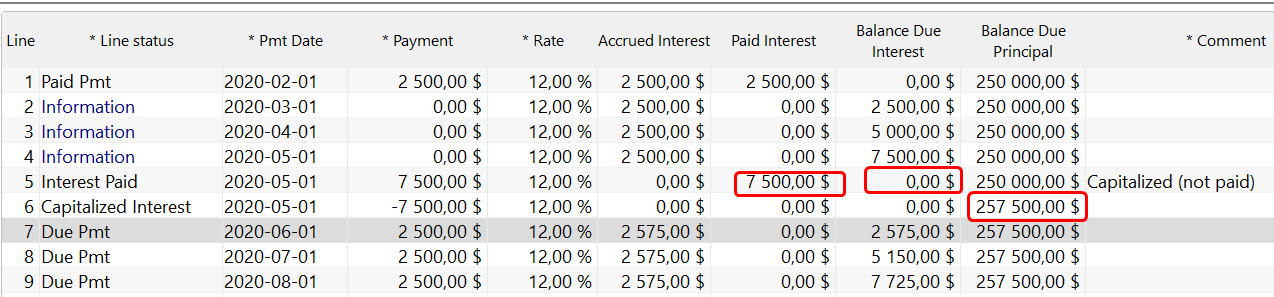

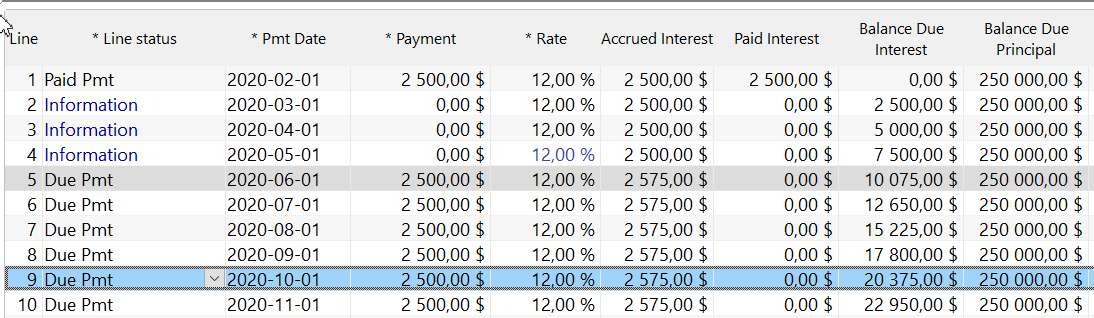

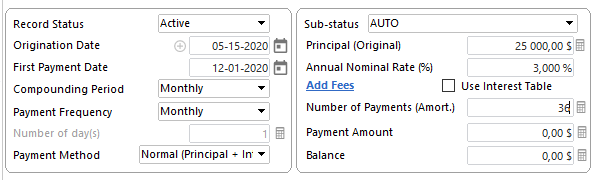

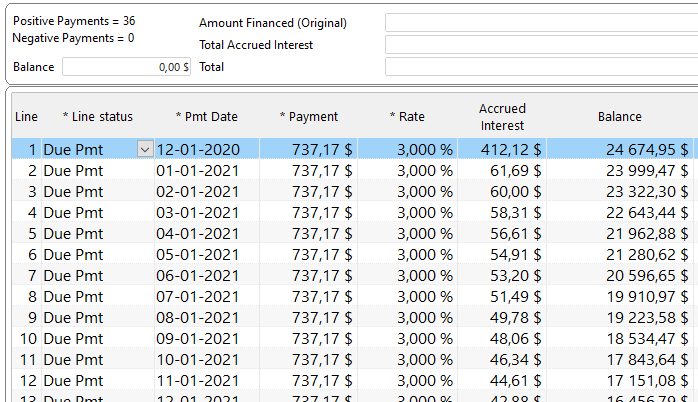

What can be done however, and this will be our solution, is to use a “Paid Pmt (x)” Line status, rename it to “Unpaid…” (renamed to “Unpaid Special” below) and mass import this Line status with a payment of 0.00 and an “Expected Pmt” for the amount that was supposed to be paid.

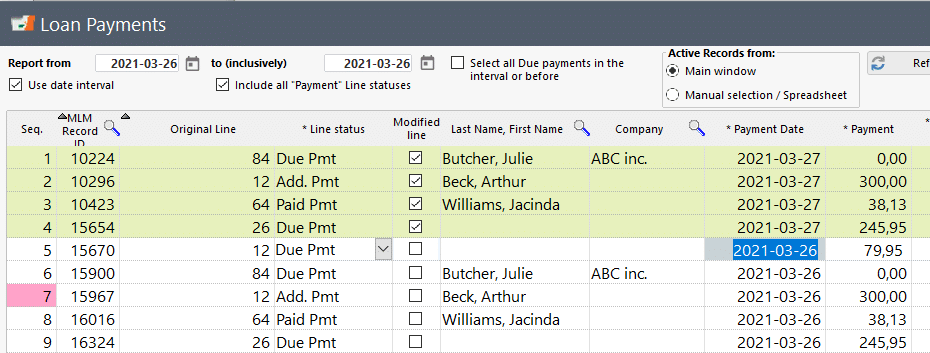

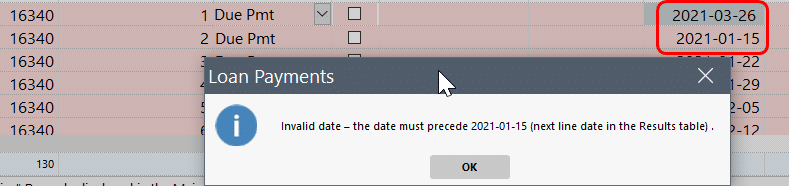

Margill allows “Paid” type Line statuses with a payment of 0.00. A little odd I agree, but this allows for greater flexibility. Even with the name “Unpaid”, the payment must not necessarily be 0.00 as in a real “Unpaid” Line status (line 6 below “Unpaid Visa” where must =0)

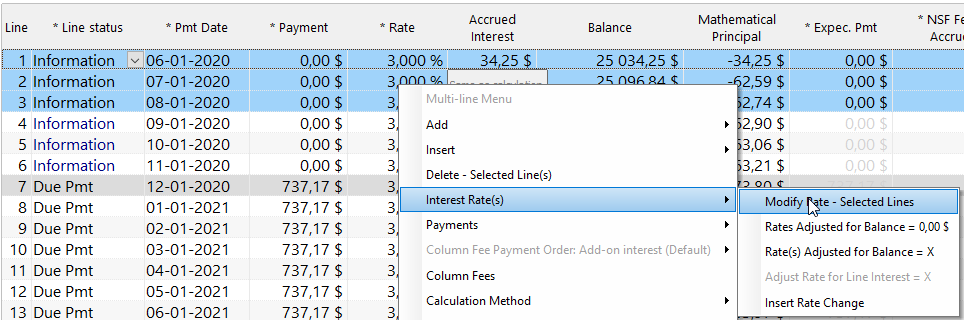

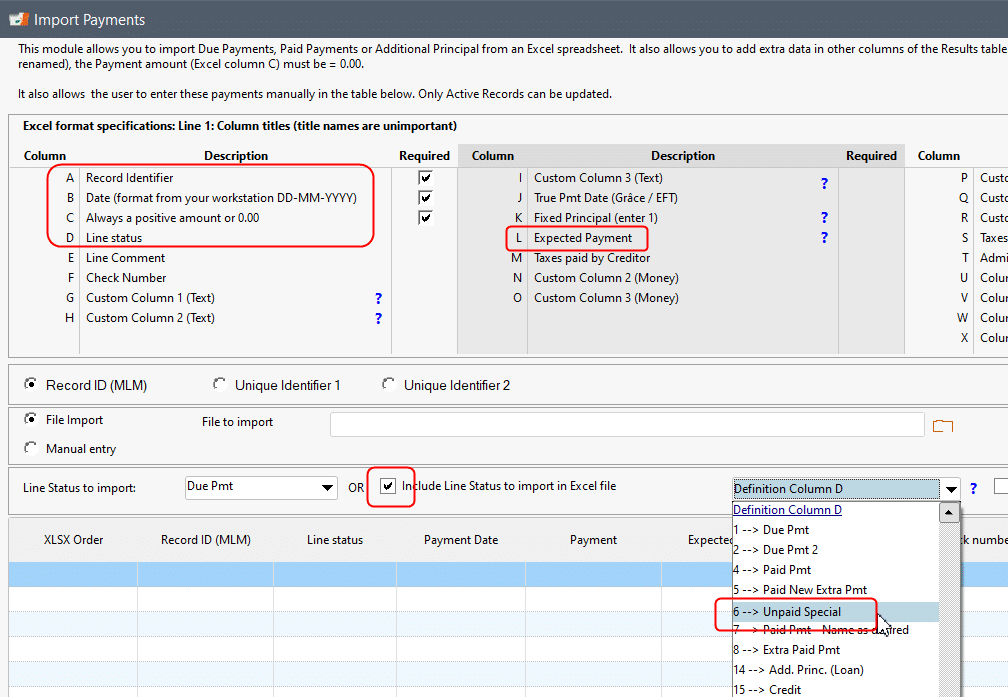

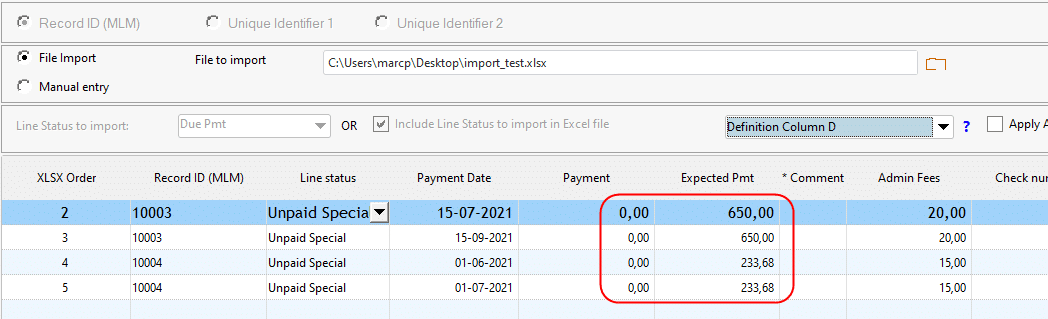

Once this Line status is created, in Bulk Payment Import > Import new payments, find the appropriate number for “Unpaid Special” (6 in this case – this is not the Line status order as in Line status Settings that vary depending on the order you desire). The Excel sheet must contain data and a header in columns A, B, C, D and L.

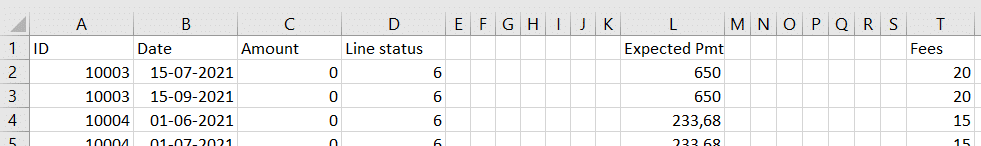

Here is the Excel sheet with only 2 loans. Notice I also added fees (column T for my Admin Fees)

Bulk import window:

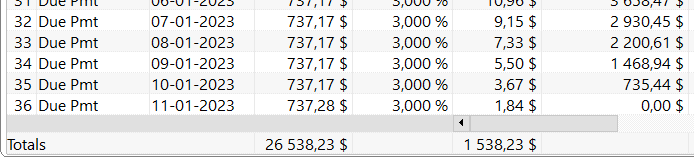

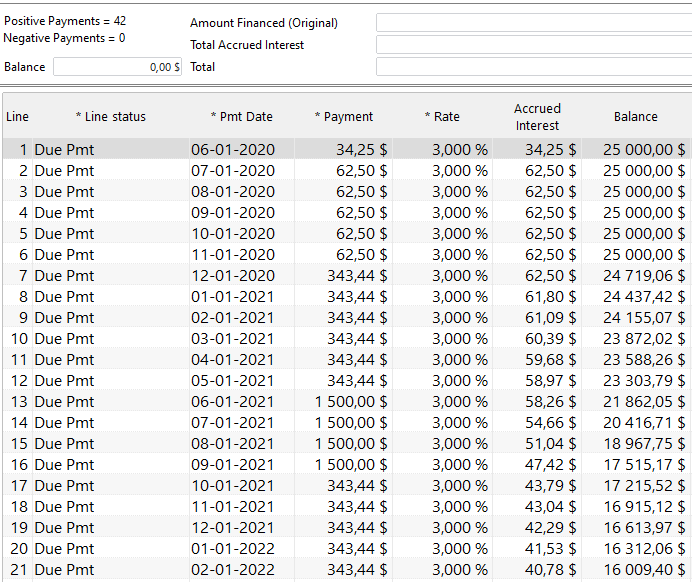

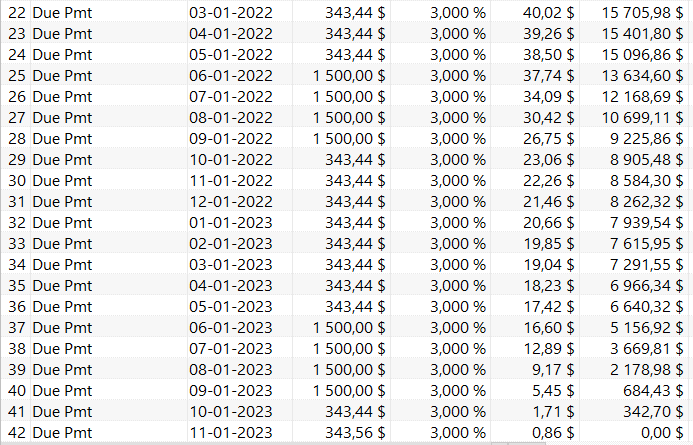

Final result in Record 10003 after pressing on “Insert lines” with an Outstanding of 1300:

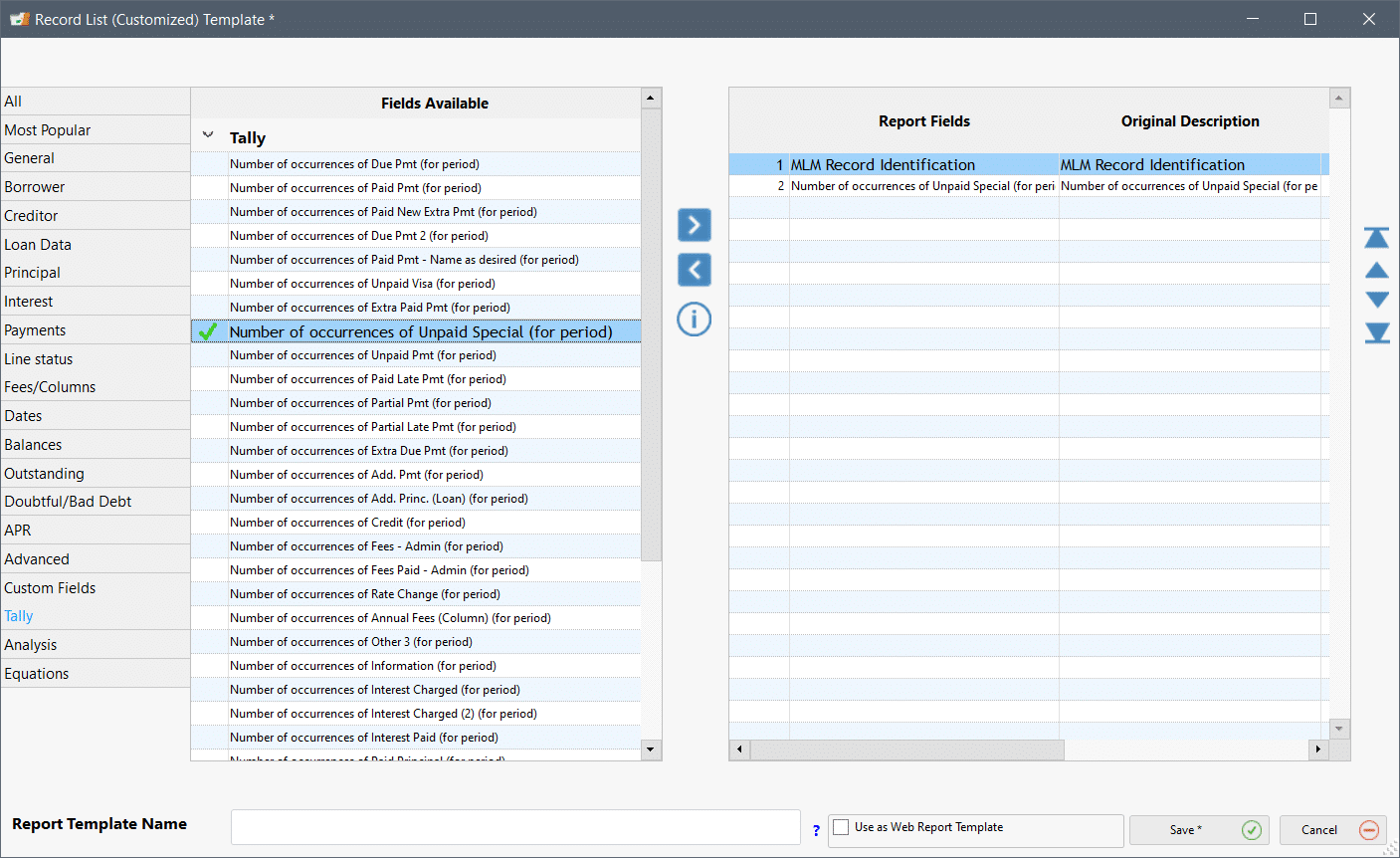

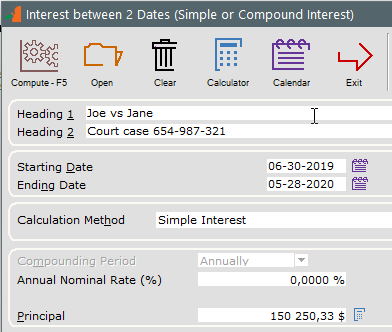

You can even get the number of each and every Line status through “Personalized Reports” > “Record List” (“Tally” theme):

+++++++++++

+++++++++++