I would like to convert 7500 of accrued interest to principal. Can this be done in Margill Loan Manager?

Question: I would like to convert 7500 of accrued interest to principal. Can this be done in Margill Loan Manager?

Answer: Certainly with special Line statuses.

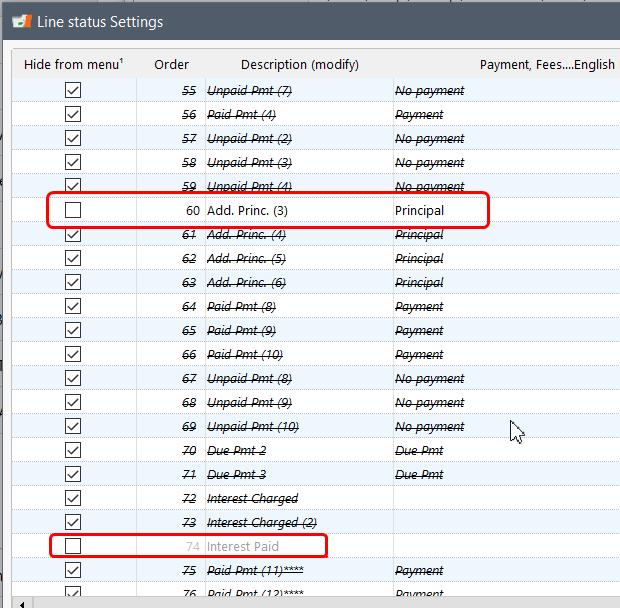

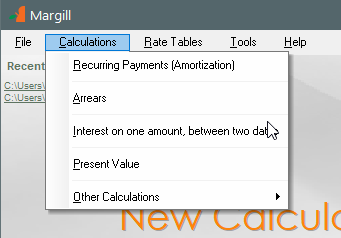

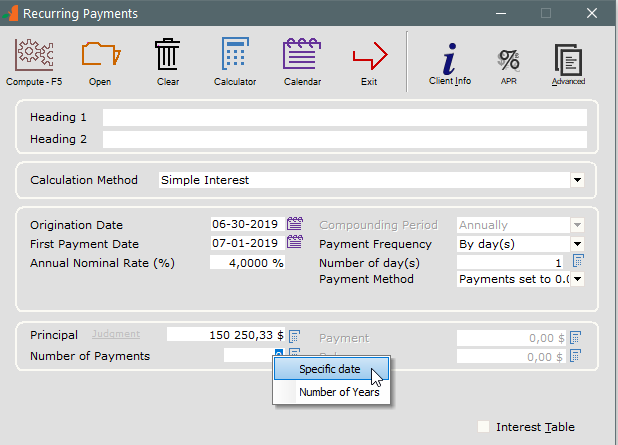

First, go to Tools > Settings:

Make sure “Interest paid” is available (not checked to Hide from menu) as well as an “Add. Principal X” Line status.

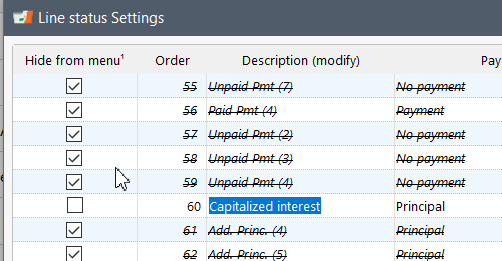

We will rename Add. Princ. (3) to “Capitalized interest” (or another name that fits your needs). We cannot however rename “Interest Paid” so you must be careful when using this. If it is already used to pay, on a cash basis, pure interest in other loans (as opposed to using it as we will do now), then you will have to note this in your reports not to mix up cash and non-cash items.

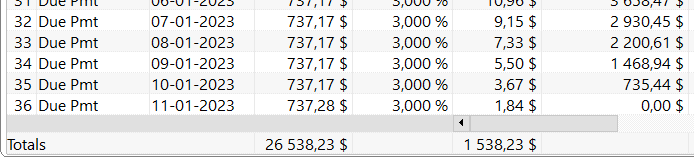

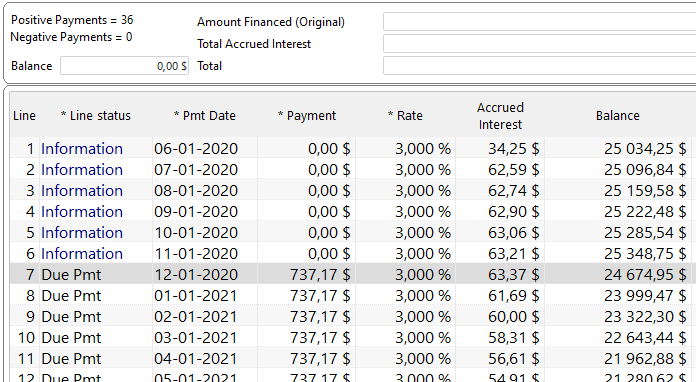

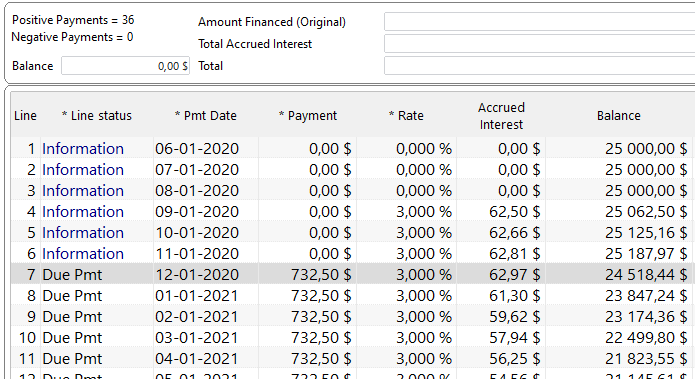

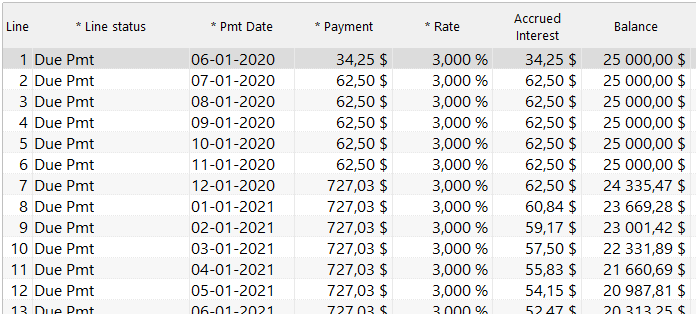

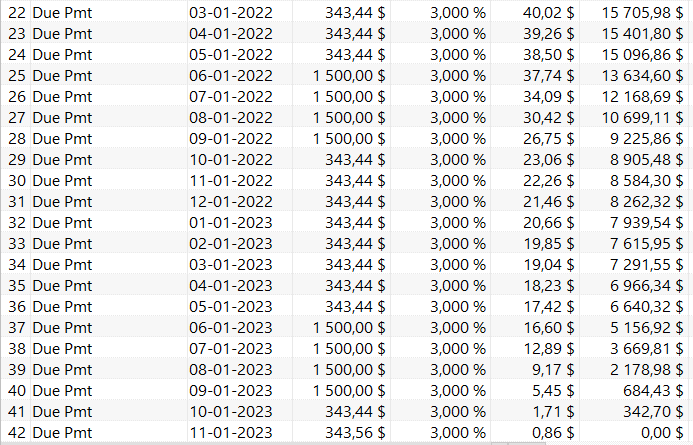

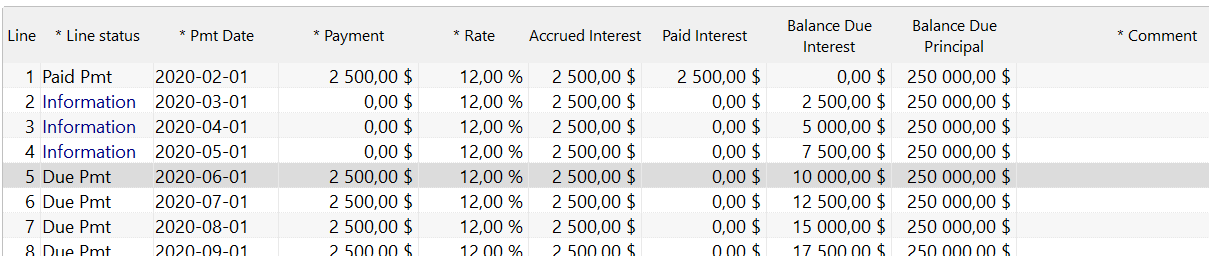

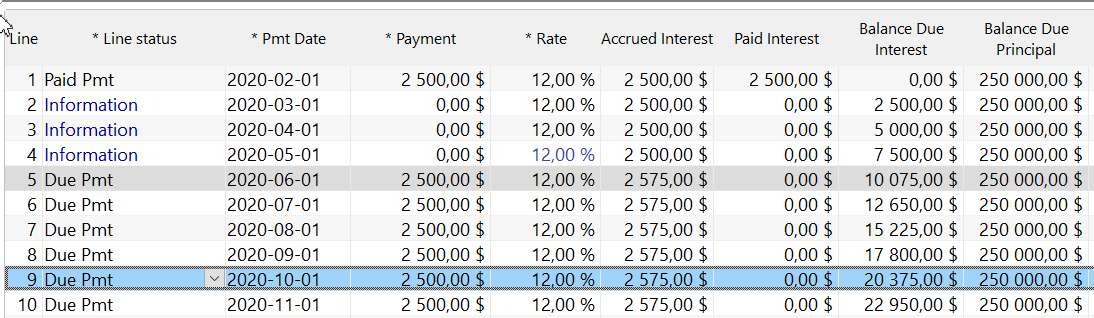

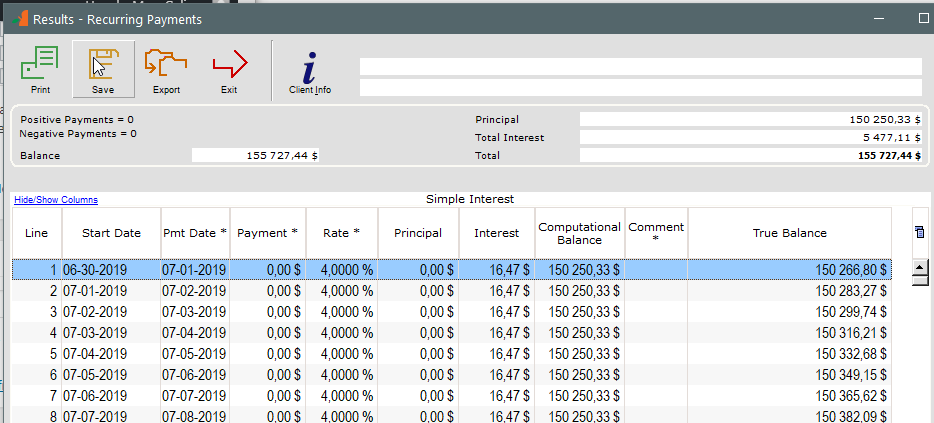

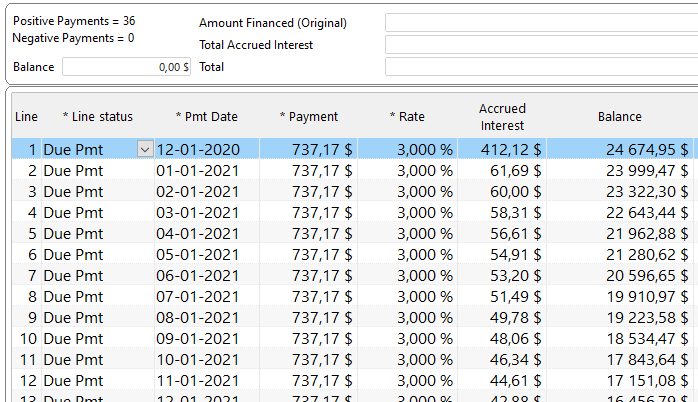

Normal scenario where Interest remains interest (in Simple interest no interest is generated on interest – Day count is 30/360 for equal interest every month):

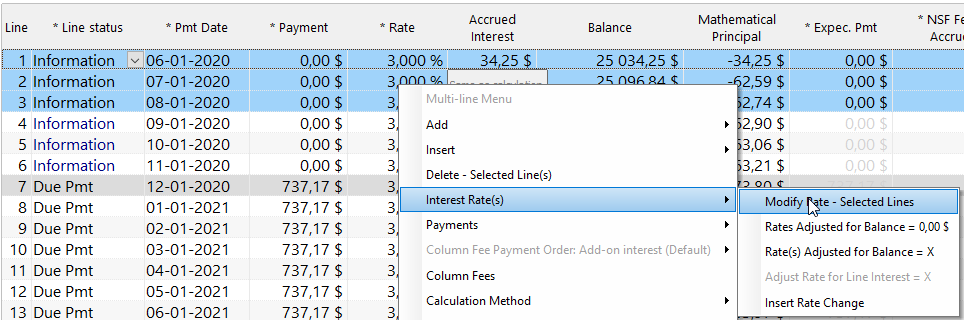

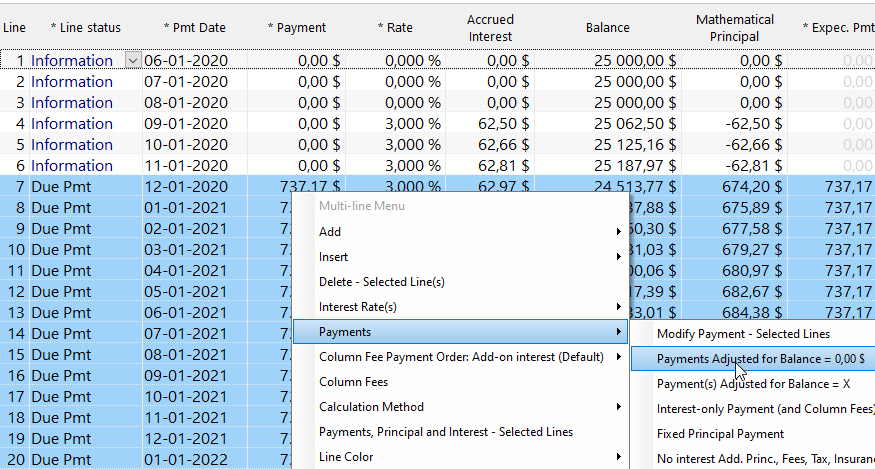

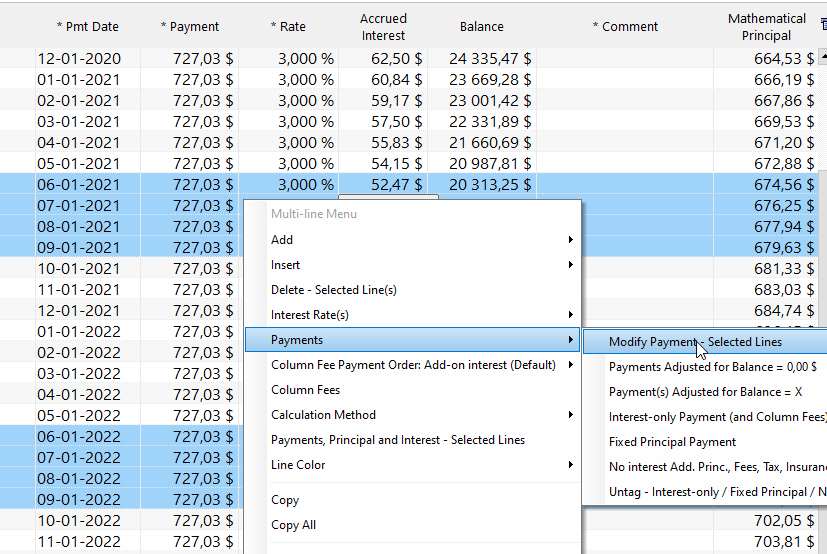

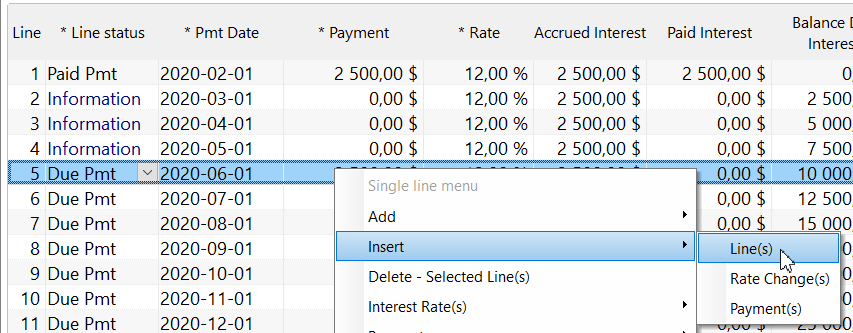

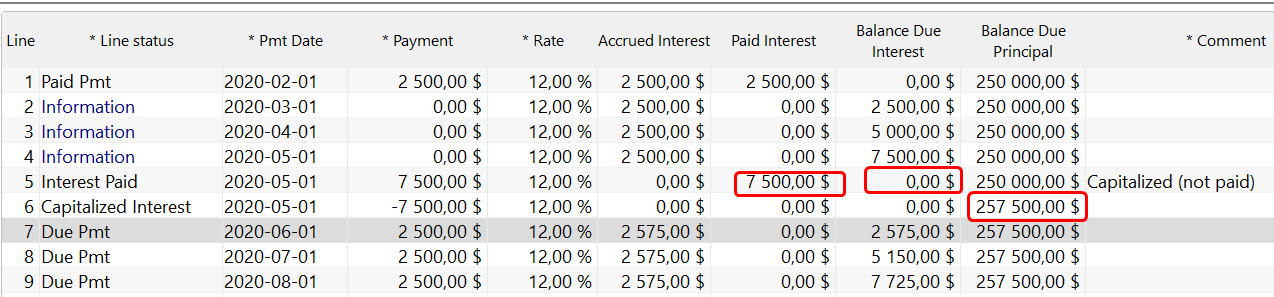

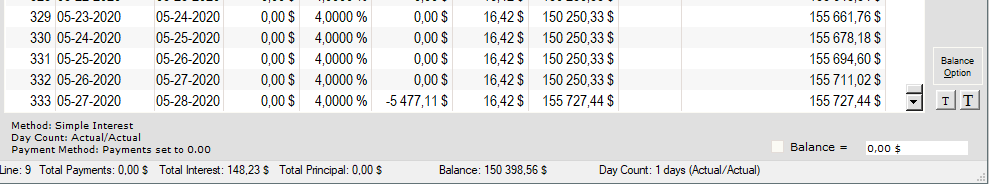

We will “pay” 7500 in interest and add 7500 in this new “principal” (non cash). Insert 2 lines (right mouse click)

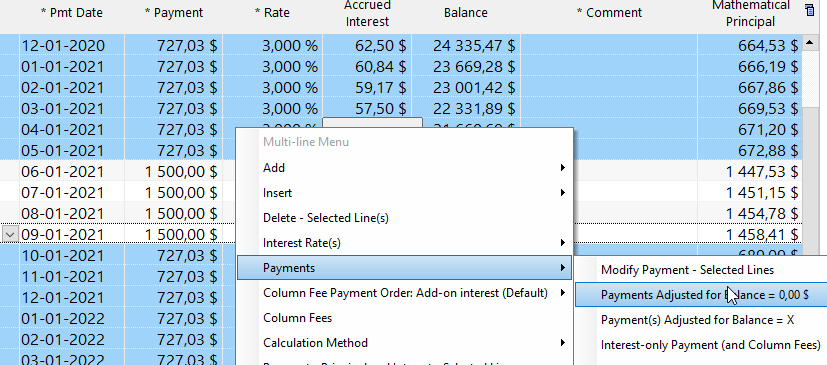

Since interest is now capitalized (so really brought to Principal), the new monthly interest amount increases. You could have said no interest on the 7500 but this becomes a little strange (right mouse click on the line).

When reporting you will need to isolate these special transactions as not to mix them up as cash transactions.

Personally, I would not have converted interest to principal since I believe from an accounting perspective interest must remain interest, not be converted to principal, but you are doing this for a good reason…

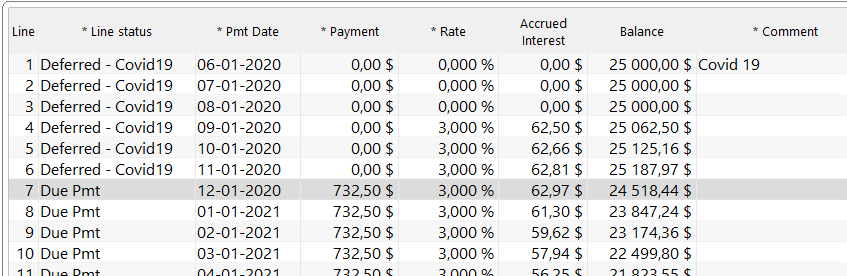

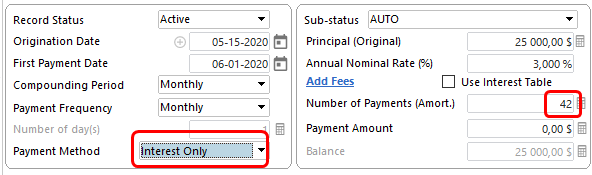

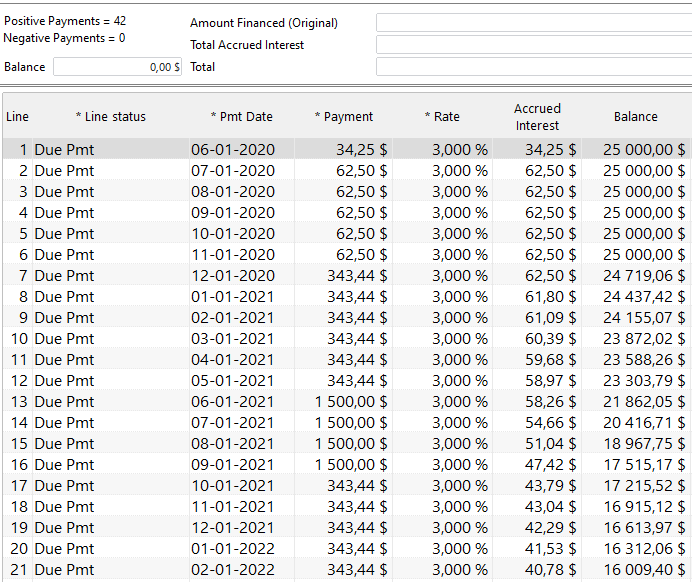

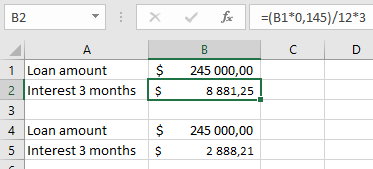

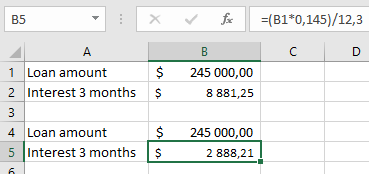

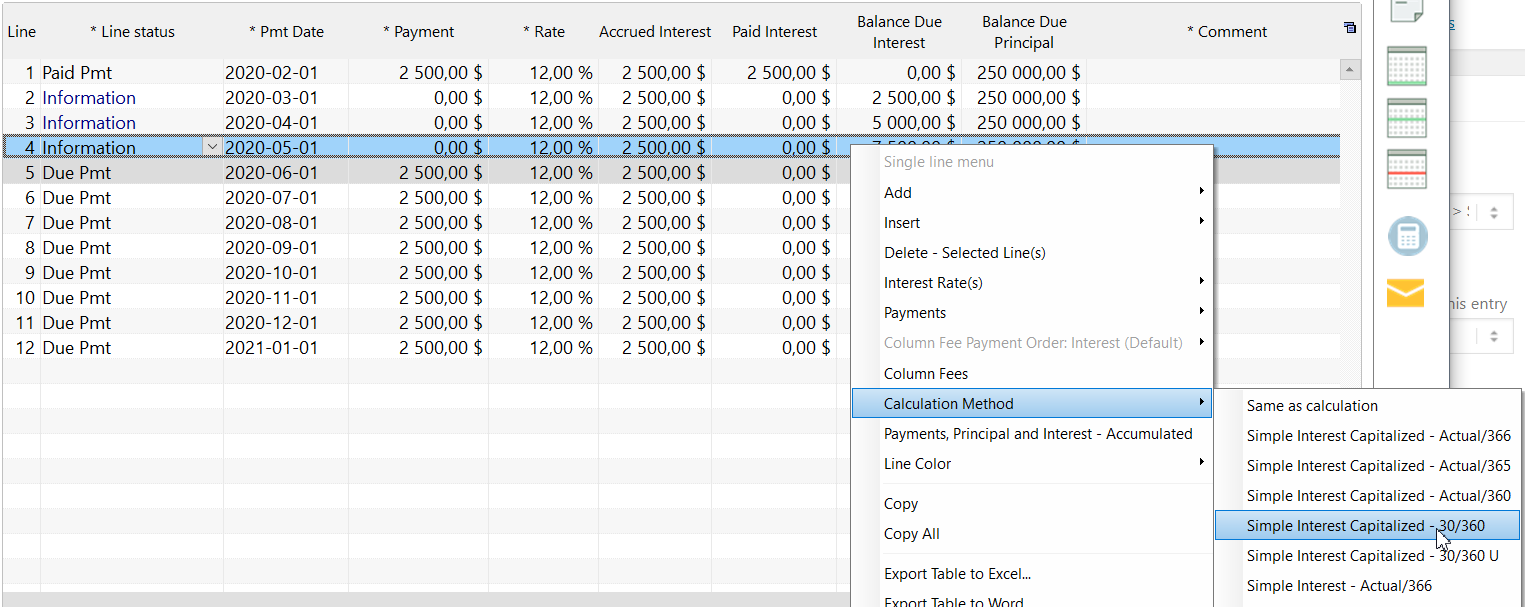

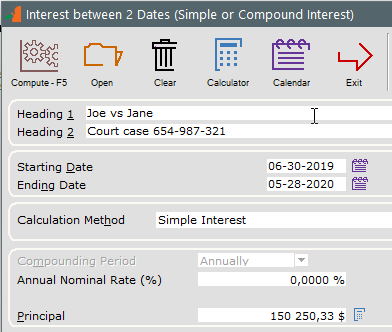

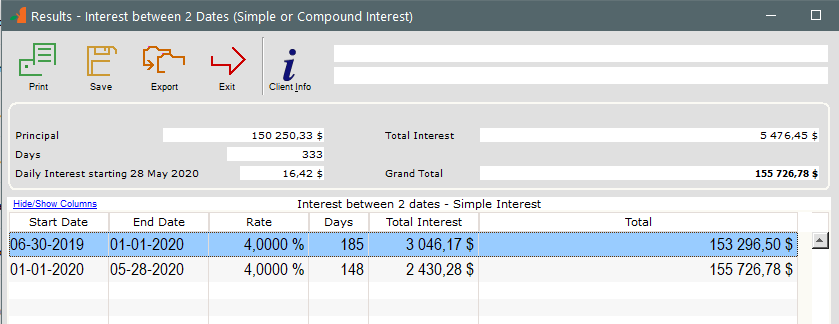

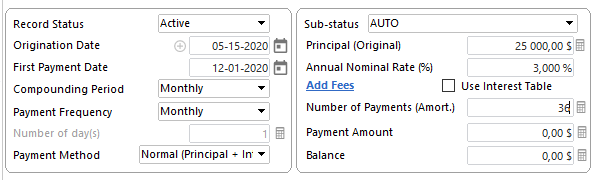

I would have done it this way by telling the system to capitalize the 7500 (thus there would be interest on this amount- goes to Computational Balance):

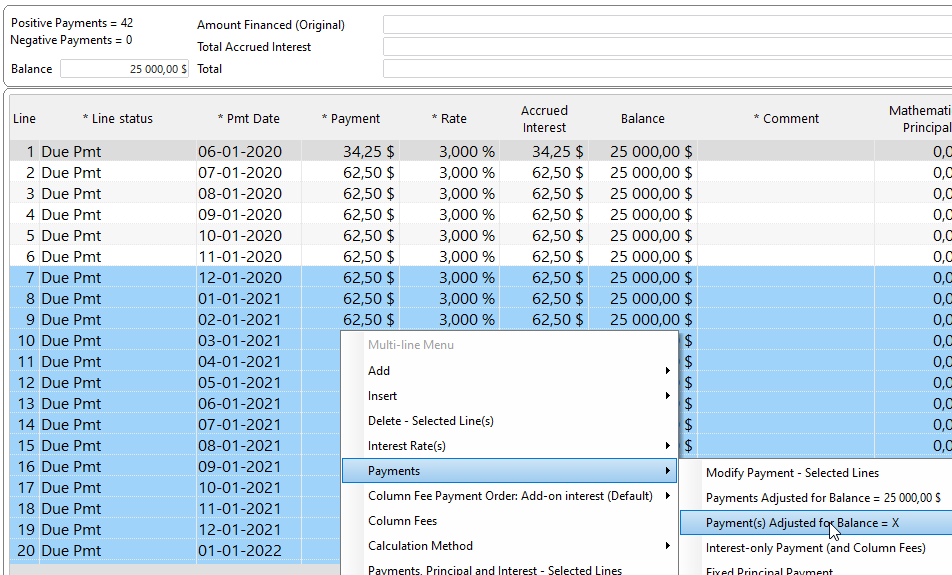

Comes up to the same mathematical results but interest remains interest:

After more than 2 years of work, the latest version 5.1 of the User Guide is now available. In it you will learn all you need to know about the new features.

+++++++++++

+++++++++++